Learn about updates to the new AI-powered banking page

by Intuit•9328• Updated 1 week ago

Whether you're a new or experienced QuickBooks user, your bank transactions page has features designed to help you efficiently manage your bank and credit card transactions.

Get powerful accounting and expert tax help in one place with QuickBooks Online + Live Expert tax. Explore your options.

Tips and where to find common items

Here's some tips for getting the most out of your new transactions table and finding items that moved.

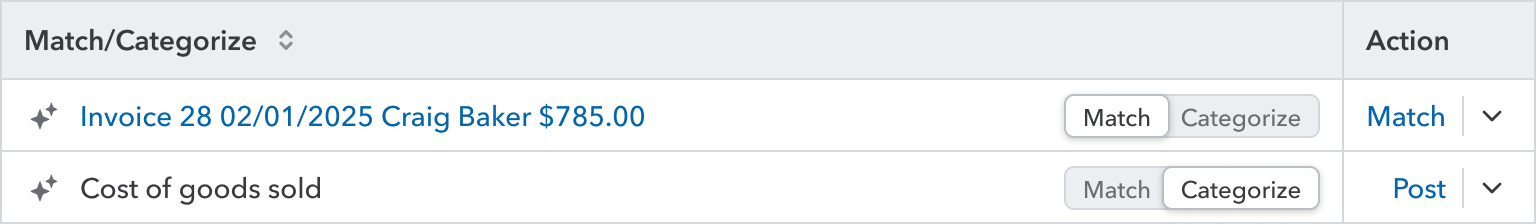

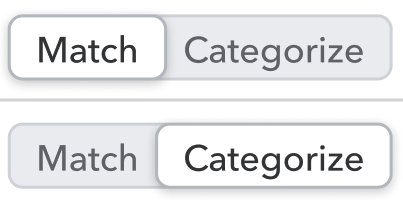

- Match or categorize: QuickBooks uses AI to find matches and prevent duplicate transactions. Switch between matching or categorizing by selecting the switch for them on any transaction. Need to change a category? Just select the category area in the list to change it right there.

- Resize or customize your transaction list: See the info that's most helpful at a glance. Select the

Settings icon above the transaction list to add columns or free up space if it's too wide.

Settings icon above the transaction list to add columns or free up space if it's too wide. - Split transactions and see category history: Select the

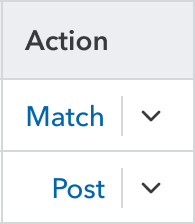

dropdown in the Action column on any transaction to get the options to Split or see Categorization history for a transaction's customer/vendor.

dropdown in the Action column on any transaction to get the options to Split or see Categorization history for a transaction's customer/vendor.

- See transfers or card payments: QuickBooks adds a Pair badge to anything it predicts as a transfer or card payment. To edit this for a transaction, select the row to expand it. Then select Transaction type.

- Edit right in the transaction list: When you select an editable item in the transaction list, a menu appears for it. This lets you quickly add attachments and update info without having to expand the row.

- Use AI-powered suggestions: AI suggestions are there when you want some guidance. Select the Suggested by AI

icon to see AI-powered suggestions on what to use for category, match, or customer/vendor options.

icon to see AI-powered suggestions on what to use for category, match, or customer/vendor options.

For more details and directions, see the frequently asked questions below.

Frequently asked questions

AI suggestions

Basics and navigation

Accounting AI features

More like this

- Learn about Accounting AI featuresby QuickBooks

- How AI suggestions help match and categorize bank transactionsby QuickBooks

- How to use the AI-powered banking pageby QuickBooks

- AI-powered Report Insightsby QuickBooks