Provide a termination reason for employees to prepare for STP Phase 2

by Intuit• Updated 4 days ago

With STP Phase 2, any employees terminated in the 2021/2022 financial year must have a reason for termination recorded. This is especially the case for employees terminated between 1st July and 19th October (when termination reason was made mandatory in QuickBooks Online Payroll powered by Employment Hero.

If there was no reason recording, any STP event containing that employee will fail validation and you will have to update this information.

How to update termination reason

Go to All apps ![]() , select Payroll, then select Employees (Take me there).

, select Payroll, then select Employees (Take me there).

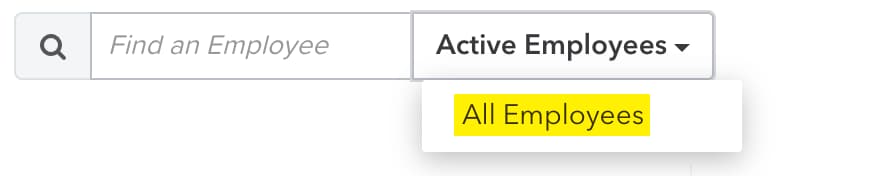

- Select the dropdown menu next to the Find an Employee search bar.

- Select All Employees. This will show a list of active and terminated employees.

- Select the terminated employee, then scroll to the bottom of the screen.

- Select the dropdown arrow next to Re-Activate Employee, then select Add termination reason.

- Select the applicable termination reason, then select Save.

How to update termination reason in bulk for multiple employees

Go to All apps ![]() , select Payroll, then select Employees (Take me there).

, select Payroll, then select Employees (Take me there).

- Select the arrow next to Add Employee.

- Select Export Employees.

- Under Data type, select Template with employee data (including terminated employees, then select Download.

- In Excel, filter the data so that only employees with a date of 1/7/21 or later in the EndDate column.

- Identify the employees with blank data in the TerminationReason column, then select a termination reason from the cell dropdown. Repeat for every affected terminated employee.

- Save the spreadsheet and select Import on the top right corner of the Export Employees screen. Then, upload the file back into the system.

I've updated my leavers' termination reason, what's next?

Below are the changes that most businesses will need to make in preparation for STP Phase 2:

- Update pay category classifications

- Update leave category classifications

- Update deduction category classifications

- Review employee tax file declaration information

If any of the following apply to your business, make these changes as well:

- If any employee is closely held, under foreign employment, an inbound assignee to Australia, labour hire or other, update their income type in the employee's settings

- If you have working holiday maker employees, classify them correctly and state their country

- If you have employees working in another country, provide their country of work

More like this

- Single Touch Payroll (STP) Phase 2 Hubby QuickBooks

- Update working holiday maker employee information for STP Phase 2by QuickBooks

- Single Touch Payroll (STP) Phase 2 FAQby QuickBooks

- Preparing for Single Touch Payroll (STP) Phase 2by QuickBooks