Purchase a single return in Pro Tax (OnePay)

by Intuit• Updated 1 year ago

What is OnePay?

OnePay is a one-time purchase that allows a Pro Tax customer to file a single T1, T2, or T3 return. It is an alternative to subscribing for unlimited returns in Pro Tax.

You can watch our video on purchasing a QBOA Pro Tax OnePay (using T1 as an example) below:

You can watch our video on finding your invoice after purchase below:

Who is OnePay for?

A OnePay is best-suited for:

● An existing Pro Tax customer whose subscription has expired but still needs to file a return (or returns) in a later module.

● A new Pro Tax customer with a limited number of returns to be filed.

What modules does OnePay apply to?

T1, T2, and T3 modules are eligible for the OnePay option.

Why am I being prompted to purchase a OnePay?

If a Pro Tax customer attempts to populate a form for any module (for example, T1, T2, or T3) without an existing valid subscription, a Filing not available message displays.

Can I use Auto-fill my Return (AFR) with OnePay?

Yes. Prior to using AFR with OnePay, the preparer:

● Must have an EFILE account or WAC for T2 corporate returns

● Must have a representative ID

● Must EFILE a T1 Authorization request form (review this article to learn more about authorizing or cancelling a representative).

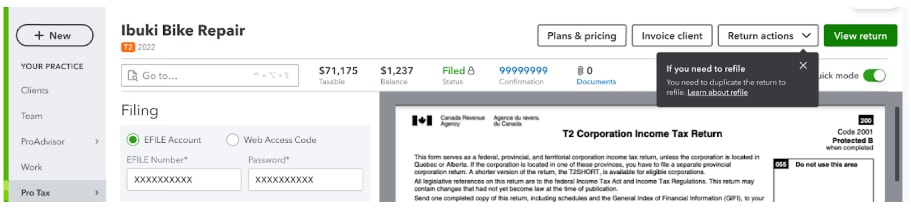

Can I refile my return?

Yes, returns can be refiled using OnePay. After you EFILE the return, the REFILE available option appearsr. If you need to refile, duplicate your return and submit it to CRA after you make your changes.

How does OnePay work?

OnePay is linked directly to the return based on:

● T1 (SIN, DOB and taxpayer name).

● T2: (BN, corporation name, taxation year).

● T3 (trust number, trust name and taxation year).

This information is locked and cannot be changed after the OnePay purchase.

If any of the above information was entered incorrectly after purchasing the OnePay, you may request a refund and repurchase the OnePay after you have made your corrections.

Note: You may need to duplicate the return in order to unlock it to make the changes.

Do I need more than one OnePay for a coupled return?

Yes. You will be prompted to purchase a OnePay for the primary taxpayer and then a second OnePay for the spouse (and dependents if applicable).

How do I purchase a OnePay?

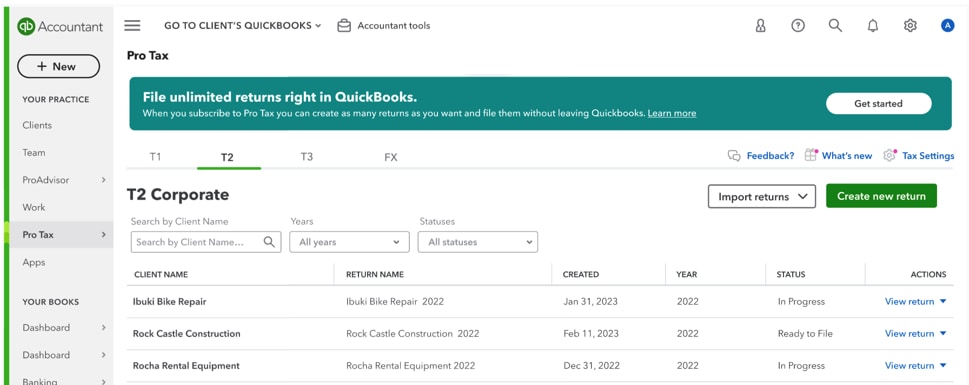

- Log in to your QuickBooks account.

- Select Pro Tax in the left navigation bar.

- Select the module tab that corresponds to the return type you wish to work on (for example, T1, T2 or T3).

- Carry forward an existing return or select Create new return:

If you are creating a new return, you’ll be prompted to enter your client information. Review this article to learn more on how to create a new return in Pro Tax.

If you do not have an active Pro Tax subscription, a Filing not available message displays.

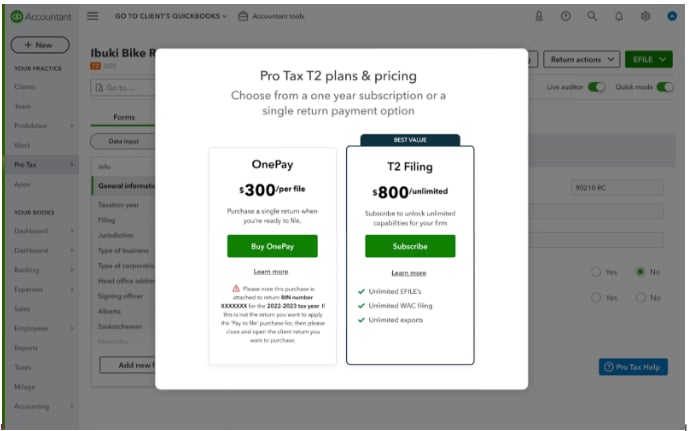

5. Select the Filing not available message.

A purchase window displays the options to purchase a OnePay:

The billing screen displays.

6. Enter your billing information.

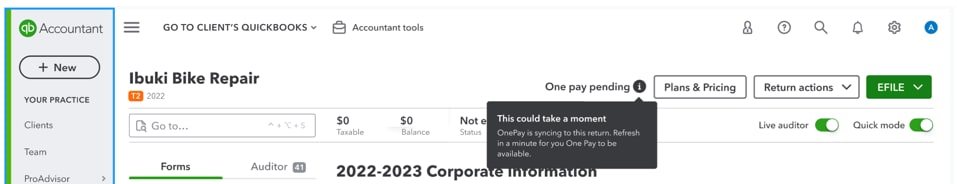

Once the purchase is completed, you will be sent back to the return. The One pay pending message displays for a duration of approximately 30 seconds as the payment is processed:

Note: You can continue to work on your return until the message closes.

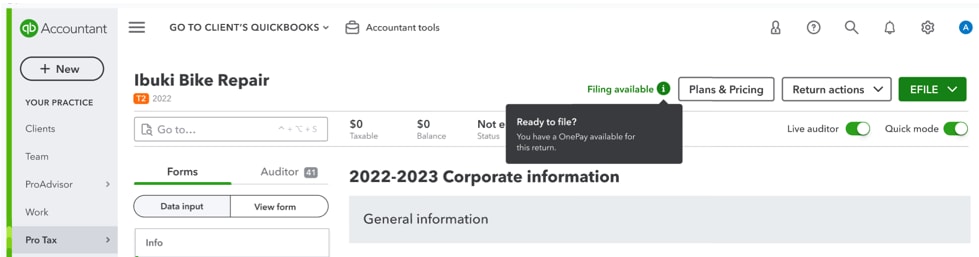

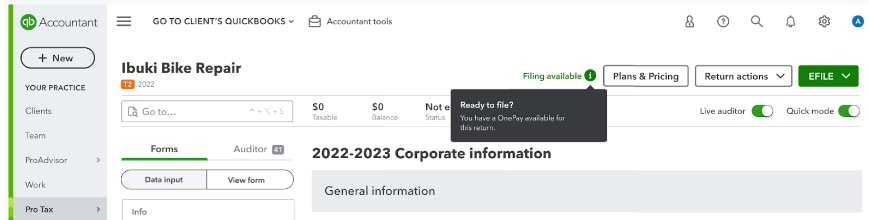

The message changes to Filing available once the payment is processed:

7. Once your return is completed, select the EFILE option to EFILE your return.

The EFILE preview displays:

8. If you need to refile your return, duplicate the return.

The status changes to Filing Available:

9. Select the option REFILE under the Return actions dropdown menu.

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

More like this

- Auto-Fill my Return in Pro Tax for T1 and T2by QuickBooks•7•Updated January 16, 2024

- Create new returns in Pro Tax T1by QuickBooks•4•Updated over 1 year ago

- Pro Tax frequently asked questionsby QuickBooks•9•Updated November 02, 2023

- Begin a return in Pro Taxby QuickBooks•4•Updated January 29, 2024

- About Pro Tax Data Entry Fieldsby QuickBooks•4•Updated over 1 year ago