- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Other questions

Hi there, anonEthos.

Welcome back to the QuickBooks Community. I appreciate you providing detailed information and performing the steps shared in the article when recording a vendor refund.

How you record the refund depends on how you enter your purchases. Since you paid the bill by credit card, you'll have to enter the refund entry in QuickBooks as Credit card credit. This way you can easily record it to balance your transaction flow.

Here's how:

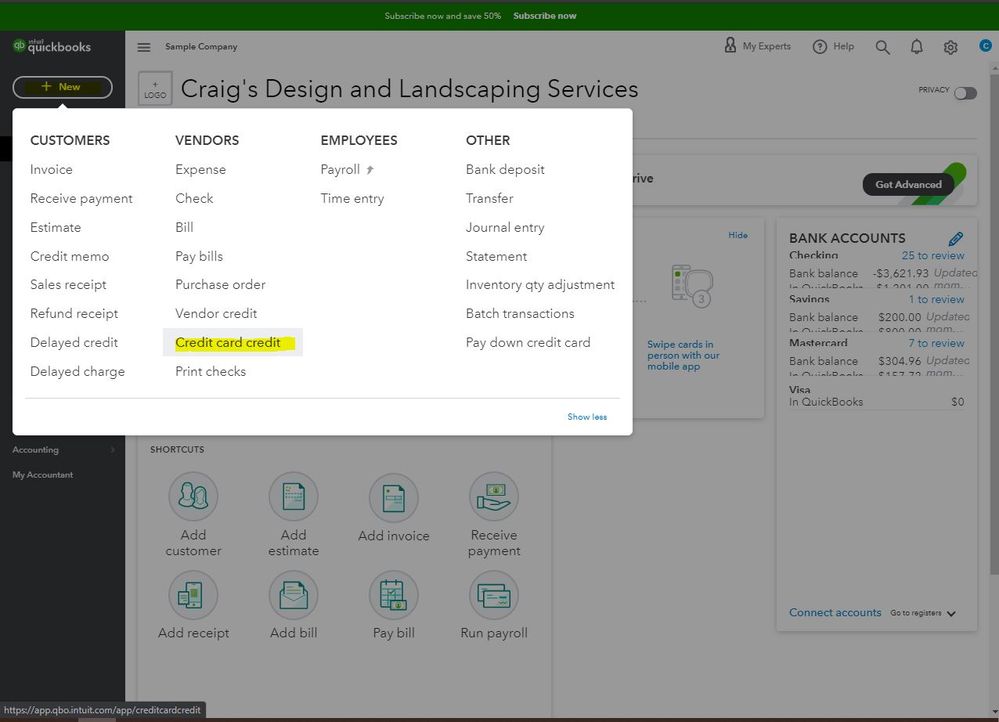

- Go to the +New button.

- Select Credit card credit.

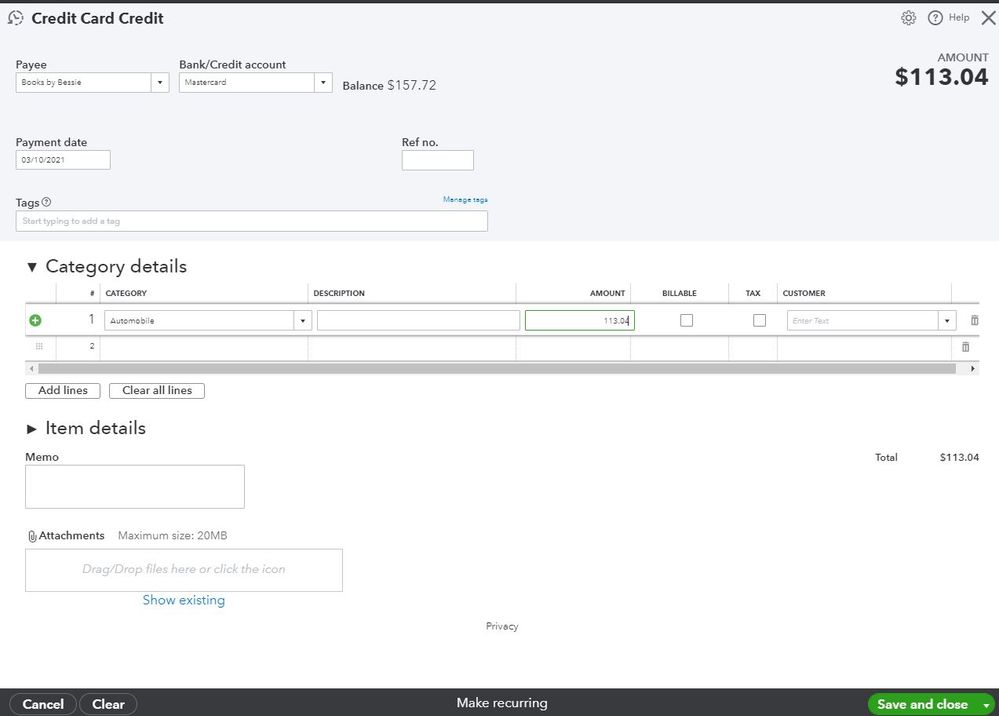

- Choose the payee.

- In the Bank/Credit account field, select the credit card account you received the refund.

- Select the date in the Payment date section.

- In the Category details section, select the same expense account of your original purchase.

- Enter the amount.

- Click Save and close.

For additional information, you can refer to this article: How can I record a cash back to my credit card account?.

Please refer to this article on how you can run a report that reflects all payments made to vendors: Run a report with vendor totals.

Please let me know if you have any other questions or concerns by clicking the Reply button below. I'll be here to assist. Have a great rest of the day!