Net Income on the Balance Sheet report does not match the Net Income on the Profit and Loss report

by Intuit•11• Updated 1 year ago

The Balance Sheet report shows net income for current fiscal year and it should match the net income on the Profit & Loss report for current fiscal year. There are times though when the reports show different net income which may be due to any of the following reasons and can be resolved by the solutions recommended in this article.

Possible reasons:

- Balance Sheet summarizes data at a specific point in time and Profit and Loss summarizes data just for the selected period.

- The dates or bases of the reports do not match or the filters are set incorrectly.

- The Fiscal Year preference is not set properly.

- Possible data damage

Recommended solutions:

Solution 1: Make sure the parameters are the same

Make sure both reports have the same Dates, Basis and Filters. The settings depend on your reason for running these reports.

Solution 2: Check the Fiscal Year

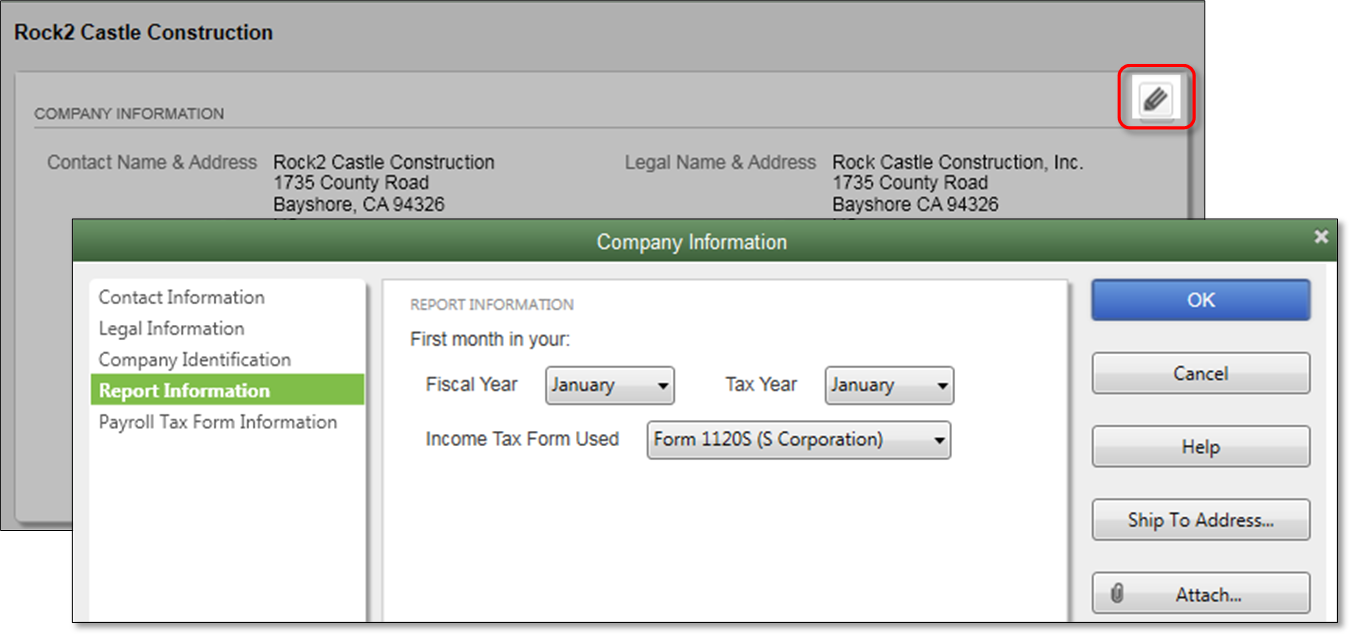

- From the Company menu, select My Company.

- Select the Pencil icon.

- Under Report Information tab, make sure Fiscal Year is set correctly.

Solution 3: Run both reports for all dates

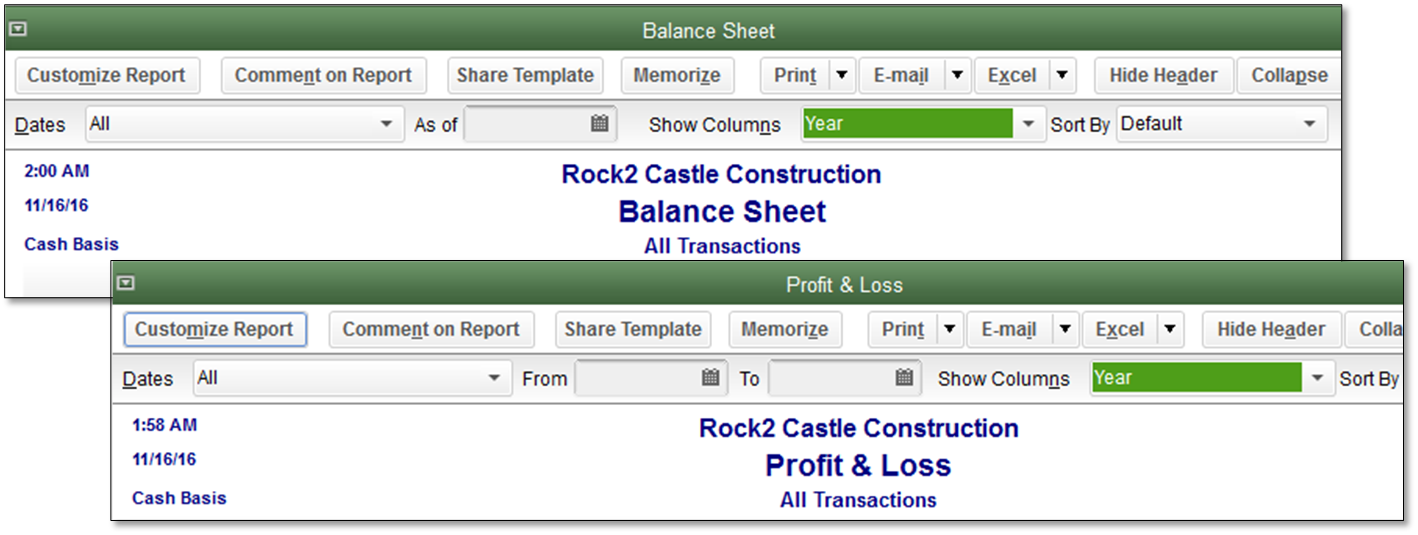

Open the Balance Sheet and Profit & Loss reports with the following settings:

- Dates = All

- Report Basis = Accrual or Cash

- Display columns by = Year

If there is still a discrepancy on the Net Income between the Balance Sheet and P & L reports, resolve data damage issues (basic troubleshooting).

More like this

- View Retained Earnings account detailsby QuickBooks

- Customize company and financial reportsby QuickBooks

- Run a Balance Sheet reportby QuickBooks

- Impacts of inventory tracking on the Balance Sheet and Profit & Loss reports in QuickBooks Onlineby QuickBooks