Create GST Inclusive Journal Entries

by Intuit•1• Updated 4 months ago

Learn how to configure your journal entries to include GST amounts.

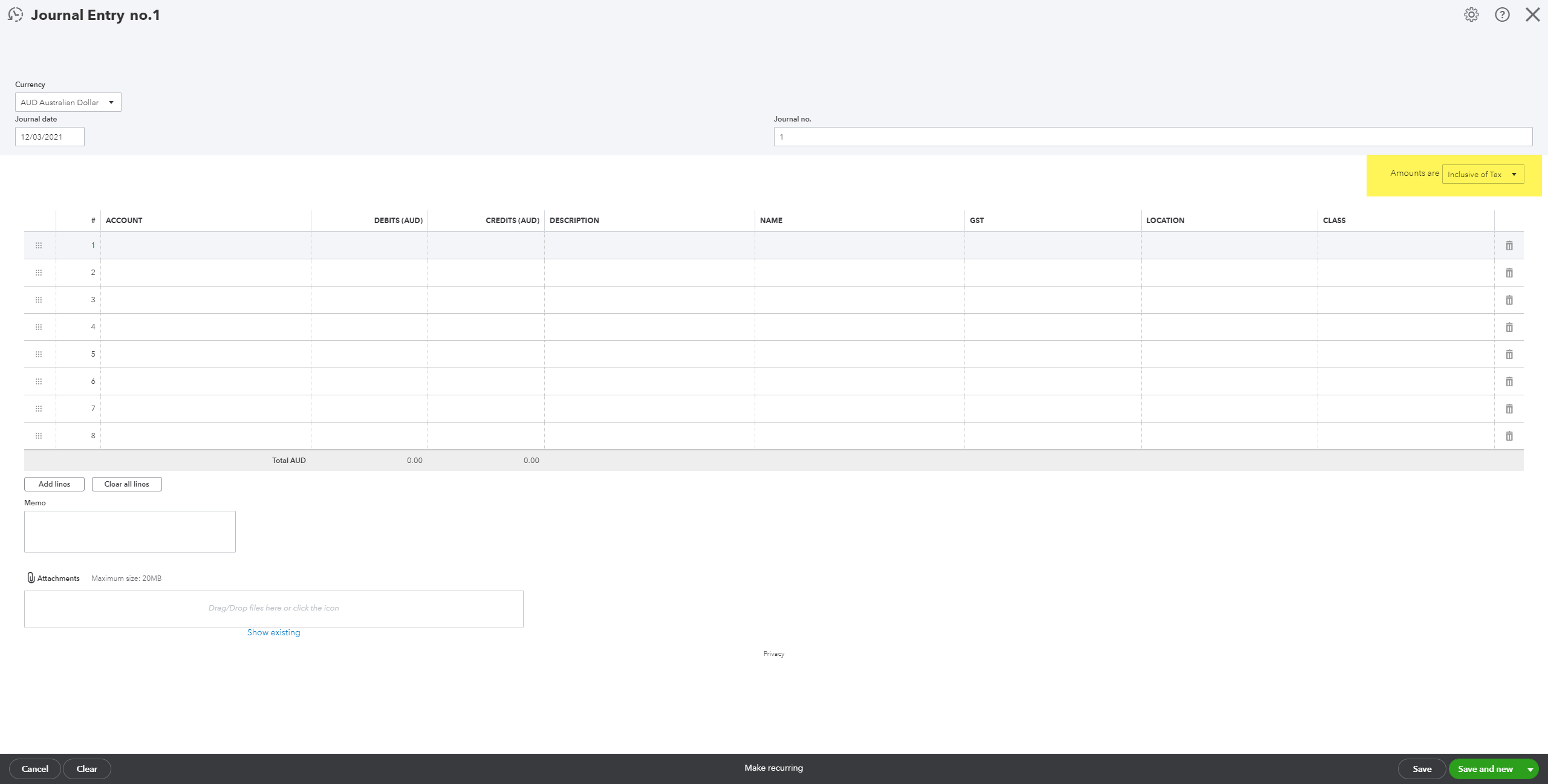

- Select +New, then select Journal entry.

- In the Amounts are drop down menu, select Inclusive of Tax.

Notes:

- If set to inclusive, when you add a GST code to that line, QuickBooks will automatically calculate the amount of paid GST as a proportion of the after-tax value.

- By default, journal entries are set to Exclusive of Tax, where QuickBooks will automatically calculate the amount of paid GST as a proportion of the pretax value.

More like this