How to set up Single Touch Payroll

Learn how to set up Single Touch Payroll (STP) in QuickBooks Online.

Step 1: Set up ATO Supplier Settings

First, you need to set up the ATO (Australian Taxation Office) settings in QuickBooks Online. To do so:

Go to All apps  , select Payroll, then select Employees (Take me there).

, select Payroll, then select Employees (Take me there).

- Select the Payroll Settings tab.

- Under Business Settings, select ATO Settings.

From here the steps differ slightly if you are setting up as the employer, as a registered Tax/BAS Agent, or as an intermediary for multiple employing entities.

If you have selected As the Employer, you will be required to complete the following information:

- Australian Business Number (ABN)

- Branch Number*

- Name

- Address Line 1

- Address Line 2*

- Suburb

- Contact Name

- Signatory Name* (only required to be completed if you want the name on the payment summaries to be different to that entered in the 'Contact Name' field above)

- Phone Number

- Fax Number*

- Is this employer exempt from FBT under section 57A of the FBTAA 1986? (If you select Yes here, a dropdown list will appear and you will need to select what exemption the business falls under. This setting is crucial as it will be used in determining what FBT amounts are exempt and taxable when submitting pay data to the ATO).

Note: items marked with an asterisk (*) are not mandatory.

Note: The ATO has reported that users lodging STP reports on behalf of clients are considered to be providing a payroll service and will therefore need to be registered as an agent with the Tax Practitioner Board (TPB).For further information, visit Registered agents providing a payroll service on the ATO website.

This setting is broken up into two sections: (a) the TAX/BAS Agent details and (b) the Business details. The business details fields required to be completed are identical to As the Employer details above.

The additional details required to be completed relate specifically to the TAX/BAS Agent:

- Tax Agent Number

- ABN

- Contact Name

- Phone Number

- Contact Email

All the TAX/BAS Agent fields are compulsory. You will not be able to save the ATO Supplier Settings without completing these details.

This setting is broken up into two sections: (a) the Intermediary details and (b) the Business details. The business details fields required to be completed are identical to the "As the Employer" details above. The additional details required to be completed pertain specifically to the Intermediary are as follows:

- ABN

- Contact Name

- Phone Number

- Contact Email

You can choose one of the employing entities to act as the Intermediary or another entity of the business. All the Intermediary fields are compulsory. You will not be able to save the ATO Supplier Settings without completing these details.

Step 2: Set up Electronic Lodgement and STP

Enabling electronic lodgement will allow you to lodge employee tax file declarations and STP lodgements online directly to the ATO. You must enable electronic lodgement before you can enable STP.

The following steps must be completed correctly otherwise your STP lodgement will fail. If you encounter an error, use the following guide to assist in troubleshooting.

.gif)

Go to All apps  , select Payroll, then select Employees (Take me there).

, select Payroll, then select Employees (Take me there).

- Select the Payroll Settings tab.

- Select ATO Settings.

- Select the Electronic Lodgement & STP tab.

- Follow the on-screen instructions and verify your business info.

- Call the ATO on 1300 852 232 and provide them with your Software Provider and ID. Or update your details through the Access Manager.

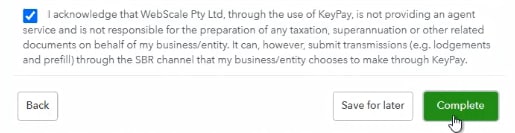

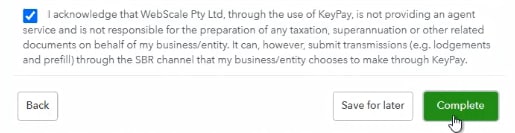

- Tick the acknowledgment message and select Complete.

- Proof of record of ownership (for example, personal Tax File Number (TFN), date of birth, address, recent ATO-generated notice)

- Your Australian business number (ABN) or, if you are a registered tax agent, you can use your registered agent number (RAN)

- The name (Employment Hero) or ABN (70 154 693 955) of your software provider

- your unique software ID

Note: If a registered agent or intermediary is lodging STP events on behalf of the business, the ATO connection MUST be against the registered agent or intermediary's record, NOT the business' record. So, with the second point above, when referencing ABN - this will be the ABN of the registered agent or intermediary.

Log in to Access Manager using your myGov credentials if you are the eligible associate or authorised staff of the business and follow these steps:

- From the left menu, select My hosted SBR software services.

- Select Notify the ATO of your hosted service.

- Search for Employment Hero on the list.

- Select the ABN link for Employment Hero.

- Enter the software ID and select Next.

- Read the Notification statement, then select Save.

How to set up STP as an employer - Video Guide

Prefer to watch a video? If you're setting up STP as the employer, here's a video guide on the above steps:

Standing Authority Declaration (Tax/BAS agent only)

This section only appears if the registered Tax/BAS Agent is set as the ATO lodgement type.

In this scenario, a declaration should be made by the employer or authorised employee at the time of providing the information to the Tax Agent and the wording of the declaration should be per the requirements set out within Section 6 of the Taxpayer Declaration Guide.

If this declaration has been completed, you can enter the details of this authority here. You are then able to use the Standing Authority when lodging pays events.

If the payroll information changes for a particular pay run, the Tax Agent must request client authority before lodging the pay event.

To add a Standing Authority, select Add Standing Authority.

- Enter the full name and email address of the person who has provided the standing authority.

- Enter the date the written authority was provided, then select Save.

Note: A registered agent doesn't need to have a Standing Authority with their client–it is not essential for STP reporting. All this means is that before you lodge a pay event, you will need to request client authority from within the system. The person(s) appointed to provide the authority will log into the applicable pay event and approve the event. Only after this time will the registered agent have the ability to successfully lodge the pay event.

Frequently asked questions

Each Employing entity's ABN will need to be registered and then enabled within the payroll software.

Note: the software ID for each employing entity is the same - this is correct and intentional

The software ID in each payroll business record is unique. The ABN will need to be registered for each different software ID.

It is the business ABN that must be registered. An authorised contact of the business must contact the ATO to register.

This is the unique ID that is used by the ATO to identify your business.

Note: The Tax agent isn't permitted to contact the ATO on behalf of the business.

--------------------------------------------

Do you have a question about this topic? Post it on our Community.

Content sourced from Employment Hero

![]() , select Payroll, then select Employees (Take me there).

, select Payroll, then select Employees (Take me there)..gif)

![]() , select Payroll, then select Employees (Take me there).

, select Payroll, then select Employees (Take me there).