How to prepare your firm and clients for new payroll billing

by Intuit• Updated 5 months ago

From 1 April 2021, we’re switching to a new way of billing for QuickBooks Payroll powered by Employment Hero. This will impact the way all QuickBooks users are charged and pay for payroll services.

If you currently pay for your clients QuickBooks Online subscriptions under Bill My Firm in QuickBooks Online Accountant (QBOA), from 1 April 2021 your firm will also be charged any associated payroll fees they incur, including additional payroll costs your clients may currently be paying directly to Webscale Pty Ltd (the creators of KeyPay). This is the result of the consolidation of billing for QuickBooks Online and payroll services into a single monthly invoice (see below).

Alternatively, you can transfer the responsibility for paying invoices for QuickBooks Online and payroll services directly to your clients. If you choose to do this, they will pay the regular retail price for both QuickBooks Online and Payroll fees (see more below).

To prepare for the change, there are a few things for you and your clients to consider.

One bill

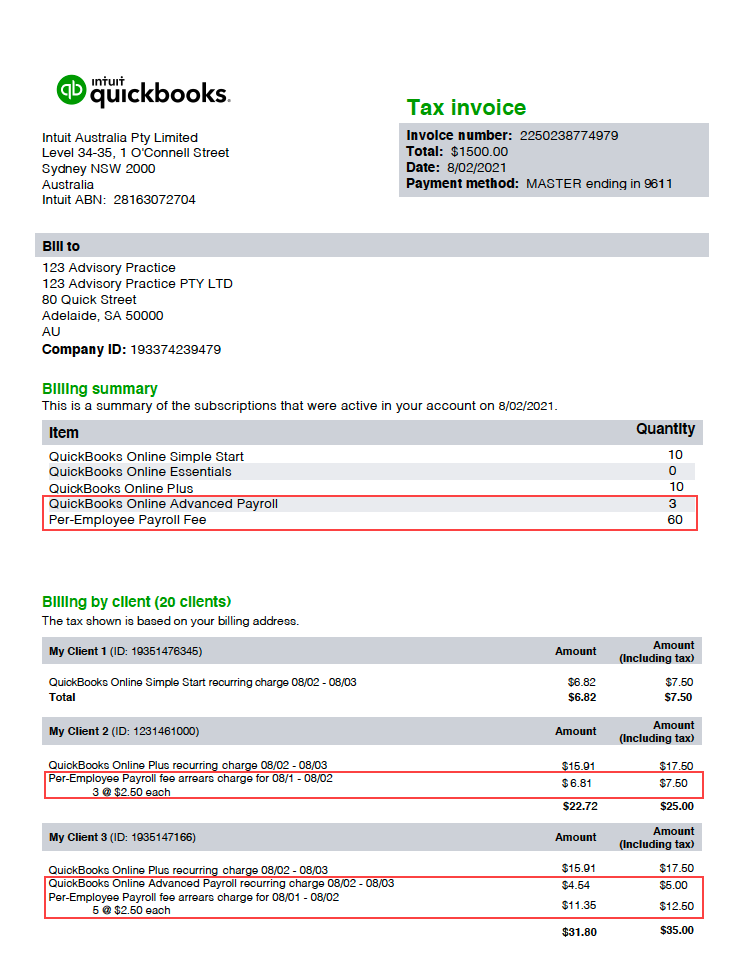

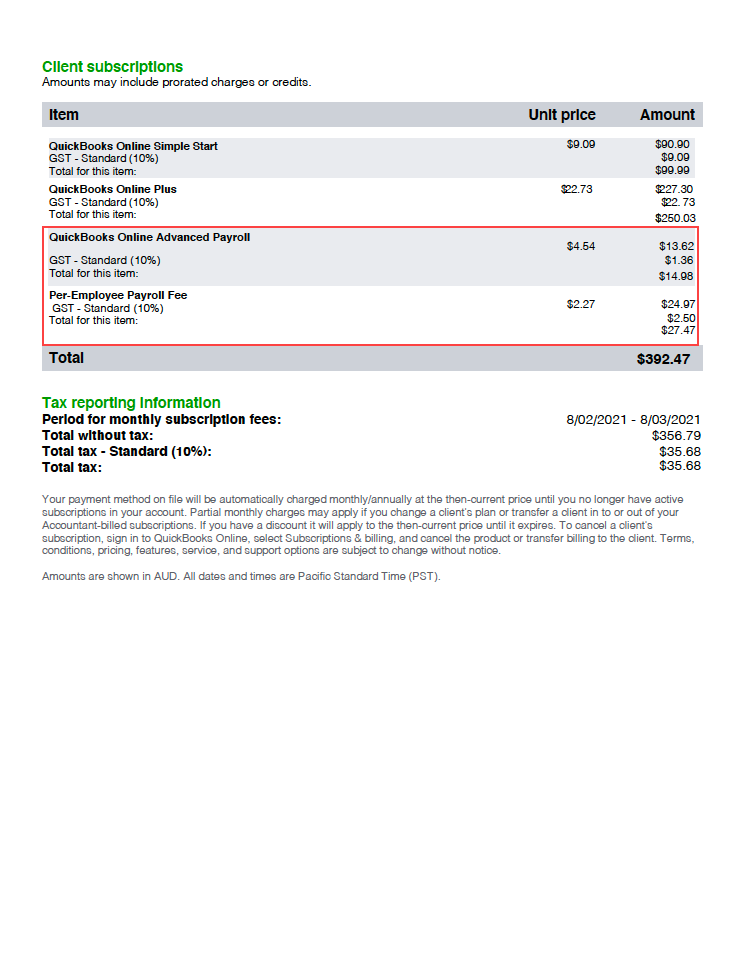

Once a month, you'll get just one bill for both QuickBooks Online and QuickBooks Payroll combined. Your bill will include line items for subscription and client usage, along with date ranges and pro-rata charges.

No more Employment Hero bills

If you are paying for your clients’ QuickBooks Online subscriptions and have clients paying Employment Hero directly for additional payroll users or Advanced Payroll, the cost for these services will be included in the consolidated invoice that is charged to your firm.

If you’d prefer, you can transfer billing to your clients. These clients will have the following discount applied to their subscription to support their transition - Simple Start 50% off the retail price for 6 months, Essentials and Plus - 50% off the retail price for 12 months. We recommend completing this by 31 March to ensure a smooth transition.

How the billing works

The QuickBooks bill will be charged based on how many unique employees were included in pay runs finalised in the previous month, while the Advanced Payroll monthly subscription fee will be billed in advance for the next month ahead.

For Standard Payroll, on any given bill, you or your client will be charged by the number of unique employees included in pay runs finalised in the previous month.

For Advanced Payroll, on any given bill, you or your client will be charged for the subscription monthly fee for the next month and also charged for the number of unique employees included in finalised pay runs in the previous month.

When to expect your bill

You will receive the consolidated invoice on your usual billing date, every month starting from 1 April. For your clients on the Advanced Payroll plan, you will be charged the monthly subscription fee in advance. The monthly fee for the employees your clients have paid will be charged in arrears.

Activating and accessing payroll

To help with the transition, we will pause new payroll sign-ups from 15 March to 1 April. There will be no downtime for current payroll users, so there’s no need to worry about missed pay runs.

Managing your client subscriptions

Compare ProAdvisor discount & retail prices

| Payroll plans | ProAdvisor discount price | Retail price |

| Standard monthly fee | $0 | $0 |

| Advanced monthly fee | $5.00 | $10.00 |

| Cost per employee paid | $2.50 | $5.00 |

Pay for your clients at a discounted rate

You can pay your clients’ QuickBooks Online and QuickBooks Payroll subscription fees at the ProAdvisor discount price - and best of all, no action is required from you. From 1 April, we’ll commence invoicing you for those clients subscribed under Bill My Firm in QuickBooks Online Accountant, on your usual billing date.

Let your clients pay for QuickBooks

If you’d prefer, you can transfer billing to your clients (see how below). These clients will have the following discount applied to their subscription to support their transition - Simple Start 50% off the retail price for 6 months, Essentials and Plus - 50% off the retail price for 12 months.

Here’s a reminder of how our prices stack up from 1 April 2021

| QuickBooks Online plans | Retail price |

| Simple Start | $22 |

| Essentials | $37 |

| Plus | $52 |

How to transfer billing to a client

For a client to pay their own QuickBooks Online and QuickBooks Payroll costs, you will need to switch them from Bill My Firm to Bill My Client in QuickBooks Online Accountant. Please note that this may result in you losing the benefit of any special promotional pricing bundles you may currently enjoy. Please consult the terms and conditions of your promotion.

Learn how to move a client from Bill My Firm to Bill my Client.

No split bills

QuickBooks Online and QuickBooks Payroll can no longer be billed separately. For clients who are currently paying Employment Hero directly, March will be the last month they receive an invoice from Employment Hero. Please note if your firm is currently paying for the client’s QuickBooks subscription, all associated payroll fees will be charged to your firm at the ProAdvisor discount price.

How to tell your clients

We’ve put together some resources to help you pass on the news. Find our email template here and our client-facing flyer here.

Cancelling QuickBooks Payroll

If your client wants to stop running payroll with QuickBooks, they can cancel payroll at any time.

If you have any questions about the upcoming payroll changes that are not addressed in this article, please contact your account manager or see our support options.

More like this

- For Accountants: QuickBooks Subscription and Payroll powered by Employment Hero Price and Billing changes from 1st April 2021by QuickBooks

- Transfer clients to your wholesale discount plan in QuickBooks Onlineby QuickBooks

- Email template to explain payroll billing changes to clientsby QuickBooks

- Manage your ProAdvisor Preferred Pricing plan and ProAdvisor discount clientsby QuickBooks