Setting pricing in Pro Tax

by Intuit• Updated 4 months ago

You can set pricing in Pro Tax based on the type of returns and services you offer your clients.

Getting started

- Select Product and services from the Sales option in left-side navigation pane.

- Select New.

- Select Service.

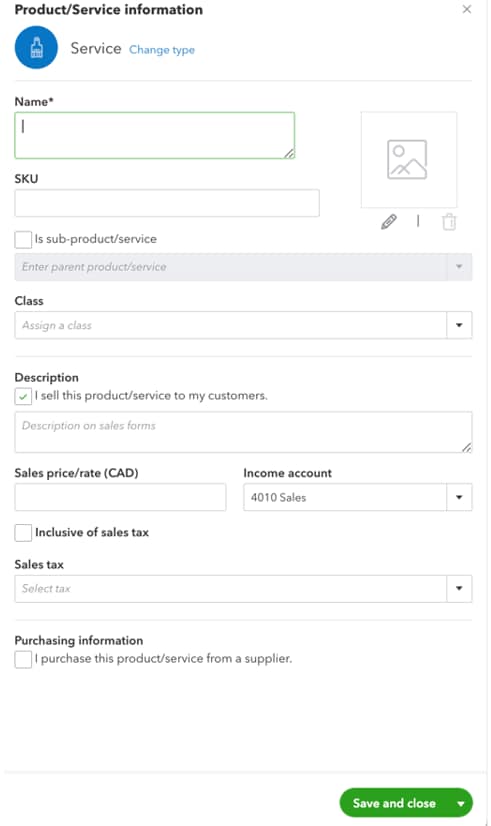

The Product/Service information page displays.

Completing required fields

The Product/Service information page provides the opportunity to set pricing:

- Name your service in the Name field (for example, T1 Tax return). This is a mandatory field.

- Enter a SKU in the SKU field, if applicable. This is an optional field.

- Under Description, select I sell this product /service to my customers. You may add a description if applicable.

- Enter the price and rate in the Sales price/rate (CAD) field. Note that Pro Tax does not calculate by the hour: instead, the amount entered here is a fixed rate.

- Select into which account you want the payment to be deposited under the Income account drop-down menu.

- Select your sales tax type under the Sales tax drop-down menu.

- Select the Save and close button.

Note: If you offer multiple services, you will have to create different options for each under Product/Service information. For example, if there is an additional charge for T1 returns that have foreign income, you may choose to create a second pricing that you can add to the base service.

Applying the pricing to the return

- Select EFILE -> T1 General from the left-side navigation pane.

- Select Invoice client from the top menu bar:

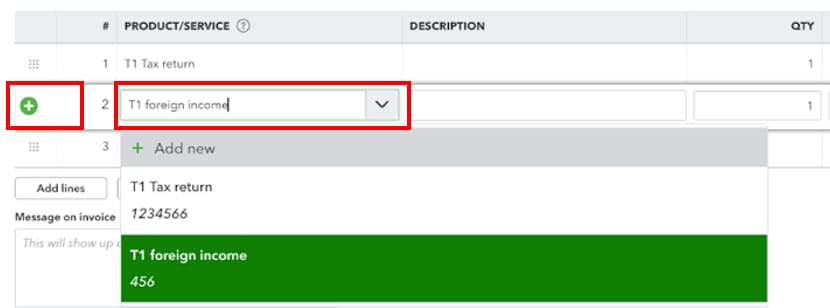

- Select the service you created under the PRODUCT/SERVICE column. The fields automatically populate:

- Select an additional service from the drop-down menu, or use the green “+” sign to add additional services to your tax return:

Pro Tax automatically calculates the additional services and taxes.

More like this

- QuickBooks Online Accountant Pro Tax Billing FAQby QuickBooks

- Pro Tax release notesby QuickBooks

- Introducing Pro Tax bundlesby QuickBooks

- Setting up Tax Settings in Pro Taxby QuickBooks