QHSF Contribution Update

by Intuit• Updated 3 years ago

The calculated Québec Health Services Fund (QHSF) contribution for employers with a total annual payroll greater than $6,000,000 for 2021 may be incorrect. This article explains how you can review it and make any adjustments, if required.

QHSF Contribution Rate

Follow these steps to calculate your contribution rate:

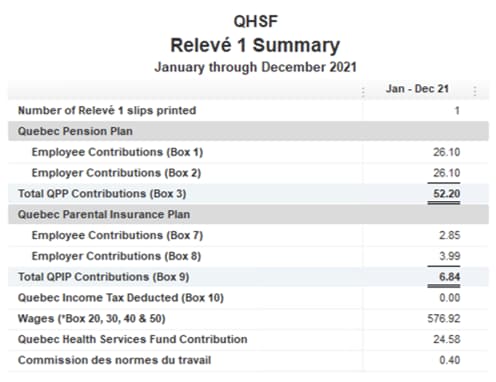

- Open the Relevé 1 Summary report from the Reports menu item in your QuickBooks Desktop:

2. Calculate your current QHSF Contribution Rate by using the following formula:

QHSF Contribution Rate = (Quebec Health Services Fund Contribution/Wages)*100

For example, in the above screenshot, QHSF Contribution Rate = (24.58/576.92)*100 = 4.26%

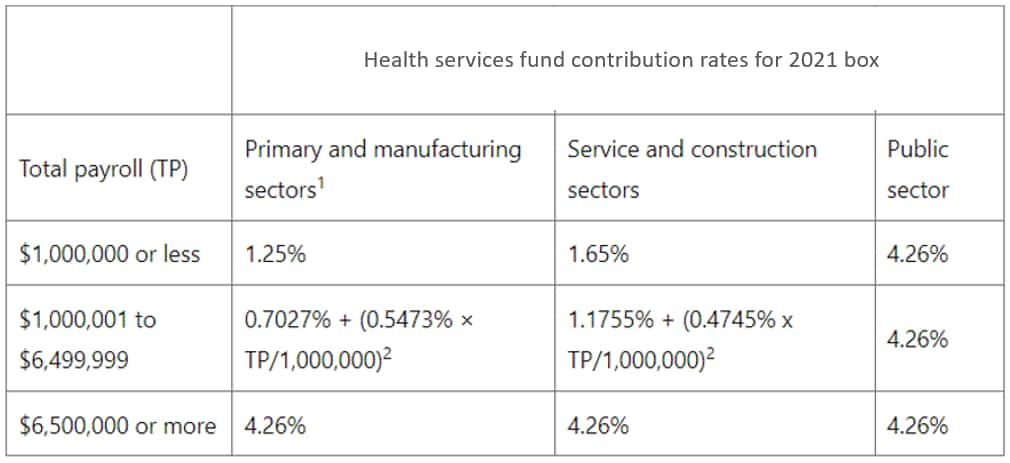

3. Refer to the following table to determine your QHSF contribution rate as required by Revenu Québec. Total payroll mentioned in the first column is the same as Wages in your Relevé 1 Summary report:

1The activities concerned are those grouped under codes 11 (Agriculture, Forestry, Fishing, and Hunting), 21 (Mining and Oil and Gas Extraction), or 31-33 (Manufacturing) of the North American Industry Classification System (NAICS) Canada. Visit the Statistics Canada website for a description of the codes.

2The contribution rate must be rounded off to two decimal places. If the number in the third decimal place is 5 or more, round up the number in the second decimal place.

4. If your current QHSF Contribution Rate, as calculated in step 2 is higher than the required QHSF Contribution Rate in step 3, then you have paid more than the required amount for 2021. In this scenario, you will be eligible for a refund from Revenu Québec.

5. Note: If your current QHSF Contribution Rate, as calculated in step 2 is lower than the required QHSF Contribution Rate in step 3, then you need to make an adjustment in the last remittance of QHSF contribution to Revenu Québec and the last TPZ-1015 form filed along with it. Follow these steps to calculate the adjustment amount:

a. Calculate the total QHSF contribution amount (in $) you are required to pay as per the required QHSF Contribution Rate which you calculated in step 3.

b. Subtract the QHSF Contribution you have already withheld, as mentioned in your Relevé 1 Summary report from the total amount you are required to pay.

c. The difference is the amount you need to pay in addition to what QuickBooks calculates for your last remittance of QHSF contribution in 2021.

d. Ensure that any more paycheques you create in 2021 after this adjustment, have the required QHSF Contribution Rate.

More like this

- Québec Health Services Fund (QHSF)by QuickBooks

- Download the latest payroll tax table update for QuickBooks Desktopby QuickBooks

- Run a sales and member contribution reportby QuickBooks

- Record donations and charitable contributions in QuickBooks Onlineby QuickBooks

- Set up and assign employee deductions and company contributions in QuickBooks Onlineby QuickBooks