Employee payroll tax exemptions

by Intuit•1• Updated 1 week ago

Some employees may be exempt from certain payroll taxes. When exempt from a tax, an employee is not required to contribute to that specific tax.

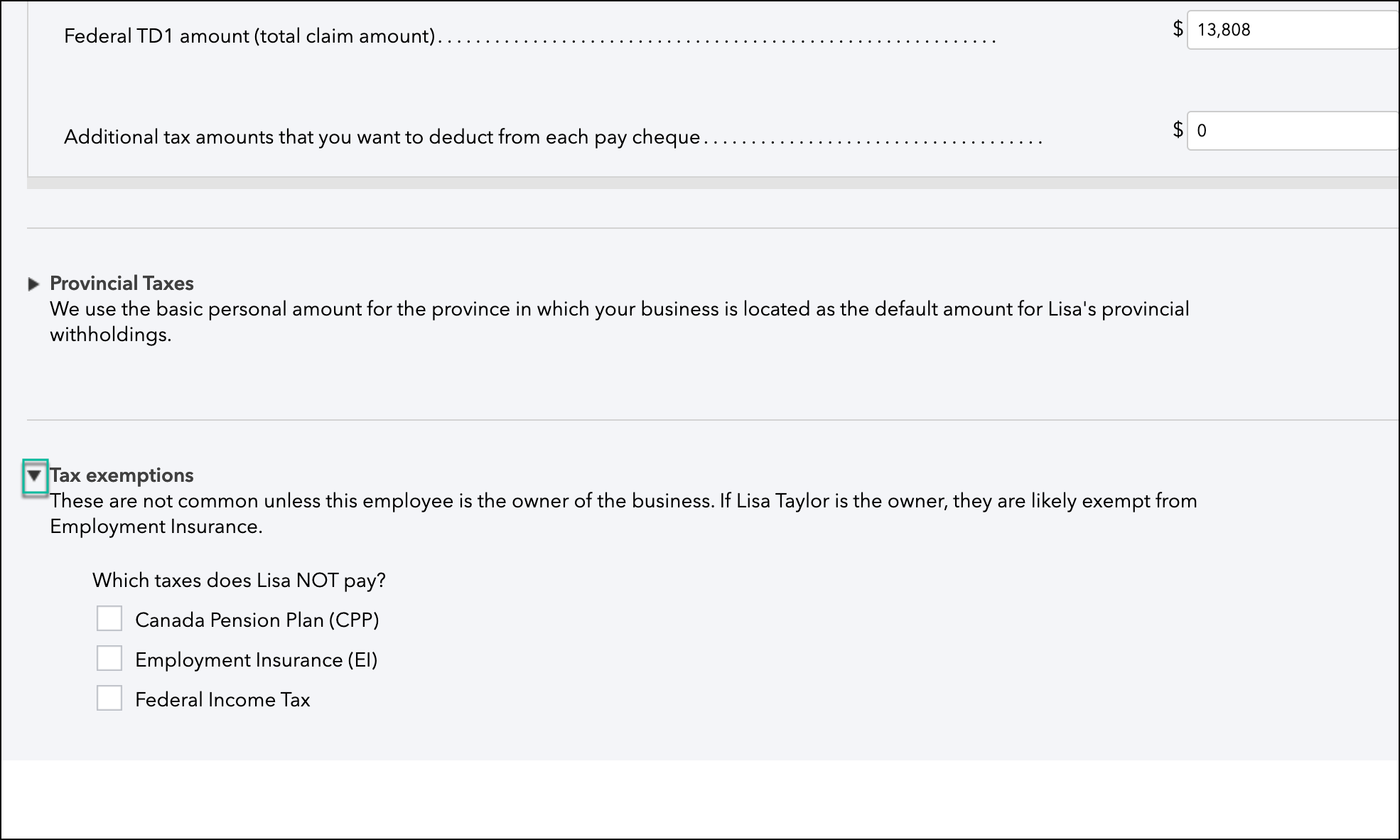

In QuickBooks Payroll, you can set up each employee as exempt from Canada Pension Plan (CPP), Employment Insurance (EI), or Federal Income Tax. Consult with a tax professional or financial advisor if you are not sure if an employee should be exempt from certain taxes.

View or change employee tax exemptions

QuickBooks Online Payroll

Follow this link to complete the steps in product

- Select your employee.

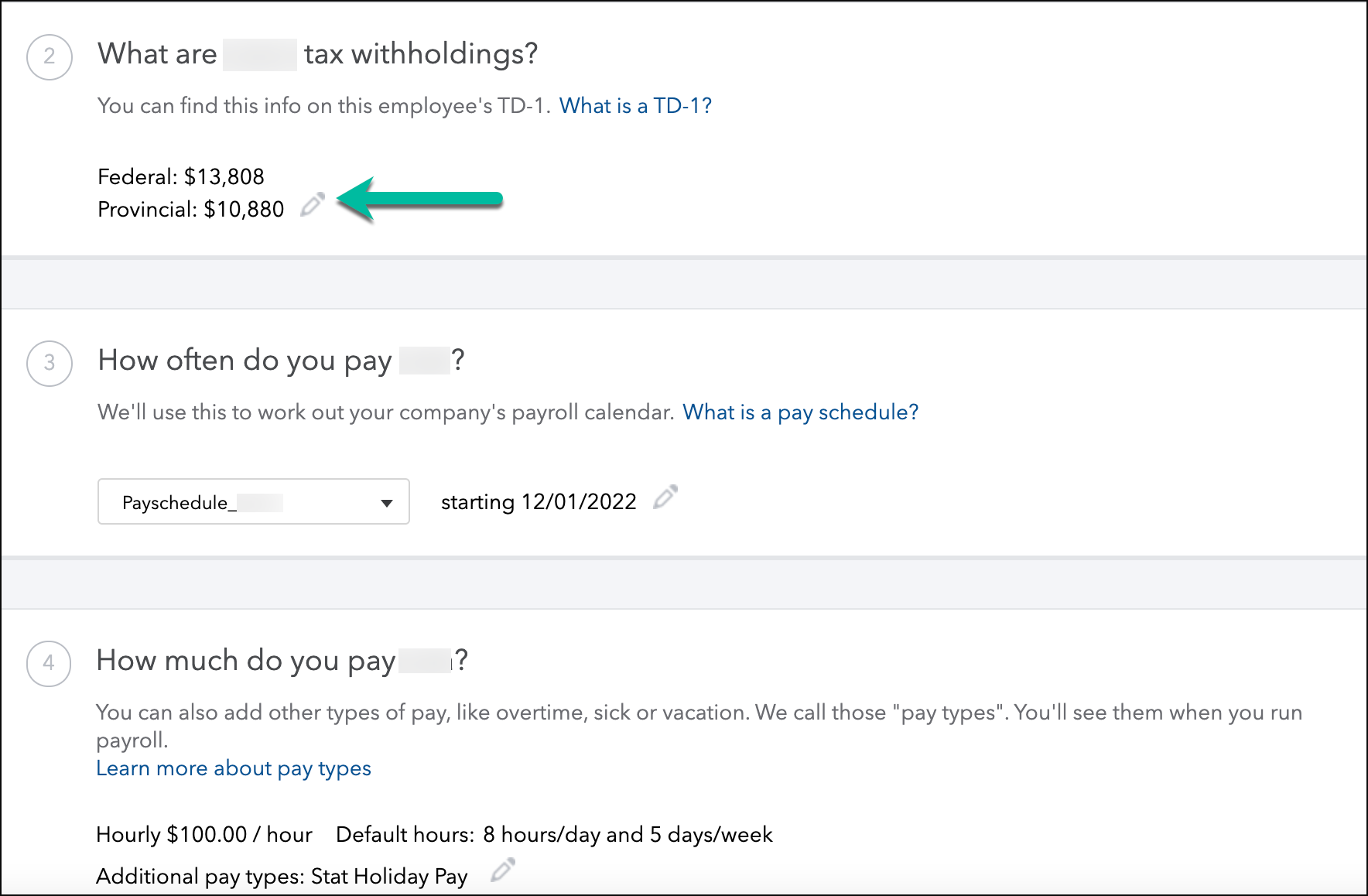

- Under Edit employee details, select the pencil icon under the question What are (employee's name) tax withholdings?

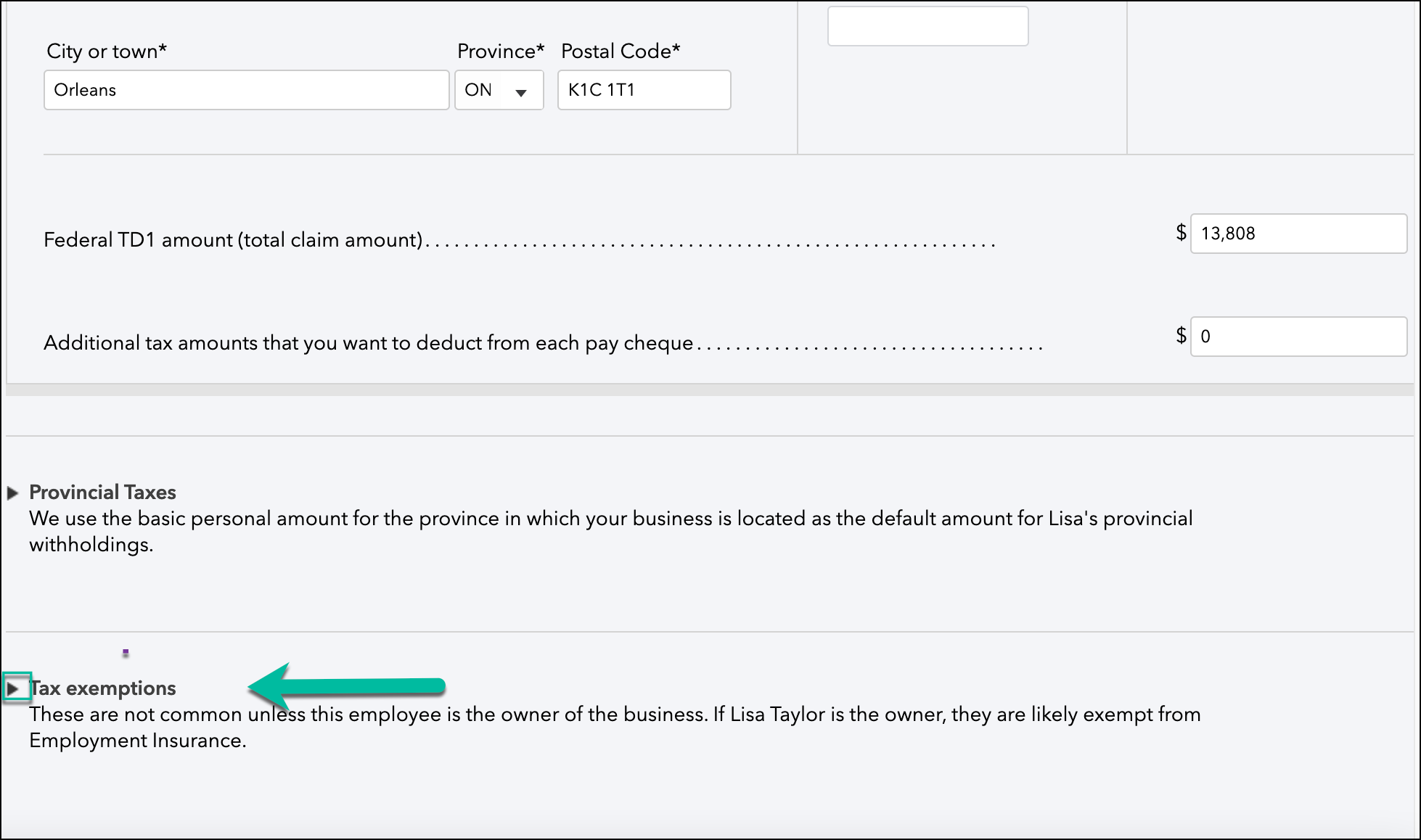

- Scroll down until you reach the Tax exemptions section and select the dropdown arrow.

- Select the taxes the employees are exempt from, then select Done.

See also

More like this

- Set up your payroll service in QuickBooks Desktopby QuickBooks

- Make an employee tax exempt in QuickBooks Desktop Payrollby QuickBooks

- Make an employee tax exempt in QuickBooks Online Payrollby QuickBooks

- Edit or change employee info in payrollby QuickBooks