Managing Long Service Leave in QuickBooks Payroll powered by Employment Hero

by Intuit•3• Updated 1 month ago

Learn how to set up long service leave for your employees and apply it in the pay run.

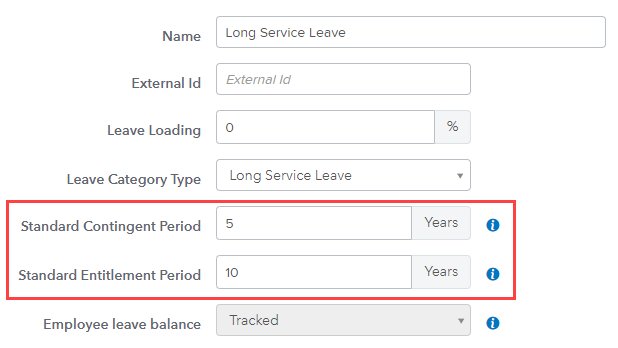

How to change the default Long Service Leave contingent and entitlement periods

The contingent period is the period of time after which an employer may be required to pay out long service leave under certain circumstances.

The entitlement period is the period of time after which an employee is eligible to their long service leave entitlement

To modify these numbers:

Follow this link to complete the steps in product

- Select the Payroll Settings tab.

- Under the Pay Run Settings column, select Leave Categories.

- Select Long Service Leave from the list of leave categories and edit the contingent period and entitlement period if needed.

- Select Save.

How to view Long Service Leave for individual employees

Follow this link to complete the steps in product

- Select the employee's name.

- Select Leave Allowances from the left menu, then navigate to the Long Service Leave section.

- From here you can view the employee's long service leave entitlement date, contingent period and entitlement period.

Note: You can edit the figures in the Leave Allowances section if you navigate to the Apply the following leave allowance drop-down menu at the top of the screen and select No leave allowances template. Remember to Save your template configuration at the bottom of the page to apply your changes.

How to apply Long Service Leave in the pay run

- Open the relevant pay run that an employee has taken Long Service Leave in.

- Select the employee name to expand their pay run details.

- Select the Actions button, then select Take Leave.

- Select Long Service Leave from the drop-down menu, then enter the number of Long Service Leave hours taken.

- Select Save.

More like this