- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Taxes

Hi ,

I have used SAGE as well so I understand that QB will be very different for you. From your screenshot, It appears that you are manually entering your GST by G/L account in the Expense section of the bill, instead of using QB's built-in GST tax provisions. Only by using QB's built-in tax provisions will you be able to get a correct Sales Tax report. QB is designed to work with only one GST account, with transactions being separated into 'collected' and 'ITC' by other means of classification in the Sales Tax items.

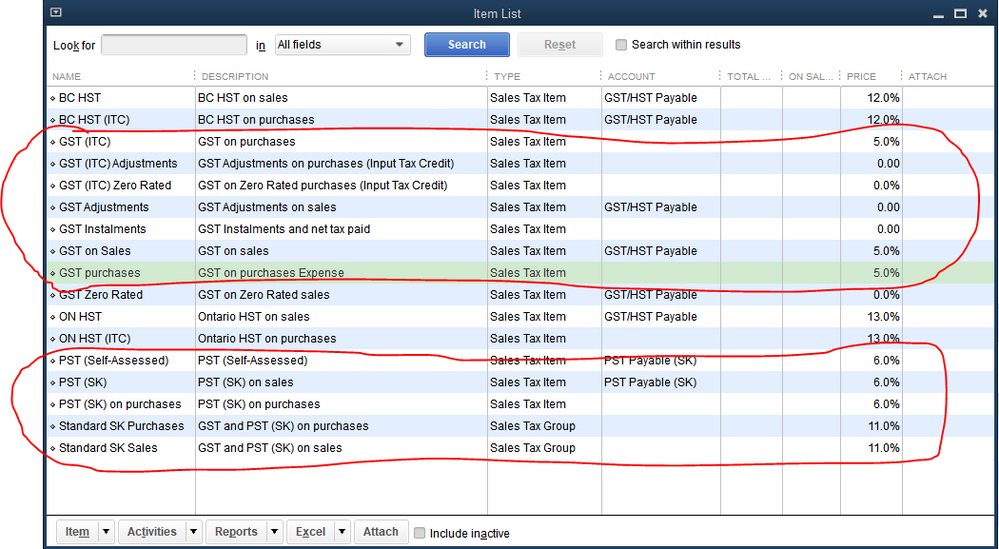

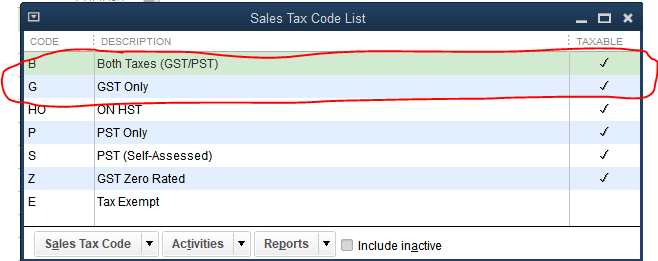

First of all, you need to ensure that you have your Sales Tax Items set up properly in your Item List. QB has some default sales tax items, but check them to make sure they are what you need.

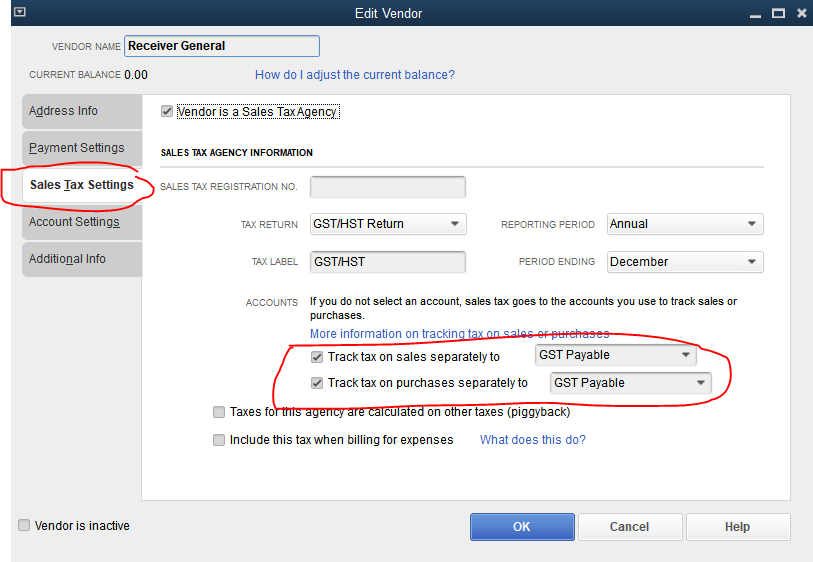

The sales tax information for your tax vendors determine which accounts are used with all of these codes.

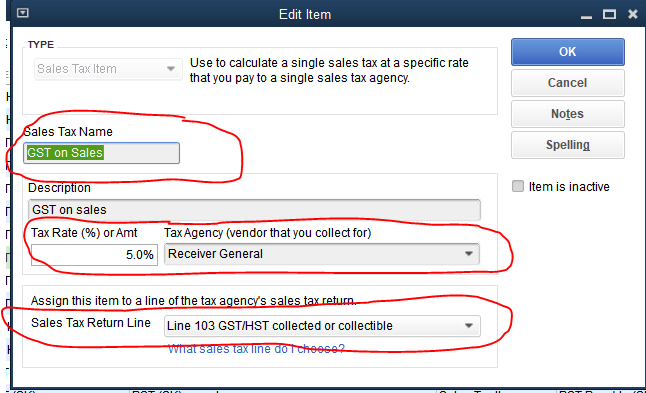

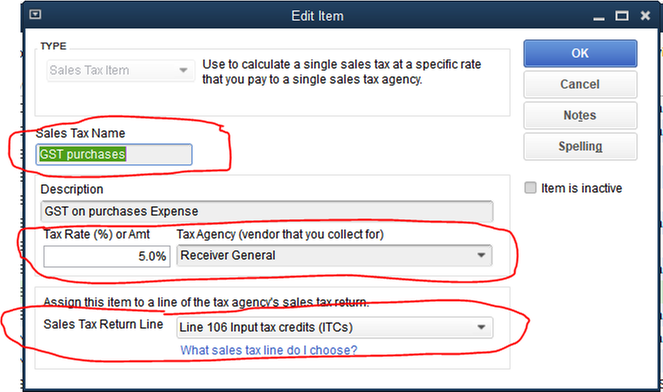

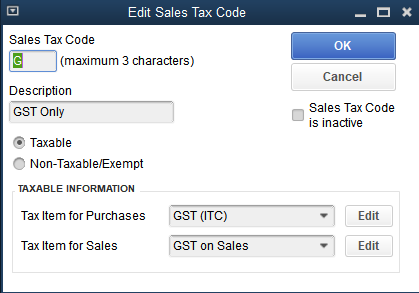

When you drill down into these sales tax items (Note that they are Sales Tax Items), you have the opportunity to set the tax rate, the tax agency (Vendor that is designated as a tax agency in your Vendor list), and assignation of the code to a particular Sales Tax Return line.

Now you use these Sales Tax Items to link up to your Sales Tax Codes. See example below for my list.

Drilling down into these items is where you set which 'Sales Tax Items' make up each code. For example, I have one I have re-named 'B', (QB's original code was 'S', but it makes more sense to me to use 'B' for 'Both'). See below for my GST sales tax code which is 'G'. Note that the Tax Item for Purchases and the Tax Item for sales are indicated with sales tax items from your Item List.

This ensures that when you use the Tax Code G on Bills , the tax is assigned properly as an ITC and populates the sales tax reports accordingly, and when you use Tax Code G on Invoices or Credit Memos, the GST collected is assigned properly and populates the sales tax reports accordingly.

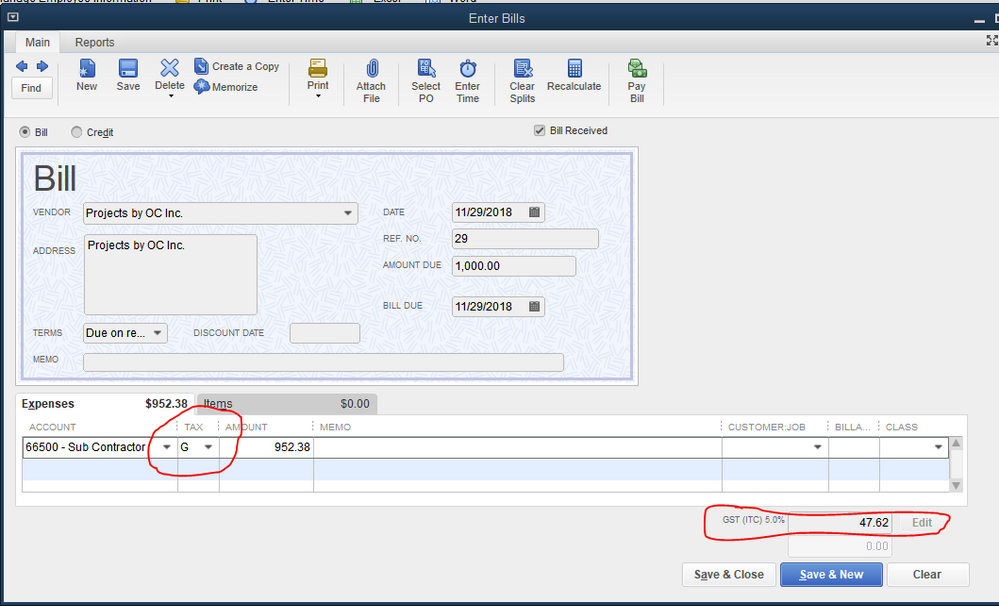

Here is your transaction below using the tax code instead of the G/L account distribution:

Note that posting directly into the GST G/L account in this window (how you did it originally) will always result in Unassigned Sales Tax amount. You will have to go back into your transactions and use the 'G' code to establish your ITC's, rather than coding directly to the GST G/L account.

Sometimes QB will calculate the GST off by a penny here or there, but no worries, you just override it right here on the bill. Note that it automatically recognizes this GST transaction as an ITC.

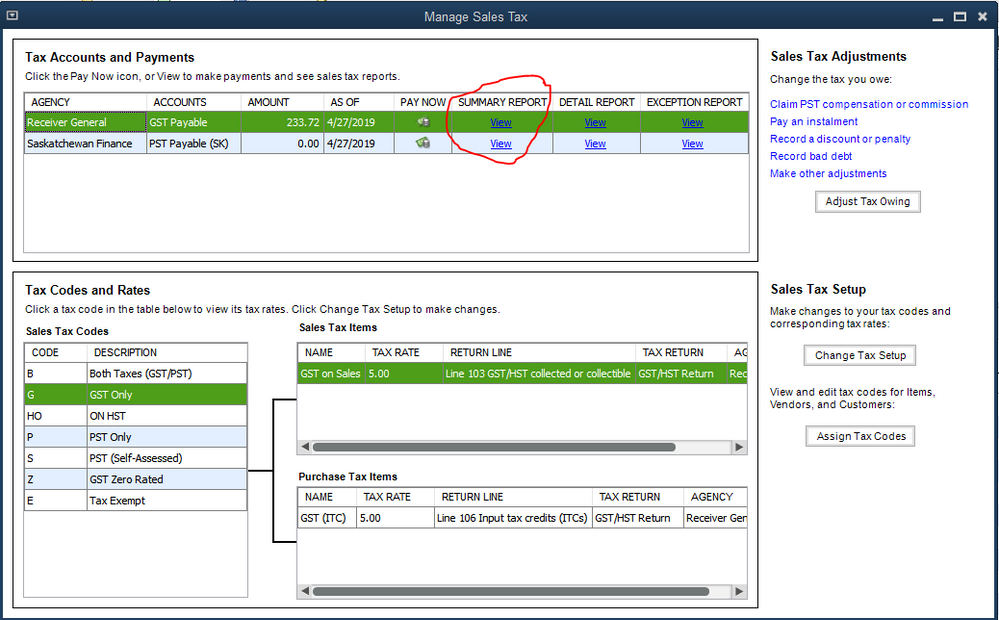

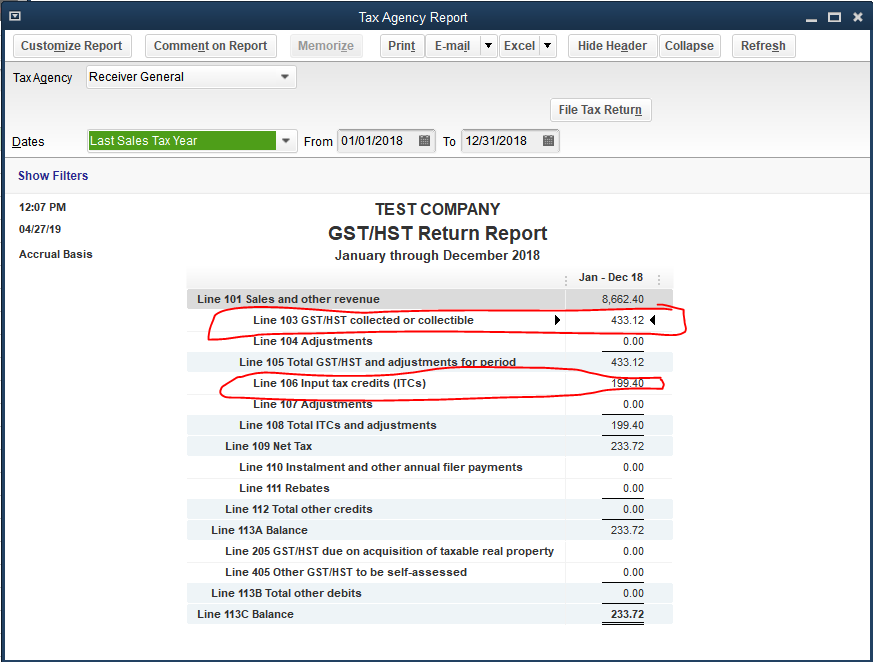

Now you will File your Sales tax for a given period so the first thing I do is go to 'Manage Sales Tax' and open a summary report for Receiver General - GST Payable.

The following report opens:

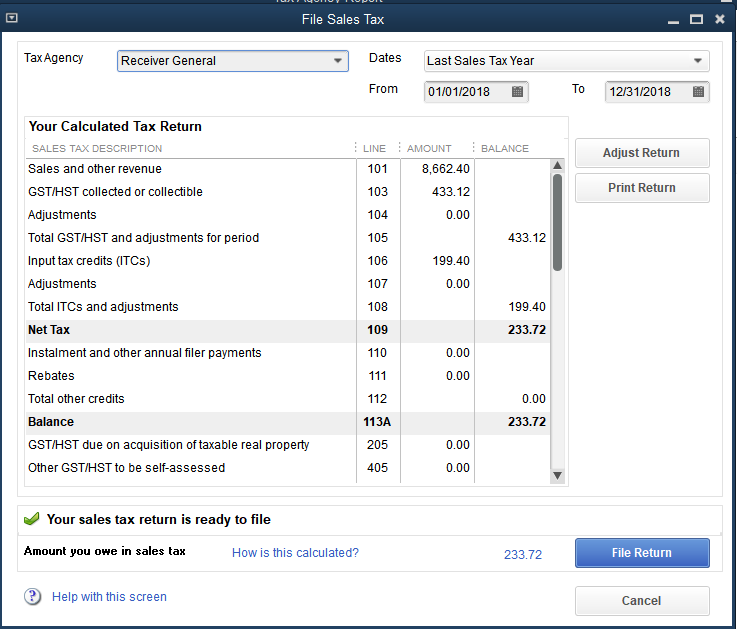

You can drill down into any of the numbers there to see where they are coming from (you will likely have to change the date range to 'ALL' once you have drilled down so the actual transactions will show up.) Once you know this is all correct, Click on the File Tax Return button. Once you do, the following dialogue will come up:

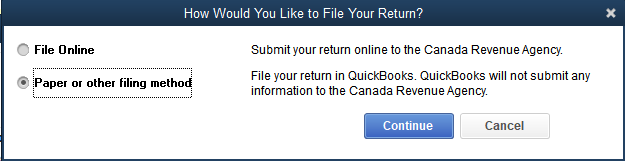

Click on File Return. The following will come up:

I always choose Paper or other filing method as it gives me more control over the process. Choose Continue. Another diaglogue will come up asking if you want to print your sales tax return before filing. At this point, a Payment dialogue will come up asking whether you want to pay now or pay later. Whether you choose one or the other, this is the point at which QB takes your GST liability, removes it from the GST G/L Account and turns it into a Payable to your tax vendor in your A/P register. I usually choose Pay Later.

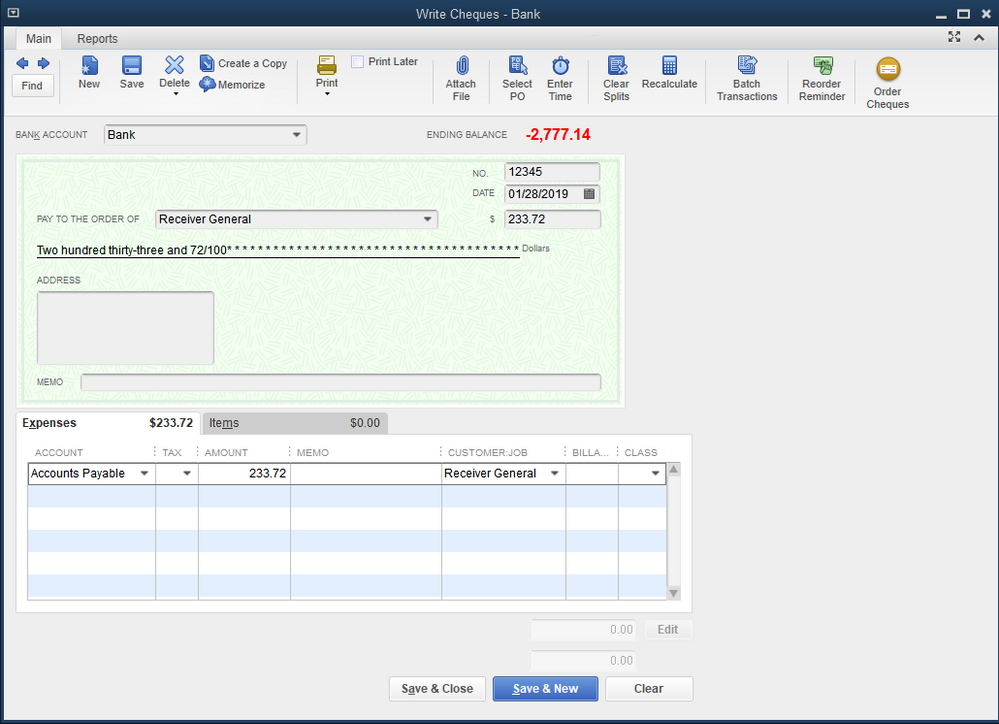

You mentioned that you had already remitted the GST prior to discovering the incorrect attribution of GST to collected or ITC. At this point I would go back to the cheque where you made payment for the GST originally and for which you had not yet filed in QB. Change the account from the GST account you originally used and insert Accounts Payable account. Tab over to the Customer:Job and enter your GST Tax Vendor (in my case it is called Receiver General).

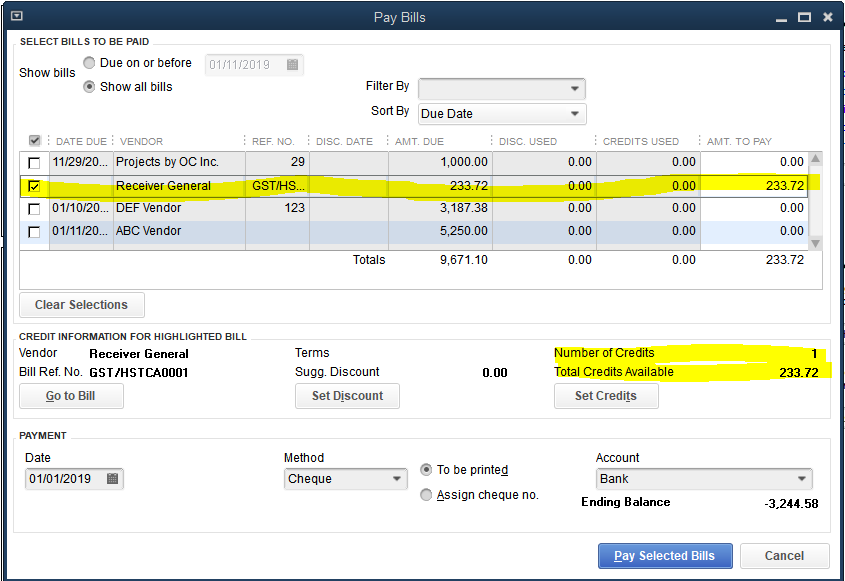

Now go to your Pay Bills. Click on Receiver General. Note as soon as you do, there is now a Credit available.

Click on Set Credits and apply the credit to the Receiver General Bill.

Now you have filed all your GST properly, and applied your previous payment towards the filed amount. There is no need to use the Adjustment window in the tax filing process.