- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Other questions

Glad to hear again from you, @Kitkat2.

I appreciate you for clarifying your concern. Let me share additional information on how to set up progress invoicing.

For starters, if you create an invoice out of the estimate that you have created in the system, all the information on the estimate will be carry over to the invoice.

On the other hand, since you're creating an invoice based on the percentage of the completed task or supplied materials, you can create send your vendor a progress invoice.

Let's make sure that this feature is enabled on your end. Here's How:

- Go to Edit.

- Choose Preferences.

- Under Jobs and Estimates, select Company Preferences.

- Click Yes on the question Do you create estimates?

- Under Do you do progress invoicing, click Yes.

- Hit Ok.

Once progress invoicing, you can now create an invoice for a specific item on your Estimate. Here's how:

- Create the Estimate

- Go to Customers.

- Choose Create Estimates.

- Choose your customer.

- Fill in the rest of the Estimates details.

- Click Save and Close.

- Create the Invoice.

- Click Customers.

- Select Customer Center.

- Look for the specific customer.

- Open the estimate you have created.

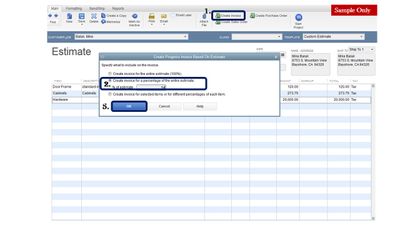

- Click Create Invoice.

- Choose Create invoice for a percentage of the entire estimate.

- Indicate how many percentage of the estimate would you like to invoice.

- Click Ok.

- Review the details of the automatically created invoice.

- Click Save and Close.

Also, you can pull up your Job Progress Invoices vs Estimates report to verify how much of the estimated amount has been billed.

That should do it! Feel free to click the Reply button if you have other questions about creating a progress invoice. I'm here to help.