Change a direct deposit paycheck to a paper paycheck

by Intuit•81• Updated 2 months ago

Learn how to pay a paper paycheck to an employee who’s usually paid via direct deposit in QuickBooks Online Payroll and QuickBooks Desktop Payroll.

You can switch your employee's direct deposit to a paper check for one payroll only if needed. Your future paychecks will change back to direct deposit.

| Note: Not sure which payroll service you have? Here's how to find your payroll service. |

Go to All apps ![]() , then Payroll, then Employees (Take me there).

, then Payroll, then Employees (Take me there).

Create a paper check

You can turn off your employee’s direct deposit feature temporarily as you run payroll.

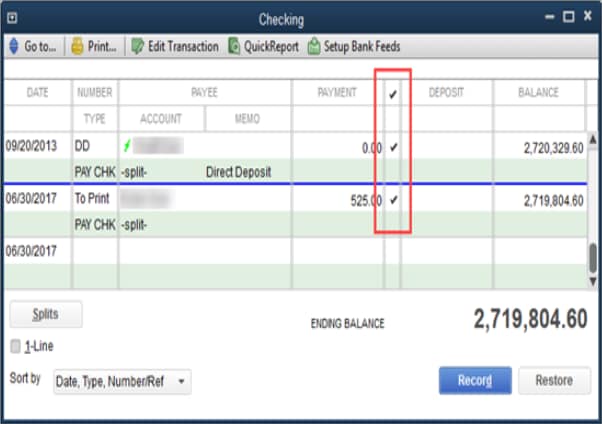

Change an existing direct deposit paycheck to paper check

If the direct deposit check has already been processed or sent to Intuit, you need to void the paycheck and create a paper one.

Note: Check your payroll service processing time, to find out when you can void a paycheck.

If the direct deposit check hasn’t been processed or hasn’t been sent to Intuit yet, follow the steps below for your product.

Go to All apps ![]() , then Payroll, then Employees (Take me there).

, then Payroll, then Employees (Take me there).

More like this

- Edit, delete, or void employee paychecksby QuickBooks

- Handle a direct deposit paycheck that was not received by an employeeby QuickBooks

- Fix incorrect pay period dates on paychecksby QuickBooks

- Get help if you’re over a direct deposit limitby QuickBooks