- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am trying to fix a Other Currant Liability NON PAYROLL

Hi,

I am trying to figure out how to zero out a NON payroll, other currant liability account. Payment were made, which lead to a negative balance in the account.

I am working with QBs desk top pro plus, 2021.

Thank you!

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

Hello @HOw to clear a depost from serva,

Thank you for posting here in the Community. I can share what I know about how to zero out a current liability account in QuickBooks Desktop.

You can use the Journal Entry feature to clear account balances in the chart of accounts. You can enter debits and credits manually, like in traditional accounting systems.

When performing the process, I suggest working with an accountant. This way, you'll be able to create the transactions using the correct accounts and at the same time ensure your books are accurate.

Here's how:

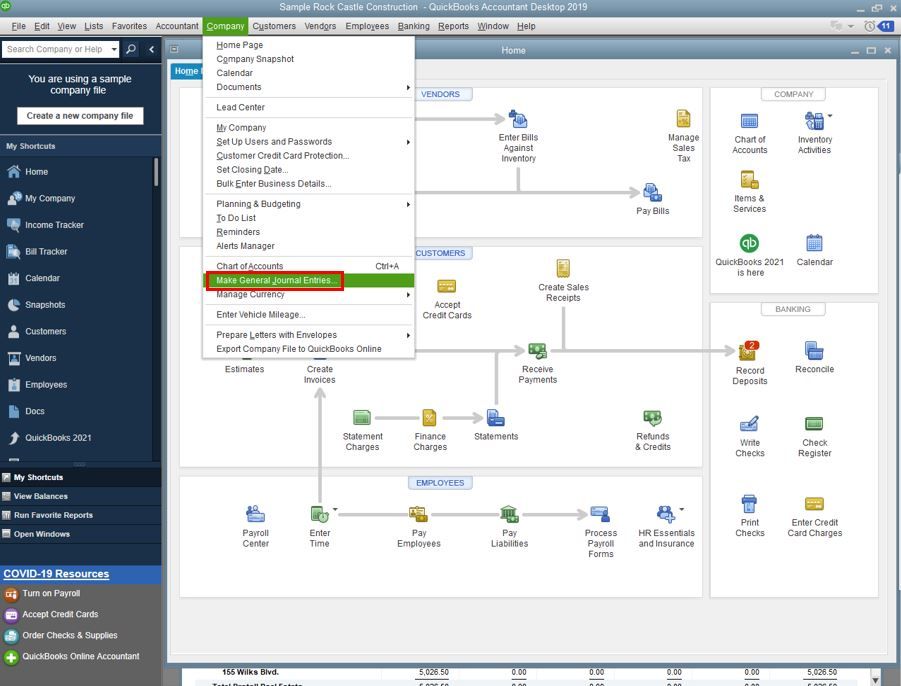

- Click the Company tab at the top menu bar and select Make General Journal Entries.

- Select Find and enter the Name, Date, Entry No., or Amount then select Find.

- Once done, select Save or Save & Close.

I've also attached an article for more information about recording journal entries, as well as how to reverse them in QuickBooks: Create a journal entry in QuickBooks Desktop for Windows or Mac.

Feel free to hit that Reply button if you more help to clear liability accounts in the Desktop version. Have a great day ahead.