Payments Dispute Protection Overview

by Intuit•57• Updated 3 weeks ago

Learn how Payments Dispute Protection helps protect your business against payment disputes.

QuickBooks Payments Dispute Protection protects your business on disputed charges for both fraudulent and non-fraudulent claims.

Payment Dispute Protection:

- Applies to credit and debit card transactions only

- Doesn't apply to automated clearing house (ACH), Paypal, or Vemo

- Is only available for QuickBooks Online US

- Only covers chargebacks that happened after your enrollment date

Costs for Payments Dispute Protection

You’ll see an increase in the processing fees you pay. The fee for Payments Dispute Protection can be as low as 0.99%, applied to every credit or debit card transaction you process with QuickBooks Payments.

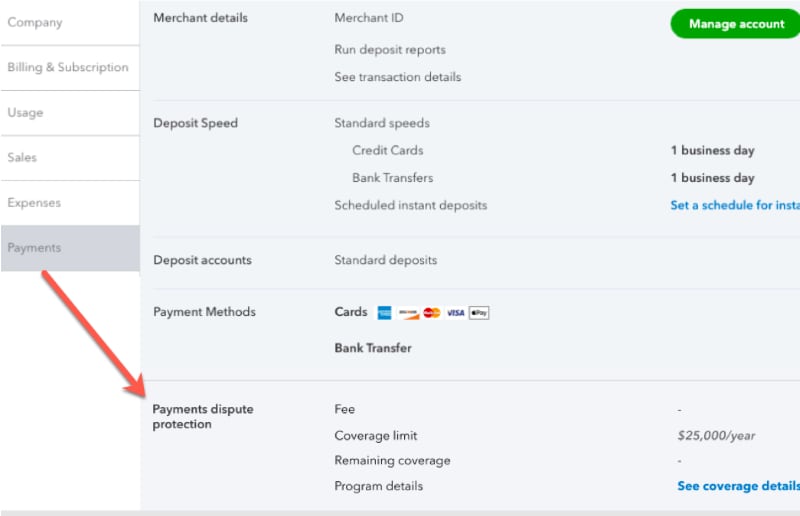

To view your Payments Dispute Protection pricing:

- Go to Settings ⚙ and select Payments (Take me there).

- Select Payments dispute protection, then Coverage Details to see:

- Fee per transaction

- Coverage limit

- Remaining coverage balance

Note: The balance will show a 0.00 if the full coverage amount has been used.

There’s a coverage limit of $10,000 per chargeback and an annual limit of $25,000 per year. The annual limit for all Covered Disputes received is calculated on a rolling 365-day period.

Example

If you received a $9,000 chargeback in the first month of signing up then we calculate your remaining coverage balance as:

$25,000 limit (-) $9,000 chargeback = $16,000 remaining coverage.

QuickBooks looks at all chargebacks from the previous 365 days:

- For example, if you received a $10,000 chargeback in the first month and a $6,000 chargeback in the 10th month, your current remaining balance would be $9,000.

- After you reach your first year in the program, QuickBooks will look at the last chargeback (the $6,000 in month 10) and will calculate your new remaining coverage as $19,000. (This is because the most recent chargeback occurred within the previous 365 days of your program anniversary.)

Coverage

Will I still get charged if I've reached my coverage limit? Yes, charges will continue as long as you are enrolled in PDP.

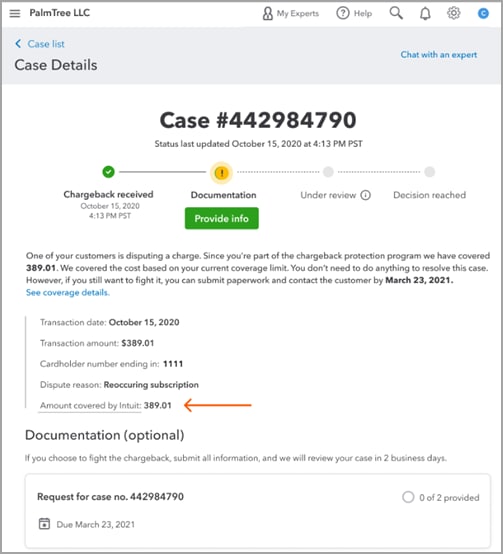

How do I know when and if a chargeback is covered by PDP?

If it meets the program’s eligibility criteria, you'll receive an email that a chargeback occurred on one of your transactions and that it’s automatically covered. You can also find additional information on the chargeback in the Resolution Center. You can choose to fight it, despite the coverage.

The following graphic provides an example of the PDP Case Details page.

What happens if I choose to fight a chargeback?

If you want to fight a chargeback, you will need to:

- Check the Resolution Center for the deadline (given by the bank/payment providers) to reply back with supporting documents for the chargeback.

- If you win the chargeback, your coverage balance remains the same, and won't be replenished until your next renewal date. If your bank was charged for a part of the chargeback, you will receive those funds back as part of the normal chargeback process.

Will a chargeback show up in the Resolution Center even if it's covered?If the chargeback was covered, but the case is still open, it will appear in the Resolution Center. Chargeback cases that have been covered remain open for a short period of time in case you wish to fight it. After the case is closed, it won’t appear in the Resolution Center.

Does the coverage include any additional fees like arbitration or chargeback fees from Intuit?Your coverage does not include arbitration; however, the $25 chargeback fee is waived when you are enrolled in PDP.

Does PDP cover "no recourse chargebacks?" We currently cover all chargebacks regardless of how the card was processed. For example: the card has a chip, but the merchant intentionally swiped the card.

Why wasn't my chargeback covered?

Possible reasons your chargeback was not covered could include:

- The payment you processed occurred prior to signing up for PDP. Only payments processed post sign up are covered under this program.

- You have exceeded the individual chargeback amount limit of $10,000 or the total yearly limit of $25,000.

- Your remaining coverage balance wasn’t enough to cover the full amount. You can still fight the chargeback from the Resolution Center. If you win, the uncovered amount will be returned to you.

- The chargeback occurred over the weekend and will be covered (if eligible) the next business day.

- The payment came through PayPal or ACH, which is not covered by PDP.

More like this

- Use Payments Dispute Protectionby QuickBooks

- Respond to a retrieval requestby QuickBooks

- Respond to a chargebackby QuickBooks

- Reverse a direct depositby QuickBooks