- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Taxes

Welcome to this thread, MissAliss.

We’ll have to create an employee liability adjustment to correct the amount. Let me help you on how to accomplish these steps in QuickBooks.

Here’s how:

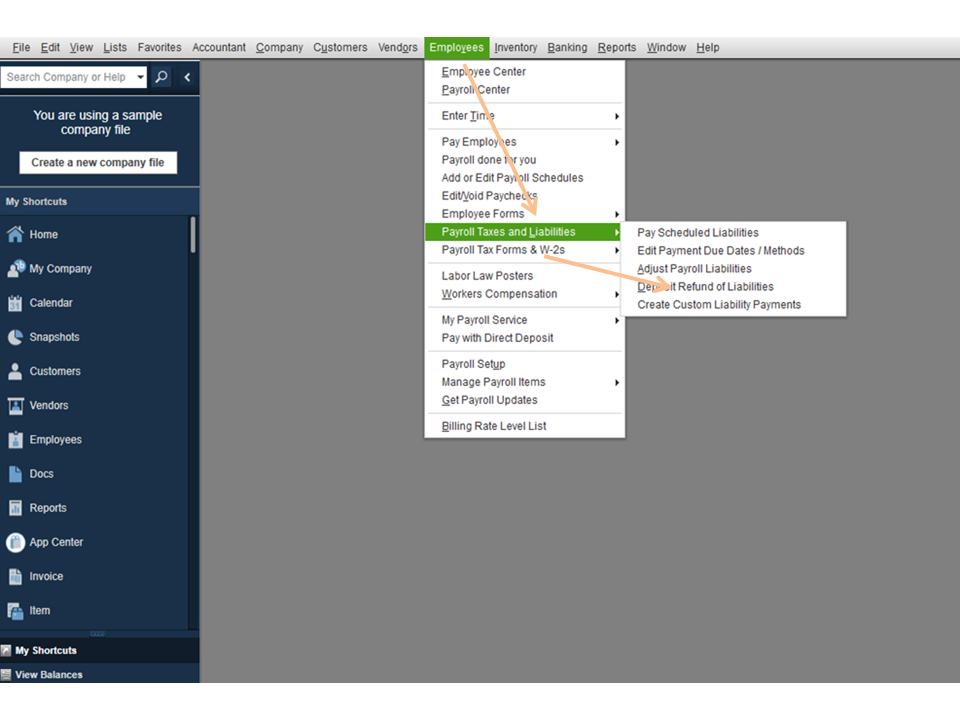

- Press the Employees menu at the top and choose Payroll taxes and Liabilities.

- Then, select Adjust Payroll Liabilities.

- This will open a page where you can enter all the details about the adjustment.

- Enter the correct date in the field box.

**Use the same date as the last paycheck of the affected quarter. Use today's date if you’re working on the current quarter.

**The Effective Date is used to calculate amounts on your 940 and 941 forms as well as the Payroll Liability Balances Report. - Next, tick the box for Employee and click the drop-down to select the worker’s name.

- In the Taxes and Liabilities section, go to the Item name column and pick CA-Unemployment Company.

- Put a negative sign for the figure to be adjusted in the Amount field.

- Use the Memo field to note what happened to the transaction.

- Press the Accounts Affected button and pick the appropriate option.

**Do not affect accounts to leave balances unchanged for the liability and expense accounts. The adjustment will only change the year-to-date amounts on your payroll reports.

**Affect liability and expense accounts to enter an adjusting transaction in the liability and expense accounts. - Click OK twice to keep the changes.

Here’s a guide that provides more insights about the process: Adjust payroll liabilities in QuickBooks Desktop.

Now that we’ve corrected your payroll records, I suggest you get in touch with the state agency. Then, inform them about the overpayment. One of their specialists will guide you on how to properly handle the situation and make sure your state tax is in order.

For future reference, this article covers all the steps on how to handle overpayment in payroll liabilities: Record a payroll liability refund check.

Feel free to click the Reply button if you have any clarifications or other concerns. I’ll jump right back in to answer them for you. Stay safe and enjoy your day.