Write off inventory items given as promotional samples in QuickBooks Online

by Intuit• Updated a day ago

Learn how to write off inventory items you used for promotional samples.

Inventory features are available for QuickBooks Online Plus and Advanced. If you don’t have Plus or Advanced, upgrade your QuickBooks plan to start tracking your inventory.

Inventory features are available for QuickBooks Online Plus and Advanced. If you don’t have Plus or Advanced, upgrade your QuickBooks plan to start tracking your inventory.

Promotional samples given to customers count as inventory items. We’ll show you how to adjust your inventory and move the Cost of Sales to a Promotional Expense account.

Note:

|

Create an expense account to track

Here's how to create an expense account to track:

- Go to Settings

and select Chart of accounts (Take me there).

and select Chart of accounts (Take me there). - Select New.

- From the Account Type dropdown, select Expenses.

- From the Detail Type dropdown, select Advertising/Promotional.

- Enter a name in the Name field (for example, "Promotional/Samples - Not for Sale") or accept the suggested name.

- Select Save and Close.

Create an invoice for the item

Here's how to create an invoice for the item:

- Select + New or + Create.

- Select Invoice and complete the fields.

- Select Save and close.

Notes:

- Creating an invoice will reduce the item count in your inventory.

- Under Description and Message on invoice, explain the action (ex. to write off Promotional Sample Invoice #).

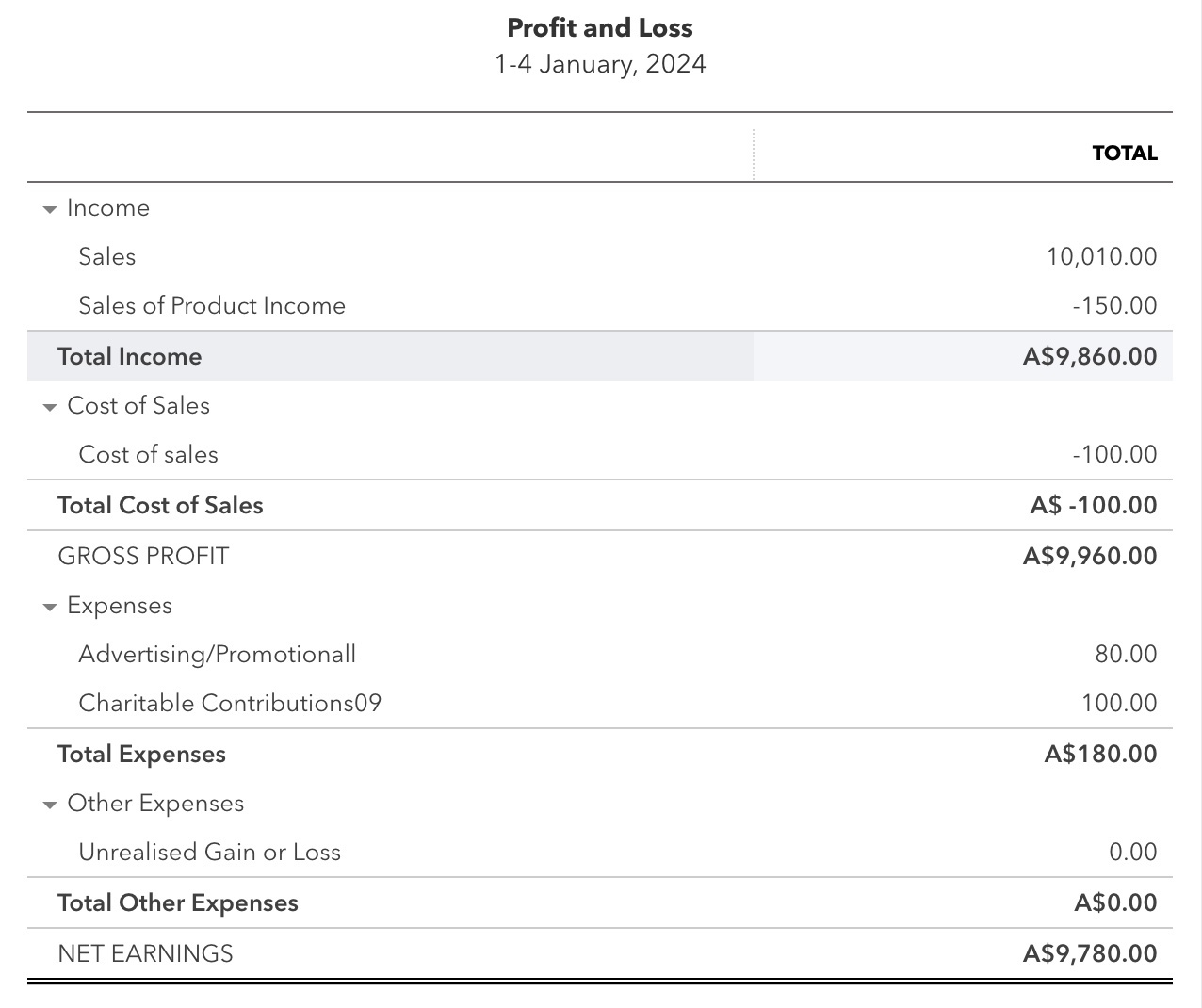

Run a Profit and Loss report

To see the income and cost of goods amount you need for your journal entry, run a Profit and Loss report on Accrual basis.

Follow this link to complete the steps in product

- Search for and open the Profit and Loss report.

- Select the start and end dates.

- For Accounting method, select Accrual.

- Select Run report.

- Identify the amount of Income and Cost of Sales you need to adjust.

Create a journal entry

This removes the income, credits the customer in Accounts Receivable (A/R), and credits the Cost of Sales to record the Expense.

- Select + New or + Create.

- Select Journal entry.

- Enter the date in the Journal date field.

On the first line:

- Under Account, select Sales of Product Income.

- Under Debits, enter the amount you are writing off.

- Under Description and Memo, type something like "To write off Promotional Sample Invoice # - [insert client name]".

On the second line:

- Under Account, select Cost of sales.

- Under Credits, enter the amount that the Cost of Goods are for this product.

- The Memo field should auto-populate.

- Under Name, select the customer name.

On the third line:

- Under Account, select Accounts Receivable (A/R).

- Under Credits, enter the same amount as the write-off.

- The Memo field should auto-populate.

- Under Name, select the customer name.

On the fourth line:

- Under Account, select Advertising/Promotional.

- The Debits amount should auto-populate.

- The Memo field should auto-populate.

- Under Name, select the customer name.

- Select Save or Save and close.

Apply the adjustment note

Here's how to apply the adjustment note:

- Select + New or + Create.

- Select Receive payment.

- Select the customer name.

- All open transactions should be listed. Tick the box beside the one(s) you want, then select Save and new. If there are no transactions, select Cancel.

End result sample

The end result should look like this sample:

More like this

- Write off bad debt in QuickBooks Onlineby QuickBooks

- Inventory valuation methods for cost accountingby QuickBooks

- How to prepare your firm and clients for new payroll billingby QuickBooks

- Shopify and QuickBooks Online integration guideby QuickBooks