- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Taxes

Thanks for sharing the details with me, @Leah1989.

I’m here to help you and share some insights on how to record this in QuickBooks Online (QBO).

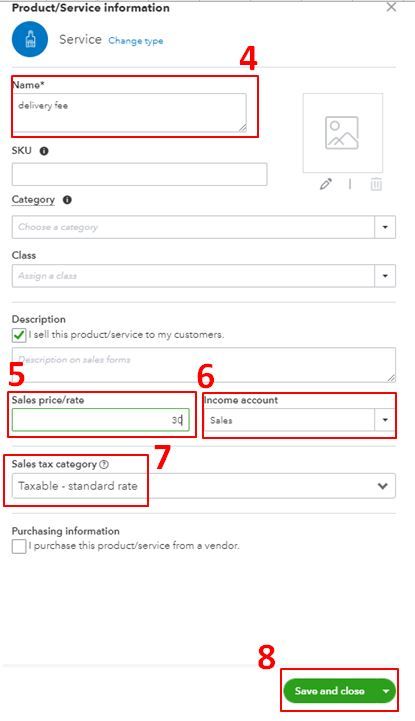

To easily track those delivery service sales, you’ll want to create a service item. No need to do a journal entry. Let me show you how:

- Go to the Gear icon.

- Select Product and Services.

- Click New and select Service and the Item type.

- Add the Name (delivery fee).

- Enter the delivery fee amount under the Sales price/rate field.

- Choose an income account. (you can work with your accountant on which account to choose).

- Enter the sales tax from the Sales tax category field. (If you don’t see this drop-down, you'll need to set up sales tax in QuickBooks).

- Once done, click Save and close.

You can also check this link for more details about how to add product and service items to QuickBooks Online.

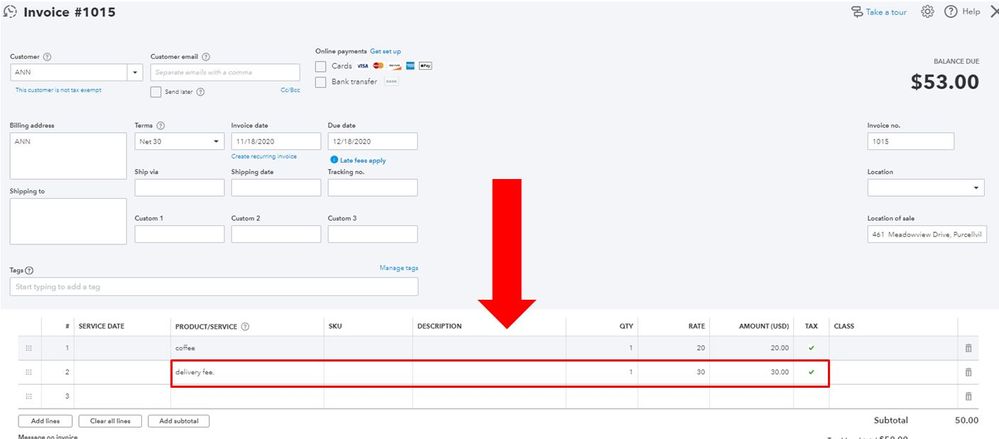

Then add the delivery fee as another line item when creating an invoice to your customer. I’ve added an image for your visual reference.

Once your customer pays their invoice, you can refer to this article on how to record it in QBO: Record invoice payments in QuickBooks Online.

Also, if you wish to create a journal entry, I suggest reaching out to an accountant for guidance. They can effectively guide you on which account to use and ensure your accounts are accurate.

Furthermore, I’m adding this link that you can utilize in reconciling your accounts: Reconcile an account in QuickBooks Online. This link provides detailed steps and information on matching your accounts correctly.

Need to learn some tips on navigating around QBO? You can check out our QuickBooks Support page. Here, you can browse articles and topics for your reference.

Let me know if you have other questions about recording sales in QBO. I’ll be around ready to help you out. Keep safe.