- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

Welcome to this thread, @PRWeld.

The Profit and Loss Report will show a double income when there are duplicate entries recorded. Let’s open the register and drill down each transaction.

From there, delete the identical transactions to correct your records. I suggest you get a copy of the bank statement and use it to compare the data entered in the chart of accounts.

The process is a breeze, and I’m here to help. Here’s how:

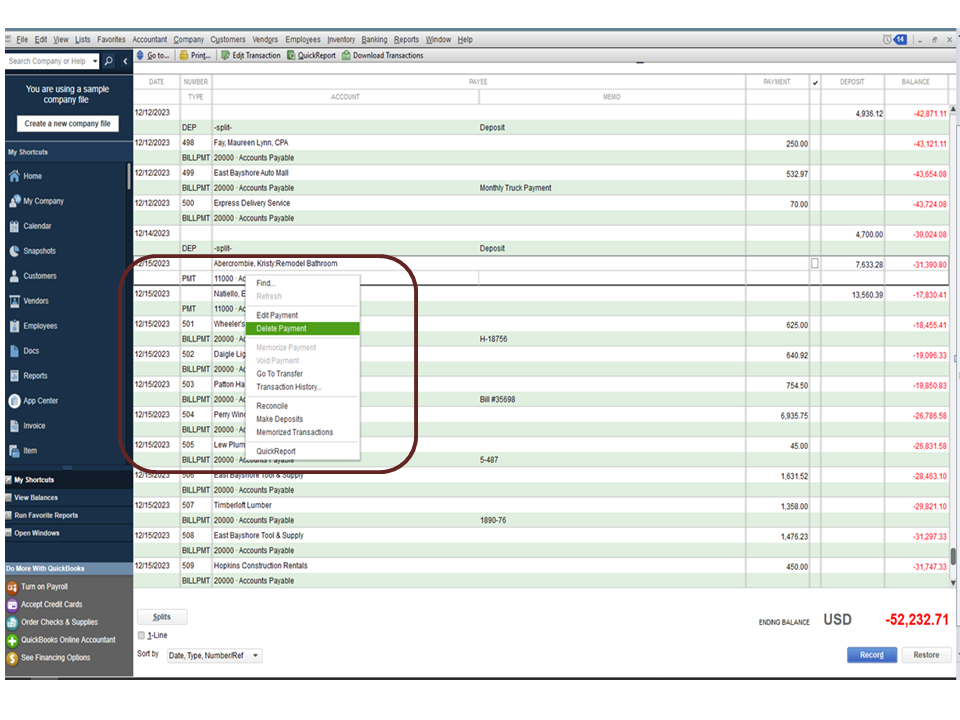

- In your company file, go the Lists menu to choose Chart of Accounts.

- This will take you to the lists of accounts recorded.

- From there, double-click the register you’re working on to see more details.

- Then, look for the duplicate deposits.

- Once found, right-click your mouse beside each deposit and then choose Delete Payment.

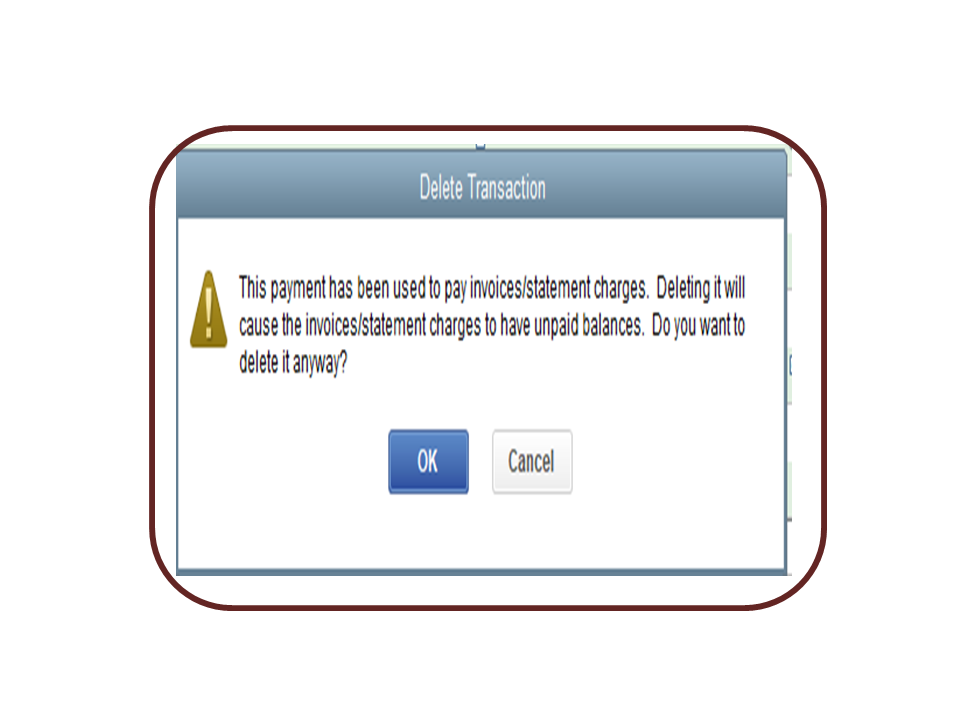

- Another window will pop-up information about the action.

- Click OK to confirm.

If you have a merchant account, make sure to match the payments to the invoices. This is to avoid duplication of transactions.

Follow the same steps to remove duplicate transactions. To keep your records in tip-top share, you can consider using the Undeposited Funds account to hold your customer payments.

Here’s an article that provides an overview of entering bank deposits. It also contains instructions on how to review payments and screenshots for visual reference: Deposit payments into the Undeposited Funds account.

By following these steps, the Profit and Loss Report will display the correct income information.

Keep me posted if you need further assistance while working in QuickBooks. I’m here to help and make sure you’re taken care of. Have a good one.