- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Hello there, @Chadster,

I appreciate you for following the steps provided by my colleague in this thread.

Right now, QuickBooks can only set up the payment frequency for previous schedule liabilities. What you need to do is set up a scheduled liability as mentioned by qbteachmt so it will show up on the Payroll Liability tab.

Let me show you how:

- Go to your Employees menu, then select Payroll Center.

- Click the Pay Liabilities tab.

- Under the Other Activities, select Create Custom Payments.

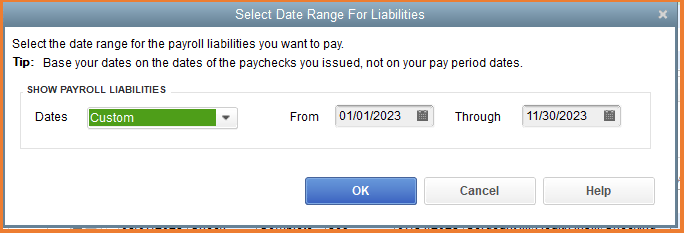

- Select the desired date, then click OK.

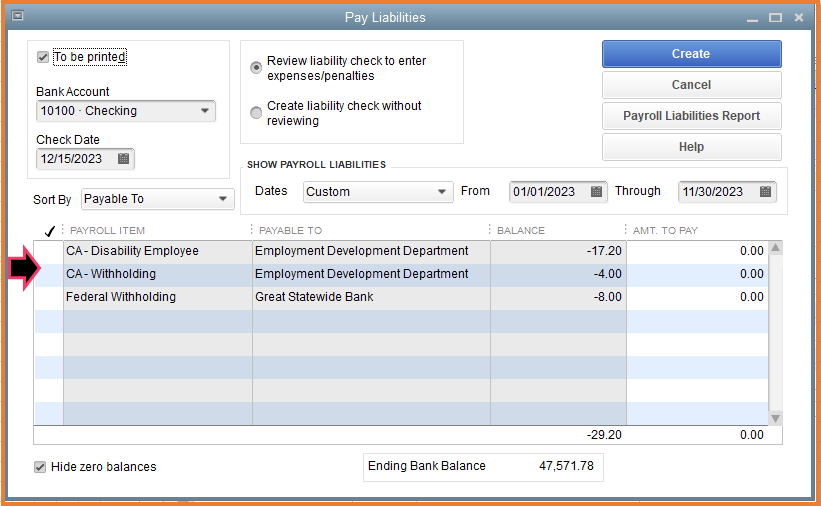

- On the Pay Liabilities window, select the Pre-paid Insurance on the table, then click Create when done.

For your guidance with the steps above, you can read through this article: Set up and pay scheduled or custom (unscheduled) liabilities.

Once done, you can then proceed with paying your liabilities. In case you've already paid them outside QuickBooks,make sure to record them in the system. To do so, check this out for the detailed steps: Enter historical tax payments in Desktop payroll.

The information I shared above will help you create a payroll liability schedule for last month and pay it.

Should you need anything else with your taxes, don't hesitate to comment below. I'd be glad to help you out.