Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowLast month, I paid state and federal payroll taxes online, as I have done previously. But I received an overdue status in Payroll Liabilities. What can I do so that each journal entry for these payroll taxes that I paid last month is properly identified as payment of payroll taxes? It used to work automatically.

What is the best way to record the online payments I just made in QB, so that the taxes are recorded as being paid and not overdue? I have never had this problem before.

Solved! Go to Solution.

I can help you with that, ABC1236.

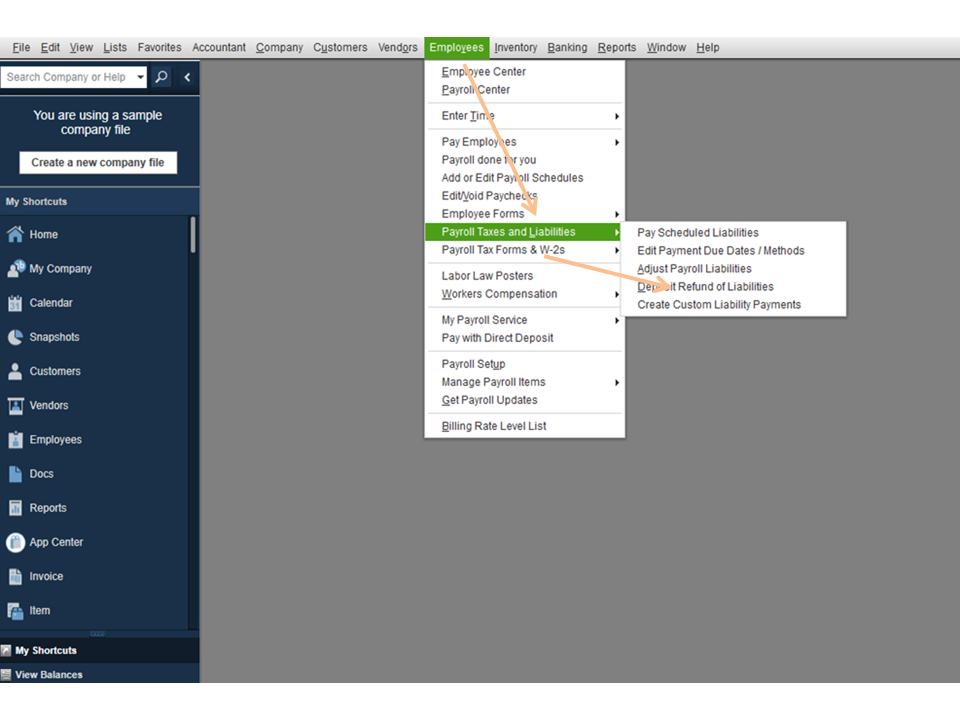

The most appropriate way of recording the tax payments you've made online is entering them as historical tax payments in QuickBooks Desktop. This way, you'll be able to get rid of the overdue status and ensure that your tax reports are accurate. Here's how to do it:

I've also included an article that will guide you in recording historical payroll information to your QuickBooks Desktop Payroll: Enter Prior Payroll.

If you need to track where your business stands in terms of employee expenses, you can customize the payroll and employee reports.

As always, I'm just a post away if you have any other concerns or follow-up questions. Stay safe and have a great rest of the weekend.

I can help you with that, ABC1236.

The most appropriate way of recording the tax payments you've made online is entering them as historical tax payments in QuickBooks Desktop. This way, you'll be able to get rid of the overdue status and ensure that your tax reports are accurate. Here's how to do it:

I've also included an article that will guide you in recording historical payroll information to your QuickBooks Desktop Payroll: Enter Prior Payroll.

If you need to track where your business stands in terms of employee expenses, you can customize the payroll and employee reports.

As always, I'm just a post away if you have any other concerns or follow-up questions. Stay safe and have a great rest of the weekend.

QB took an extra amount from my Company Paid California UI on one of my employees. How do I correct this in QB and with California EDD? The limit is supposed to be on the first $7,000 each employee

Welcome to this thread, MissAliss.

We’ll have to create an employee liability adjustment to correct the amount. Let me help you on how to accomplish these steps in QuickBooks.

Here’s how:

Here’s a guide that provides more insights about the process: Adjust payroll liabilities in QuickBooks Desktop.

Now that we’ve corrected your payroll records, I suggest you get in touch with the state agency. Then, inform them about the overpayment. One of their specialists will guide you on how to properly handle the situation and make sure your state tax is in order.

For future reference, this article covers all the steps on how to handle overpayment in payroll liabilities: Record a payroll liability refund check.

Feel free to click the Reply button if you have any clarifications or other concerns. I’ll jump right back in to answer them for you. Stay safe and enjoy your day.

Hello Klent, Because our Payroll System was down when quarterly Payroll Tax was due, I paid the liability via telephone. Now the system is up, showing the quarterly liability. If I follow the above instructions and change the liability amount in Payroll, how will I enter the payments made by phone?? Thank you.

Luapwen

Jumping in to answer your question about recording tax payments, Luapwen.

The steps shared by Klent are also applicable for payments made via phone calls. You can enter a short description in the Memo column of what the entries are for.

If no record has been made for the payments, you can select Affect liability and bank accounts after clicking Accounts Affected. Use this option if you want the prior payment to show up in the bank register automatically. If a check is already recorded or downloaded via Bank Feeds, select Affect liability accounts but not the bank account. Here's a more detailed article for more details: Enter Historical Tax Payments in Desktop Payroll.

You'll also to run these reports if you want to have an overview of the payroll amounts and tax balances:

As always, don't hesitate to reach out to us or reply down below if you have other questions. We're always here to help and guide you again.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here