What you need to know about FINTRAC

by Intuit•2703• Updated 2 months ago

This article deals with frequently asked questions about QuickBooks Online and FINTRAC. Use the jump links below if you'd like to skip to a specific question in the article.

- What is FINTRAC?

- What does FINTRAC do?

- Why are you asking for this information now?

- What information does Intuit need from our customers?

- Where can I find the required documents?

- How do I send Intuit my documents and when?

- How will I know that my documents have been successfully uploaded?

- When do I have to provide this information to keep my money moving services active?

- How long will the process take?

- How will I know if my company is fully compliant?

- How will my information be used?

- I received an email but I no longer use payroll or payments?

- What will happen if I don’t provide the requested information?

- Why do I get a warning to upload my FINTRAC documents when I already have done so?

- I have already provided documents when I filled out the application. Why am I receiving additional emails to confirm verification?

- I received an email stating my payments account was cancelled, however the account number listed is not familiar? Why did I receive this email? Was my Payments account closed?

- Can I still use paper cheques if my direct deposit access is suspended?

- The pre-filled information on the form is incorrect. How can I change the information before submitting the documents?

- FINTRAC for QuickBooks Online Accountant

What is FINTRAC?

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) is Canada's financial intelligence unit and anti-money laundering and anti-terrorist financing supervisor. It has a mandate to facilitate the detection, prevention and deterrence of money laundering and the financing of terrorist activities, while ensuring the protection of personal information under its control.

This applies to all Canadian customers using Intuit's money service products, including Payments and Payroll direct deposit services.

What does FINTRAC do?

FINTRAC collects, analyzes and discloses financial information and intelligence on suspected money laundering and terrorist financing activities. It was created as part of a Canadian government initiative to fight money laundering and terrorist financing, both domestically and internationally.

More information can be found about FINTRAC here.

Note: FINTRAC is not able to assist with Intuit’s processes for information updates, document submissions nor the review process.

Why are you asking for this information now?

As a result of new FINTRAC regulatory requirements, Intuit is updating certain elements within QuickBooks Online to ensure our products are compliant.

To meet FINTRAC guidelines and maintain regulatory compliance, we now require this information from all customers in Canada using payments and payroll services.

What information does Intuit need from our customers?

Depending on your type of business, you may be asked to provide the following information:

Sole proprietorship

- Owner title (use Chief Executive Officer as owner title if none of the options apply to you)

- Government issued ID

- Utility bill (alternatively, you can provide a statement for a bank account, a prepaid payment product account, a credit card account or a loan account bearing the account holder’s name and address, which must match the information on the application)

Private partnership

- Co-owners: Name and address of all individuals with 25% or more ownership in your business.

- A current and valid municipal, provincial, territorial or federal government-issued document that contains the legal business name and address. These can include:

- Company/Corporate Profile Report

- Articles of Incorporation

- Certificate of Incorporation

- Partnership agreement or registration

- Business license (unexpired)

Private corporation, Public corporation

- Co-owners: Name and address of all individuals with 25% or more ownership in your business.

- Name and address of all directors if your business is a corporation

- A current and valid municipal, provincial, territorial or federal government issued document that contains (a) legal business name and address or (b) business name and director names or (c) business name, address, and directors. These can include:

- Company/Corporate Profile Report

- Articles of Incorporation

- Certificate of Incorporation

- Business license (unexpired)

Not-for-profit corporation

- Owner title (this should be the title of the person that is representing the NPO while completing this process. For example, CEO.)

- Name and address of all directors, if your business is a corporation.

- A current and valid municipal, provincial, territorial or federal government issued document that contains (a) business name and address or (b) business name and director names or (c) business name, address, and directors. These can include:

- Company/Corporate Profile Report

- Articles of Incorporation

- Certificate of Incorporation/Registration as a Canadian Nonprofit

- Business license (unexpired)

Review the following table for a list of corporate documents for each province that captures business name, address, and director names.This information will be used to verify the business identity as required by Canadian regulations.

| Province or Federal | Document Title |

| Federal | Corporate Profile |

| Ontario | Profile Report |

| Alberta | Corporation/Non-Profit Search |

| British Columbia | BC Company Summary; BC Society Summary |

| Manitoba | Companies Office report |

| New Brunswick | Corporate Affairs Registry Database report |

| Newfoundland & Labrador | Companies and Deeds Online report |

| Nova Scotia | Profile Report |

| Prince Edward Island | PEI Business / Corporate Registry report |

| Quebec | Rechercher une entreprise au registre report |

| Saskatchewan | Profile Report |

| Northwest Territories | Entity Profile report |

| Yukon | Entity Profile report |

Where can I find the required documents?

- For federally registered companies, you can order certified or uncertified copies of corporate documents through Corporations Canada. Certified copies include a verification letter confirming the document is an exact copy. Uncertified copies are also acceptable for this process.

- For provincially registered companies, check with your provincial registrar.

How do I send Intuit my documents and when?

Intuit will send you an email with a link. This will take you to an application allowing you to upload your document to the case.

You can also access the application through the in-product banner at the top of the page or through the critical notice on your Payroll Overview page.

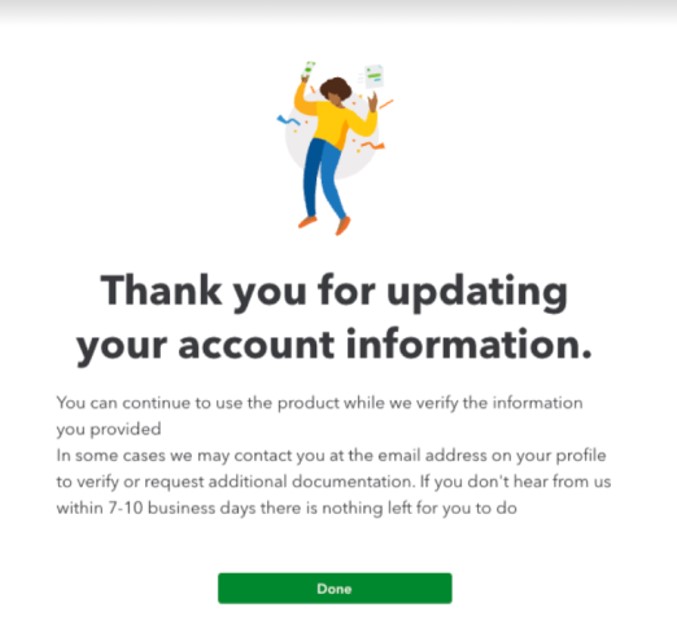

How will I know that my documents have been successfully uploaded?

A confirmation window displays within QuickBooks Online once a submission has been completed to confirm success.

You may receive an additional email to further verify the information submitted or an email confirming compliance.

Note: You may continue to encounter prompts to upload documents for 2-3 business days after having completed the upload process. You can disregard if you already successfully uploaded your documents, you do not need to do so again.

When do I have to provide this information to keep my money movement services active?

New signups to Payments or Payroll: New customers have 30 days from their sign up date to provide the requested information. For example, if you sign up for payments or payroll on January 1, 2025 you have until January 30, 2025 to provide the documentation.

Existing Payments or Payroll customers: Existing customers have until June 9, 2025 provide the requested information. If no action is taken by this date, all money movement capabilities will be suspended.

Note: New customers will have access to money movement services at sign-up, however it is still mandatory for customers to submit the required business documents within 30 days to continue processing payroll or payments.

How long will the process take?

New signups to Payments or Payroll: The review process for new customers typically takes 2-3 business days once the information has been received.

Existing Payments or Payroll customers: The review process for existing customers typically takes 7-10 business days once the information has been received.

Note: You may receive follow-up emails requesting additional information if needed.

Reminder messages in QuickBooks will clear once verification is completed.

How will I know if my company is fully compliant?

On a weekly basis, a one-time email will be sent to clients who are confirmed compliant. The email will be sent to the QuickBooks Online primary admin email address.

How will my information be used?

The information will be used to verify business identity in adherence to Canadian regulatory obligations, including:

- Verifying business name and business address

- Verifying names of directors

- Validating non-profit corporation registration status

I received an email but I no longer use payroll or payments?

You have received this email because our records indicate that you have signed up for Payments and/or Payroll and your account is still active even if you have not used it recently. If you want to continue having the ability to use this service, you will need to provide this information.

What will happen if I don’t provide the requested information?

In order to comply with updated regulations from the Financial Transactions and Reports Analysis Centre of Canada, we need you to submit additional business information through QuickBooks by June 9, 2025 to continue processing payments and payroll.

If you miss the deadline, these money movement services will be suspended.

I have multiple accounts. How will I know which one I need to update?

If you have multiple QuickBooks Online accounts, once you click the link to submit your documents, be sure to log into the account with the exact company name as listed in the email you received.

If you are already logged into a different account, you will need to log out first, then follow the link in the email and log into the correct account.

Why do I get a warning to upload my FINTRAC documents when I already have done so?

This banner in QuickBooks Online is a reminder. If you have uploaded your documents, you can ignore this message. You can also select the close icon in the banner to dismiss this.

I have already provided documents when I filled out the application. Why am I receiving additional emails to confirm verification?

We may need additional documents to confirm verification for which you may receive additional emails requesting specific documents.

You can navigate to the resolution centre where you will see additional details of what is needed.

I received an email stating my payments account was cancelled, however the account number listed is not familiar. Why did I receive this email? Was my Payments account closed?

Any active payments accounts have not been cancelled or suspended and will continue to go through remediation. The current timelines communicated will continue to apply for active accounts until otherwise notified.

Can I still use paper cheques if my direct deposit access is suspended?

Yes. See our support article Create and print a paper cheque in QuickBooks Online Payroll for instructions on how to process and print paper cheques.

The pre-filled information on the form is incorrect. How can I change the information before submitting the documents?

You can connect with QuickBooks support and we'll help you update the information.

FINTRAC for QuickBooks Online Accountant

The following frequently asked questions address FINTRAC for accountants using QuickBooks Online Accountant.

- Why am I receiving emails for a client that I am no longer working with?

- How will these changes affect my firm and my clients?

- Will I be able to complete and provide the new required information on behalf of my clients?

- Will these changes impact the time it takes for my client to be approved for direct deposit or payments?

- Will these changes affect my clients who have already set up QuickBooks Online Payroll and Payments?

- What if I put myself (Accountant/Bookkeeper) or another employee in my client’s business who is not the primary business owner?

- What if I use QuickBooks Online Payroll and/or QuickBooks Payments for my own accounting business?

Why am I receiving emails for a client that I am no longer working with?

Although you may have removed yourself as the Accountant on file you may still be listed as the primary admin user. To update the primary admin user you can follow the steps in our support article Change the primary admin user in QuickBooks Online.

How will these changes affect my firm and my clients?

These changes could result in longer approval times, and additional information may be requested to ensure approvals are completed. Customers who are not fully verified may not be able to process payments or payroll transactions.

Will I be able to complete and provide the new required information on behalf of my clients?

Yes, you will be able to complete and provide the required information on behalf of your clients.

Will these changes impact the time it takes for my client to be approved for direct deposit or payments?

Yes, these changes may impact the time it requires for new client approvals for direct deposit or payments.

On average, once documents are received, Intuit will review and make a decision of approval within 2 business days. Intuit will send you an email with a case number and a link that will allow you to track your application’s progress in the resolution centre.

Will these changes affect my clients who have already set up QuickBooks Online Payroll and Payments?

Yes, FINTRAC will also affect clients that are already set up with QuickBooks Online Payroll and Payments. Existing customers will receive an email notifying them of the need to provide updated information and will have until June 9, 2025 to submit their documents.

Note: Once existing customers have provided the additional information it will take 7-10 business days to review the application.

What if I put myself (Accountant/Bookkeeper) or another employee in my client’s business who is not the primary business owner?

If incorrect information is provided, the application will be denied and your client will not be able to use bank payments and/or direct deposit. A new application then must be submitted.

What if I use QuickBooks Online Payroll and/or QuickBooks Payments for my own accounting business?

If you are currently using QuickBooks Online Payroll and/or QuickBooks Payments for your own accounting business, you will be required to provide the information listed above starting in phase two in late December 2024.

Money movement services are provided by Intuit Canada Payments Inc.

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

More like this

- What you need to know about the capital gains tax changes in 2025by QuickBooks

- Everything you need to know about the QuickBooks Online desktop appby QuickBooks

- Everything you need to know about ProAdvisor Preferred Pricingby QuickBooks

- Everything you need to know: QuickBooks Online Advanced and revised usage limitsby QuickBooks