| Country Name | Bank Branch Identifier | Currency Supported |

| Albania | IBAN: 28 characters | ALL, USD |

| Algeria | Bank and Branch Code: 3-50 characters | DZD, USD |

| Angola | IBAN: 25 characters | AOA, USD |

| Anguilla | Bank and Branch Code: 3-50 characters | XCD, USD |

| Antigua and Barbuda | Bank and Branch Code: 3-50 characters | XCD, USD |

| Argentina | CBU number: 22 digits | ARS, USD |

| Armenia | Bank and Branch Code: 5 digits | MD, USD |

| Aruba | Bank and Branch Code: 3-50 characters | AWG, USD |

| Australia | BSB (Bank-State-Branch): 6 alphanumeric | AUD, USD |

| Austria | IBAN: 20 alphanumeric | EUR, USD |

| Bahrain | IBAN: 22 alphanumeric | BHD, USD |

| Bangladesh | Bank and Branch Code: 3-50 characters | BDT, USD |

| Belgium | IBAN: 16 alphanumeric | EUR, USD |

| Belize | Bank and Branch Code: 8 digits | BZD, USD |

| Benin | IBAN: 28 characters | XOF, USD |

| Bermuda | Bank and Branch Code: 3-50 characters | BMD, USD |

| Bhutan | Bank and Branch Code: 3-50 characters | BTN, USD |

| Botswana | Bank and Branch Code: 6 digits | BWP, USD |

| Brazil | IBAN: 29 alphanumeric | BRL, USD |

| Brunei Darussalam | Bank and Branch Code: 3-50 characters | BND, USD |

| Bulgaria | IBAN: 22 alphanumeric | BGN, USD |

| Cameroon | IBAN: 27 characters | XAF, USD |

| Canada | Institution and Transit Number: 8 or 9 digits1 | CAD, USD |

| Cape Verde | IBAN: 25 characters | CVE, USD |

| Cayman Islands | Bank and Branch Code: 3-50 characters | KYD, USD |

| Chad | IBAN: 27 characters | XAF, USD |

| Chile | Bank and Branch Code: 3 digits | CLP, USD |

| China | Cnaps code: 12 digits | CNY, USD |

| Colombia | Bank and Branch Code: 19 alphanumeric | COP, USD |

| Comoros | Bank and Branch Code: 3-50 characters | KMF, USD |

| Congo (The) | Bank and Branch Code: 3-50 characters | XAF, USD |

| Costa Rica | IBAN: 22 alphanumeric | CRC, USD |

| Croatia | IBAN: 21 characters | HRK, USD |

| Cyprus | IBAN: 28 alphanumeric | EUR, USD |

| Czech Republic | IBAN: 24 alphanumeric | EUR, CZK, USD |

| Denmark | IBAN: 18 alphanumeric | EUR,DKK, USD |

| Dominica | Bank and Branch Code: 3-50 characters | XCD, USD |

| Dominican Republic | IBAN: 28 characters | DOP, USD |

| Ecuador | Bank and Branch Code: 8 digits | USD only |

| Estonia | IBAN: 20 alphanumeric | EUR, USD |

| Fiji | Bank and Branch Code: 3-50 characters | FJD, USD |

| Finland | IBAN: 18 alphanumeric | EUR, USD |

| France | IBAN: 24 alphanumeric | EUR, USD |

| Gabon | IBAN: 27 characters | XAF, USD |

| Gambia | Bank and Branch Code: 3-50 characters | GMD, USD |

| Georgia | IBAN: 22 characters | GEL, USD |

| Germany | IBAN: 22 alphanumeric | EUR, USD |

| Ghana | Bank and Branch Code: 6 digits | GHS, USD |

| Gibraltar | IBAN: 23 characters | GIP, USD |

| Greece | IBAN: 27 alphanumeric | EUR, USD |

| Grenada | Bank and Branch Code: 3-50 characters | XCD, USD |

| Guatemala | IBAN: 28 characters | GTQ, USD |

| Guinea | Bank and Branch Code: 3-50 characters | GNF, USD |

| Guyana | Bank and Branch Code: 3-50 characters | GYD, USD |

| Honduras | Bank and Branch Code: 8 - 11 digits | HNL, USD |

| Hong Kong | Bank and Branch Code: 6 digits | HKD, USD |

| Hungary | IBAN: 28 digits | HUF, USD |

| Iceland | IBAN: 26 characters | ISK, USD |

| India | IFSC code: 11 characters | INR, USD |

| Indonesia | Bank and Branch Code: 7 digits | IDR, USD |

| Ireland | IBAN: up to 22 alphanumeric | EUR, USD |

| Israel | IBAN: 23 alphanumeric | ILS, USD |

| Italy | IBAN: 27 alphanumeric | EUR, USD |

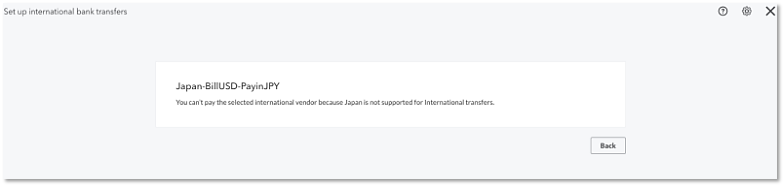

| Japan | Zengin Bank and Branch Code: 7 digits | JPY, USD |

| Jordan | IBAN: 30 alphanumeric | JOD, USD |

| Kazakhstan | IBAN: 20 characters | KZT, USD |

| Kenya | Bank and Branch Code: 5 digits | KES, USD |

| Kuwait | IBAN: 30 alphanumeric | KWD, USD |

| Kyrgyzstan | Bank and Branch Code: 3-50 characters | KGS, USD |

| Latvia | IBAN: 21 alphanumeric | EUR, USD |

| Lesotho | Bank and Branch Code: 6 digits | LSL, USD |

| Liechtenstein | IBAN: 21 alphanumeric | CHF, USD |

| Lithuania | IBAN: 20 alphanumeric | EUR, USD |

| Luxembourg | IBAN: 20 alphanumeric | EUR, USD |

| Macao | Bank and Branch Code: 3-50 characters | MOP, USD |

| Macedonia | IBAN: 19 characters | MKD, USD |

| Madagascar | IBAN: 27 characters | MGA, USD |

| Malawi | Bank and Branch Code: 3-50 characters | MWK, USD |

| Malaysia | Bank and Branch Code: 9 digits | MYR, USD |

| Malta | IBAN: 31 alphanumeric | EUR, USD |

| Mauritius | IBAN: 30 characters | MUR, USD |

| Mexico | Clabe: 18 digits | MXN, USD |

| Moldova | IBAN: 24 characters | MDL, USD |

| Mongolia | Bank and Branch Code: 3-50 characters | MNT, USD |

| Montserrat | Bank and Branch Code: 3-50 characters | XCD, USD |

| Mozambique | IBAN: 25 characters | MZN, USD |

| Namibia | Bank and Branch Code: 3-50 characters | NAD, USD |

| Nepal | Bank and Branch Code: 3-50 characters | NPR, USD |

| Netherlands | IBAN: 18 alphanumeric | EUR, USD |

| New Caledonia | IBAN: 27 alphanumeric | XPF, USD |

| New Zealand | Bank Code: first 6 digits | NZD, USD |

| Niger | IBAN: 28 characters | XOF, USD |

| Norway | IBAN: 15 alphanumeric | EUR, NOK, USD |

| Papua New Guinea | Bank and Branch Code: 3-50 characters | PGK, USD |

| Paraguay | Bank and Branch Code: 3-50 characters | PYG, USD |

| Peru | Bank Code: 20 digits | SOL, USD |

| Philippines | Bank and Branch Code: 6 digits | PHP, USD |

| Poland | IBAN: 28 alphanumeric | EUR, PLN, USD |

| Portugal | IBAN: 25 alphanumeric | EUR, USD |

| Qatar | IBAN: 29 alphanumeric | QAR, USD |

| Romania | IBAN: 24 alphanumeric | RON, USD |

| Russia | BIK code: 20 alphanumeric | RUB, USD |

| Rwanda | Bank and Branch Code: 3 digits | RWF, USD |

| Saint Kitts and Nevis | Bank and Branch Code: 3-50 characters | XCD, USD |

| Saint Lucia | Bank and Branch Code: 3-50 characters | XCD, USD |

| Saint Vincent and the Grenadines | Bank and Branch Code: 3-50 characters | XCD, USD |

| Saudi Arabia | IBAN: 24 alphanumeric | SAR, USD |

| Serbia | IBAN: 22 alphanumeric | RSD, USD |

| Seychelles | Bank and Branch Code: 3-50 characters | SCR, USD |

| Sierra Leone | Bank and Branch Code: 3-50 characters | SLL, USD |

| Singapore | Bank and Branch Code: 7 digits | SGD, USD |

| Slovakia | IBAN: 24 alphanumeric | EUR, USD |

| Slovenia | IBAN: 19 alphanumeric | EUR, USD |

| Solomon Islands | Bank and Branch Code: 3-50 characters | SBD, USD |

| South Africa | IBT Code: 8 characters | ZAR, USD |

| South Korea | Bank and Branch Code: 7 digits | KRW, USD |

| Spain | IBAN: 24 alphanumeric | EUR, USD |

| Sri Lanka | Bank and Branch Code: 7 digits | LKR, USD |

| Swaziland | Bank and Branch Code: 3-50 characters | SZL, USD |

| Sweden | IBAN: 24 alphanumeric | SEK, EUR, USD |

| Switzerland | IBAN: 21 alphanumeric | CHF, EUR, USD |

| Taiwan | Bank and Branch Code: 7 digits | TWD, USD |

| Tajikistan | Bank and Branch Code: 3-50 characters | SZL, USD |

| Tanzania | Bank and Branch Code: 3-50 characters | TJS, USD |

| Thailand | Bank and Branch Code: 7 digits | THB, USD |

| Togo | IBAN: 28 characters | XOF, USD |

| Tonga | Bank and Branch Code: 3-50 characters | TOP, USD |

| Tunisia | IBAN: 24 alphanumeric | TND, USD |

| Turkey | IBAN: 26 digits | TRY, USD |

| Uganda | Bank and Branch Code: 6 digits | UGX, USD |

| Ukraine | IBAN: 29 alphanumeric | UAH, USD |

| United Arab Emirates | IBAN: 23 alphanumeric | AED, USD |

| United Kingdom | IBAN: 22 alphanumeric (click here for help locating the IBAN) | GBP, EUR, USD |

| Uruguay | Bank and Branch Code: 3 digits | UYU, USD |

| Uzbekistan | Bank and Branch Code: 3-50 characters | UZS, USD |

| Viet Nam | Bank and Branch Code: 8 digits | VND, USD |

| Zambia | Bank and Branch Code: 3-50 characters | ZMW, USD |