Changing Payroll remittance filing frequency in QuickBooks Online

by Intuit•6• Updated 8 months ago

Follow the steps below to change the payroll filing frequency for your business in QuickBooks Online.

Federal remittance

- Select the Settings ⚙️ icon, then Payroll settings.

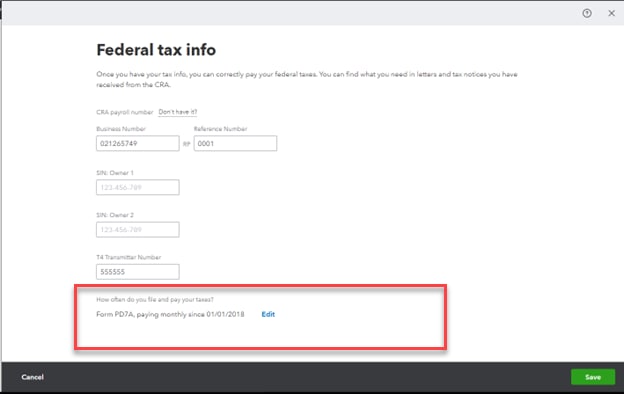

- Select the Edit icon for Federal tax info.

- Select Edit again at the bottom of the Federal tax info page.

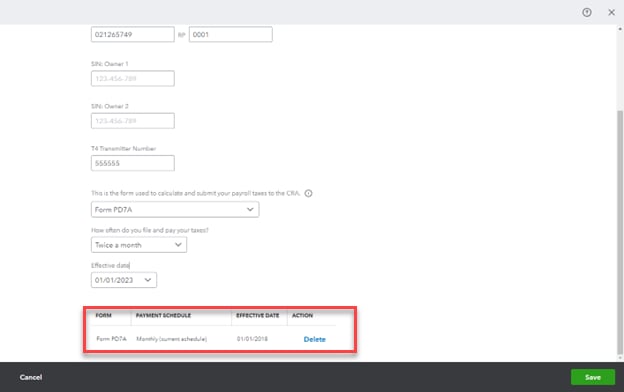

- Select the PD7A form, how often you file and pay your taxes, and the effective date by using the drop-down menus.

- Select Save.

You can also delete filing frequencies you no longer use from the bottom of the PD7A edit page.

Provincial remittance

You can adjust Québec provincial tax remittances and other provincial remittances for payments such as worker's compensation.

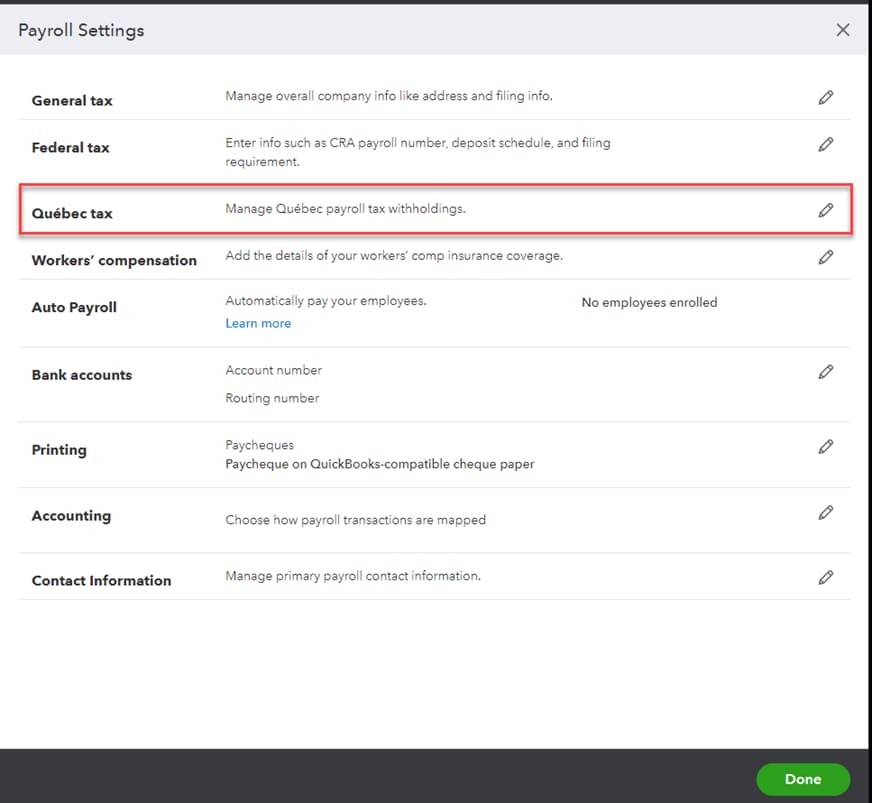

- Select the Settings ⚙️ icon, then Payroll settings.

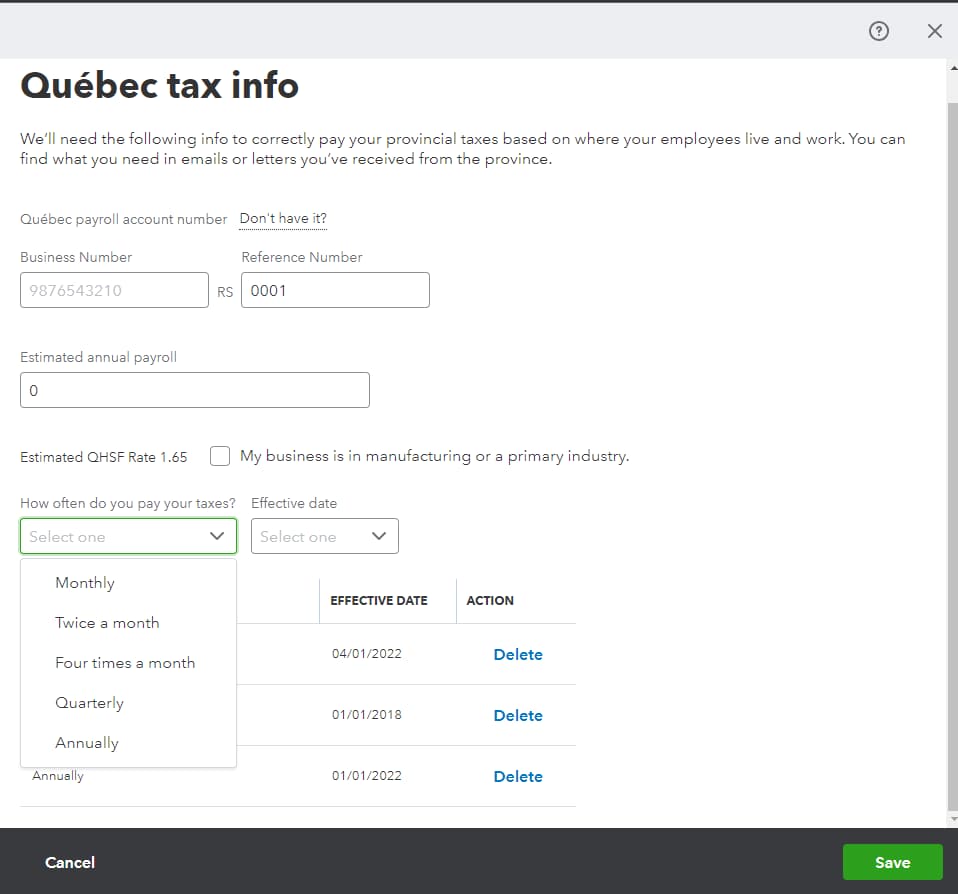

- Select the Edit icon for your province's tax withholdings. In the example below, the province is Québec.

- Select how often you need to complete your remittance. Below, you can delete other remittance schedules.

- Select Save.

More like this

- Remit deductions and contributions to the Canada Revenue Agency (CRA) or Revenu Québec (RQ)by QuickBooks

- Change sales tax filing frequency in QuickBooks Onlineby QuickBooks

- Edit or change employee info in payrollby QuickBooks

- Workers' Compensation for Quebec (CNESST), Ontario (WSIB), and BC (WSBC)by QuickBooks