Lodge your BAS or IAS in QuickBooks Online

by Intuit•10• Updated 6 months ago

Learn how to prepare and lodge your Business Activity Statement (BAS) or Instalment Activity Statement (IAS) in QuickBooks Online.

Before you start

- You can only start a BAS lodgement a maximum of 5 years prior to the current date.

- We recommend that you perform pre-BAS checks before beginning any lodgements to ensure data accuracy.

Lodging your BAS

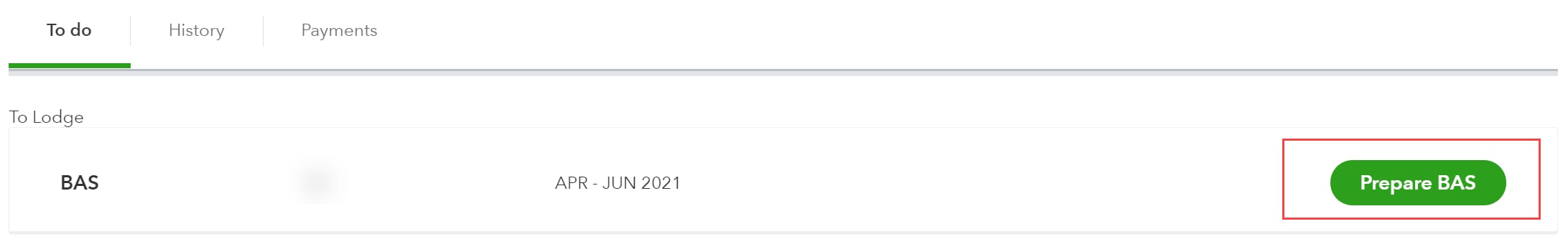

- Go to GST and select Prepare BAS. If this is the first BAS to be lodged for this company in QuickBooks, select Get Started.

- QuickBooks will display the total sales (including GST), total purchases, GST collected on sales, and GST paid on purchases based on transactions in QuickBooks. If all looks well, select Next.

- If you've enabled PAYG Withholding in QuickBooks, review your total salaries paid and total tax withheld figures. Then, select Next.

- If you've enabled PAYG Instalments in QuickBooks, enter your Income Tax instalment amount. Then, select Next.

- If you've enabled FBT, Luxury car tax, Fuel tax credits or Wine equalisation tax in QuickBooks, enter the amount due. Then, select Next.

- After reviewing the complete activity statement, select Mark as lodged to close the tax period in QuickBooks.

- After the lodgement, lodge your BAS directly with the ATO (if not lodging electronically from QuickBooks).

- Once you've made the payment to the ATO, record it in QuickBooks by following this article: Recording a GST payment (BAS Payment).

- If you've received a refund from the ATO, here's how to record it: Recording a GST refund

| Note: If you've noticed that some GST or PAYG Withholding figures do not look correct in the lodgement process, it may be caused by mistagged tax codes or GST amendments. Refer to this article on how to fix the figures: What to do when BAS amounts look incorrect. |

Here's a video guide on how to lodge your BAS in QuickBooks Online:

Monthly IAS can be completed using the same method as preparing your BAS.

For example, if you need to catch up on Q4 BAS (April to June), and report monthly PAYGW and quarterly GST, the GST page will show the April period as outstanding, with Prepare IAS as the button.

After you lodge April IAS, the GST page will then show the May period outstanding and Prepare IAS as the button.

After you lodge May IAS, QuickBooks will now show April through June as the period outstanding and Prepare BAS as the button.

The BAS lodgement will include GST obligations for the full quarter, but only PAYGW obligations for June. Once you lodge your quarterly BAS, the GST page will then show Prepare IAS for the month of July and so on.

If you've lodged your BAS but need to make changes to transactions in the lodged period afterward, you can request to unlodge your BAS by contacting support.

Note that you can only unlodge your BAS periods in chronological order (from the most recent to the oldest).

We're here to help

If you need additional help or have questions, or you require assistance at any point in this process, our Customer Success team is happy to help.

Sign in to QuickBooks and start a discussion in our QuickBooks Community or join one of our Facebook Groups to connect with other like-minded QuickBooks customers.

More like this

- Report PAYG Withholding on BAS and IASby QuickBooks

- Recover from your BAS amendments issueby QuickBooks

- Set up GST and BAS in QuickBooks Onlineby QuickBooks

- Connect QuickBooks Online with the ATO to enable direct BAS lodgementby QuickBooks