Learn how your contractors can add their own 1099 tax info in QuickBooks Online and QuickBooks Contractor Payments.

Just like having an employee fill out a W-4 when you hire them, you should ask your contractor to complete a W-9. A W-9 will allow you to gather your contractors name, address, TIN or Social Security number. For more information about W-9s see Instructions for the Requester of Form W-9.

Collecting W-9s through QuickBooks Online or QuickBooks Contractor Payments lets you invite your contractors to complete their own profile and submit a signed W-9 online anytime. It only takes a few minutes, and when you do, you'll have what you need for tax time, which makes creating 1099s a breeze. This feature also encrypts your contractor’s sensitive tax info so they can feel comfortable about sharing it.

Note this service isn't available in QuickBooks Desktop.

If you use our 1099 e-file service, your contractors will also be able to view and get their 1099s from the same account. If you are ready to create your 1099s, see What is a 1099 and do I need to file one?

To watch more how-to videos, visit our video section.

Step 1: Invite your contractor

For additional steps about how to add contractors, see Set up contractors and track them for 1099s.

Step 2: Wait for your contractor to submit their W-9 info

We’ll send your contractor an email inviting them to fill out and submit their W-9 info. They’ll either log in with an existing Intuit account if they have one, or create a free account to securely share their tax info with you. The whole process should only take a few minutes.

Next, they'll enter their W-9 info and digitally sign the form. Once completed, their info is saved in their account. For more info and detailed steps, direct your contractor to this article Fill out a W-9 and view your 1099-MISC.

Step 3: Check your QuickBooks Online or QuickBooks Contractor Payments account

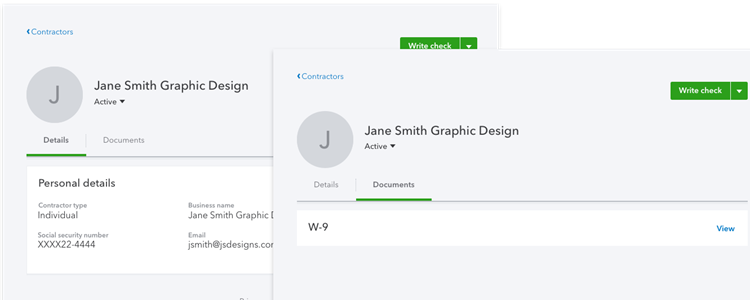

When your contractor submits their W-9, their info and a PDF of the signed W-9 is added to their profile in your account.

Need to make updates?

If the contractor updates their info at any time in their account, QuickBooks will automatically update it in your account.

What about 1099s?

Come tax time, if you e-file your contractor’s 1099 form through QuickBooks Online or QuickBooks Contractor Payments, your contractor will have access to it in their account. To access the account:

- Login at https://selfemployed.intuit.com/login#/contractor/clients.

- Go to Clients.

- Select View on the client who sent the 1099.

- Select Tax Forms.