Accept Card Payments with PayPal app FAQ

by Intuit•28• Updated 1 month ago

Get answers to frequently asked questions about setting up the Accept Card Payments with PayPal app in your QuickBooks Online.

Note: To download, visit our App Store or select the Apps tab in QuickBooks Online.

What are the benefits of the PayPal app?

The Paypal app provides four key benefits:

- Low credit card and debit card fees starting from 1.7% + 0.20 per transaction

- Easy to set up or upgrade from the existing PayPal app

- Improved and simple checkout experience for your customers

- With debit, credit card and PayPal wallet, there are more ways to pay for your customer

Will this integration work with other third-party PayPal-QuickBooks integration software?

With Accept Card Payments with PayPal, there's no need to use any other PayPal to QuickBooks integration software. If you do, you may find that duplicate transactions appear in QuickBooks.

What information do I need to provide to open a PayPal Business Account?

In order to seamlessly process payments with PayPal, you will need a fully verified PayPal Business Account. The documents required to verify your account will differ for sole traders, legal entities, and companies.

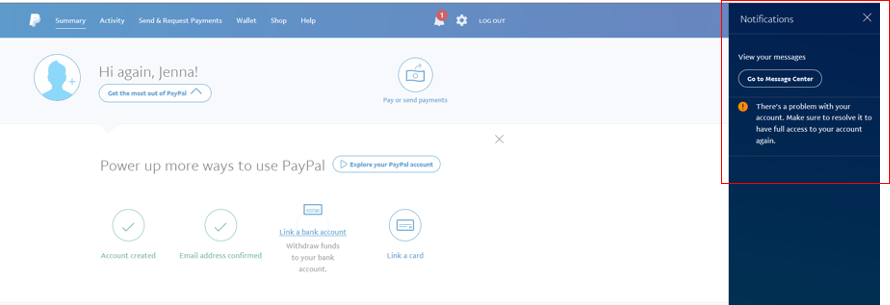

To begin the process, log in to your PayPal Business Account and follow the Account Notifications on the right-hand side. More information on PayPal’s Customer Identification Program can be found here.

How do I configure my PayPal integration settings?

To get to PayPal Settings:

- Follow this link to complete the steps in product.

- In the Find integrations tab, search for Accept Card Payments with PayPal.

- Under the Launch button, select Settings.

What does each setting mean?

- Automation - Choose whether or not you'd like to import PayPal transactions (Income and Expenses). This is the transaction sync functionality that was present in the previous Accept Payments with PayPal app.

- PayPal account - All PayPal payment transactions (minus fees) will be assigned to this Chart of Account.

- Defaults for income - Select an income type from the dropdown menu for PayPal income transactions to default to. You can also select the default GST code and choose if you want to use the name “PayPal Customer” or create a new customer whenever the integration does not recognise a customer.

- Defaults for expenses - Select the default GST code for expense transactions brought in from the integration.

- PayPal Fees - Select a pre-existing expense type to record PayPal fees.

How secure is the setup process?

We use the highly secure OAuth2 transfer protocol to transfer your PayPal information to QuickBooks Online.

What happens to my transactions after I change mapping settings?

All transactions will follow the new mapping setting, while the previous imported transactions will remain in their appropriate accounts.

Do I need to create invoices in PayPal and in QuickBooks Online?

You can create invoices in QuickBooks Online directly and email them to your customers. This allows your customer to pay with a credit card, debit card or PayPal wallet. When they make a payment to the invoice, payment is automatically created in QuickBooks Online and linked to the invoice.

What if I have a QuickBooks Online account, but don’t have a PayPal account yet?

If you don’t have a PayPal Business account, create one here.

What if I already have a QuickBooks Online and a PayPal Business account?

Great, setup will take just a few simple steps. Simply add the Accept Card Payments with PayPal app to your QuickBooks Online account.

Follow these steps to set up:

- Select + New button and select Invoice.

- Select Connect to PayPal next to the Payment Options.

- Grant permission to connect your PayPal account.

- Select Launch PayPal which will direct you to the PayPal login screen.

- Log in and enter your password.

- Follow the PayPal prompts.

- Select Go back to QuickBooks Online.

- Review account names and fee categories.

Now you can use PayPal to receive payments in QuickBooks Online.

How does the Accept Card Payments with PayPal app work?

Connecting the Accept Card Payments with PayPal app is quick, easy, and secure. The app will allow you to send invoices with a ‘Pay now’ button, so your customers can make online payments using Visa, Mastercard, American Express or their PayPal wallet.

You’ll receive payments in your PayPal account and the accounting will be done in QuickBooks Online.

Which credit cards are accepted?

Visa, Mastercard and American Express.

Will the Accept Card Payments with PayPal app help save time entering PayPal transactions?

Yes. When a payment is received by PayPal, it will automatically sync with QuickBooks Online, and record detailed information including items sold, quantity, discount, taxes, and so on.

PayPal fees are also imported as an expense in your QuickBooks account.

How much does the Accept Card Payments with PayPal app cost?

The app is free to download and use. You will need an Australian QuickBooks Online account and an Australian PayPal Business account to use the app.

PayPal merchant transaction fees apply for receiving online payments.

Learn more about PayPal fees.

Does the Accept Card Payments with PayPal have data import or sync functionality?

Yes, you can import up to 18 months of past PayPal transactions into QuickBooks through the PayPal Settings. There is also a real-time sync feature which will bring all your transactions from PayPal into QuickBooks Online with support for Multicurrency.

What is the difference between PayPal automation and connecting PayPal as a bank account?

Here is a table of the differences in the transaction detail of the PayPal app automation and bank connection.

| PayPal Automation | Bank Connection integration | |

| Transactions Imported | All types | All types |

| Payments | E-invoicing solution | N/A |

| Sales transactions | Imported (detailed categorisation) | Imported (only summary) |

| Transfers | Not yet available (coming soon) | Imported (detailed categorisation) |

| Expenses | Imported (default categorisation) | Imported (detailed categorisation) |

| User’s primary benefit | Detailed sales transactions, helps with accounting, online invoice payments capability, multicurrency | Categorised expenses and transfers |

| User’s primary limitation | User has to manually categorise supplier payments | Users do not get detailed sales transactions |

Note: The sync feature will automatically validate and stop the transaction sync if the same chart of accounts is used for both PayPal sync and bank feed.

What is the maximum amount I can request payment for in a single invoice?

The maximum amount a buyer can send in a single transaction is dependent on a number of factors, such as the status of their PayPal account, transaction limits set by their credit card issuer, and availability of funds.

If my customer used a credit card to pay my invoice, what would I be charged?

If your customer paid with a credit card linked to their PayPal account, then the standard PayPal wallet transaction fees (domestic and international) apply.

If your customer pays directly with their credit or debit card (not linked to a PayPal account), then the low card transaction fees apply, currently 1.7% + AUD 0.20.

Why is my PayPal account limited?

In order to ensure the security of your account and to comply with Australian regulations, PayPal may place limitations on your account which may prevent you from completing certain actions such as sending, withdrawing, or sometimes receiving money. More information is available from PayPal here.

Why can’t my buyer pay their invoice with PayPal?

There are a number of reasons why your buyer may not be able to complete a payment using PayPal.

If your buyer hasn't verified their PayPal account, or there are limitations on it, they will need to verify it by logging in and following the notification icons. Alternatively, they can visit the Confirm Your Identity page to resolve the issue. See more information from PayPal here.

If your buyer is paying by credit card, they may have reached their spending limit. They'll need to contact their card issuer, or consider linking their bank account to their PayPal Account.

Important:

PayPal account transaction fees (domestic and international) apply to all PayPal wallet payments, which include linked bank accounts, credit and debit cards, and PayPal balance.

The PayPal service is provided by PayPal Australia Pty Limited (ABN 93 111 195 389) which holds Australian Financial Services Licence number 304962. Please read and consider the Combined Financial Services Guide and Product Disclosure Statement before acquiring or using the service.

| Have any other questions for our team? If any of your questions were left unanswered, we'd love to hear them! Pop over to our QuickBooks Community's discussion on invoicing where you can ask your questions, have them answered by qualified QuickBooks Online experts, and hopefully help others with the same questions out in the process. |

More like this