- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

I appreciate you for coming back to the thread and adding extra clarification about your concern, dmcintire33. Let me discuss extra details on how W-2s and payroll item works in QuickBooks Desktop. Then, I'll ensure you'll be pointed to the right person to assist you further on this matter.

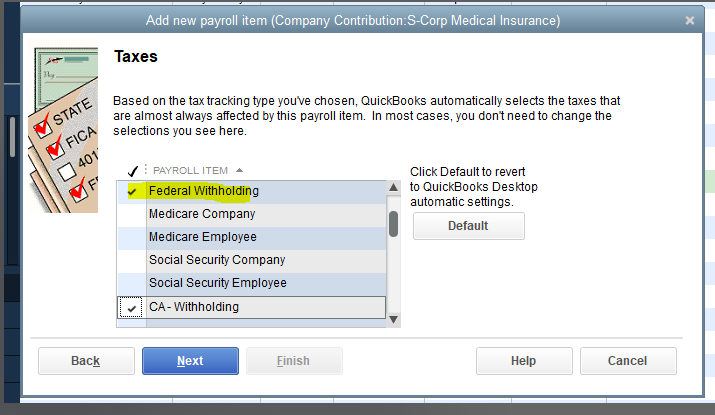

The information that appears on the W-2s is based on the payroll item you selected. Then, the taxes that are always affected on the payroll item are determined by the tax tracking type you've selected when the time you create the item. That said, adding S Corp 2% Health Insurance is subject to federal withholding. That is why the additional amount is not included in the State Wage. I've attached a screenshot below for visual reference.

On the other hand, you can consult your accountant to ask for additional help. They can provide you with complete details on how to properly handle the S Corp 2% Health Insurance so it'll post on the correct taxes.

Lastly, you may refer to this article to see various details about W-2 so you’re prepared for tax season and file this accurately: How to Understand and Fill Out a W2.

Always remember that you can always hit the Reply button anytime you have questions about the payroll forms or the payroll data in QuickBooks. I'm always here to help, dmcintire33. Have a great day ahead.