Give customers the info they need with QuickBooks.

Personalize estimates and make the right impression

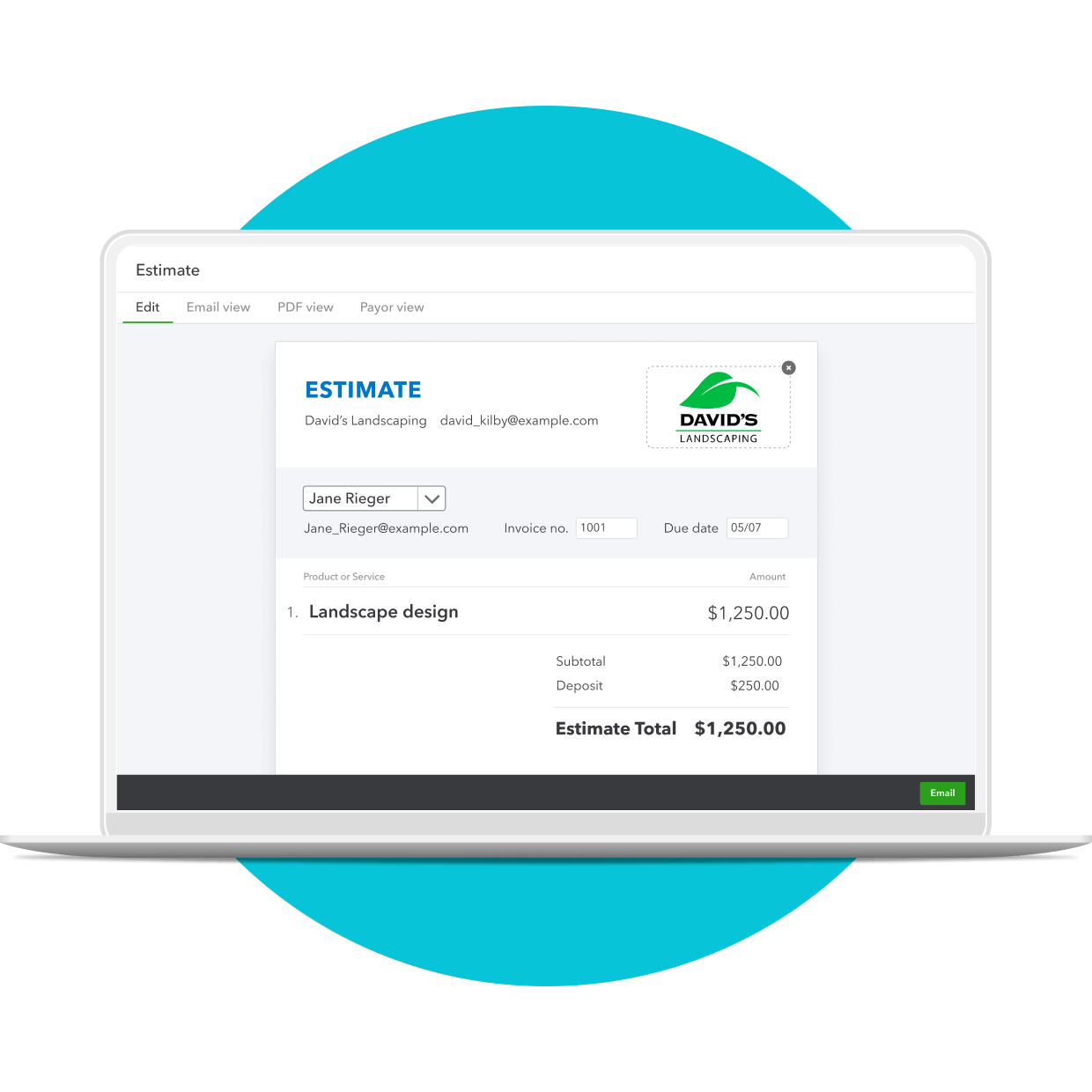

Create estimates

Design professional estimates that include discounts, product stock keeping units, payment terms, and other line items. Instantly email an estimate to a customer or let them accept and sign right on your mobile device.

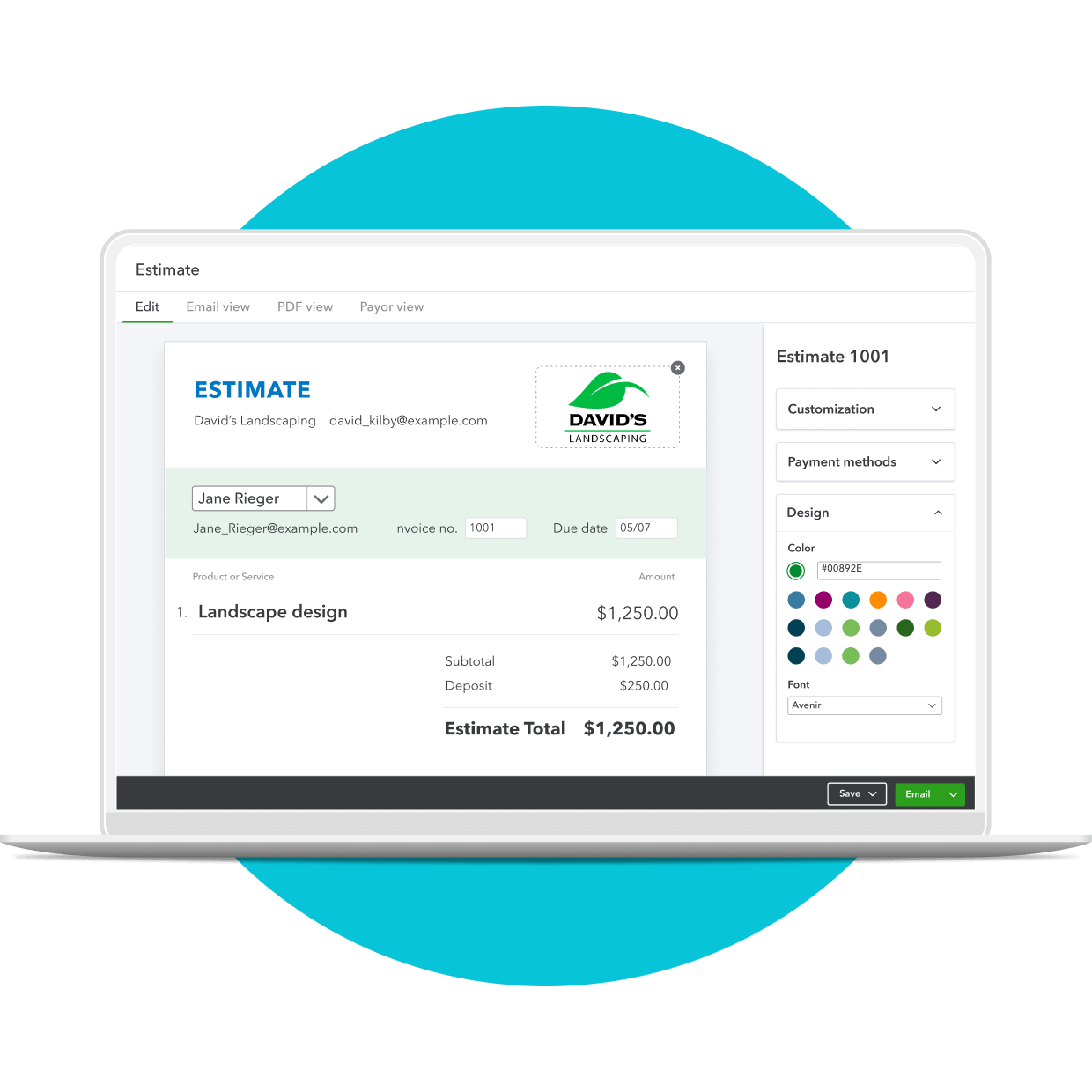

Easily customize estimates

Use a fully-customizable estimate template to create personalized, professional estimates that reflect your small business. Adjust the layout, add your logo, include a personal message, or add custom fields for tracking and reporting within minutes.

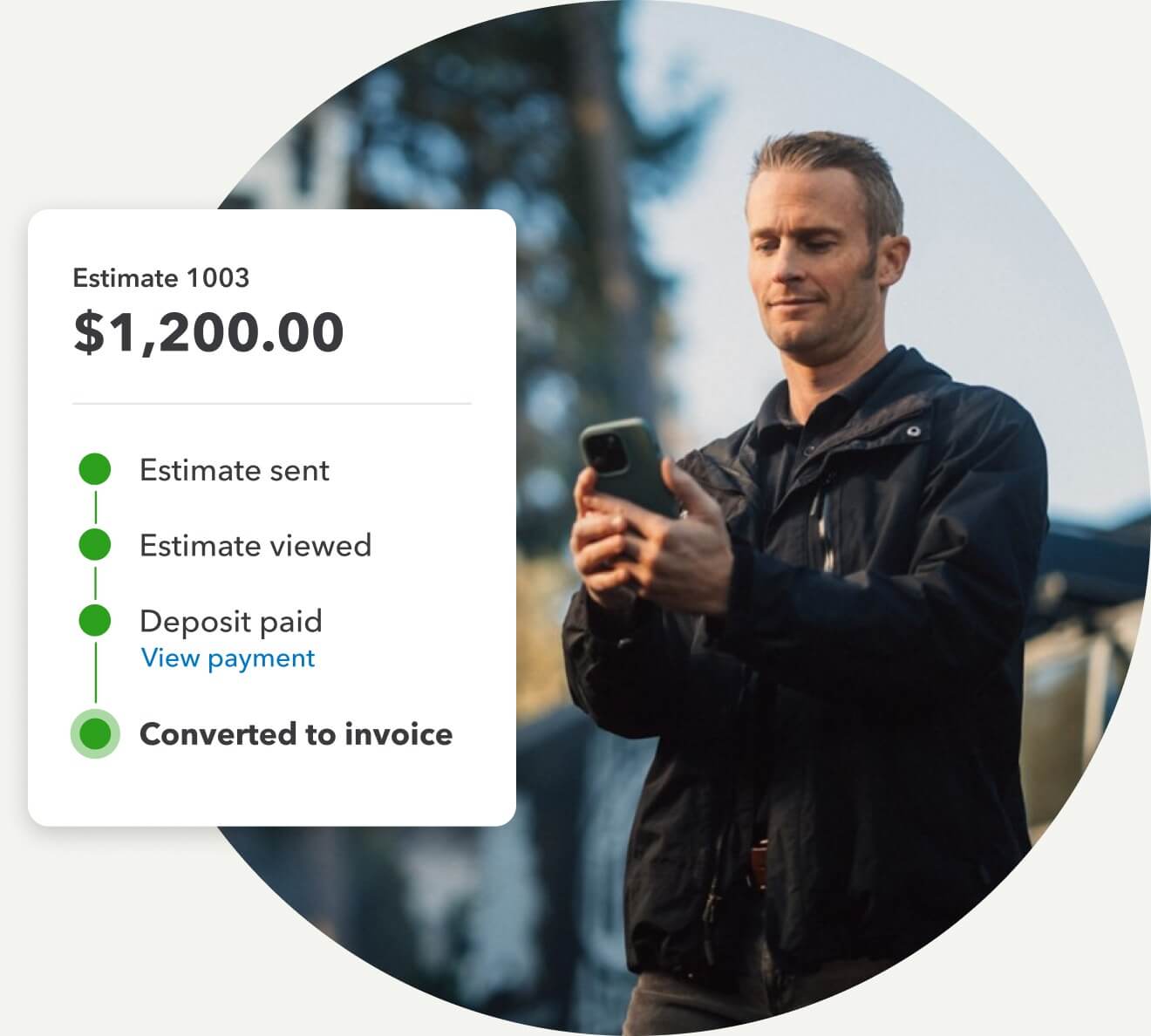

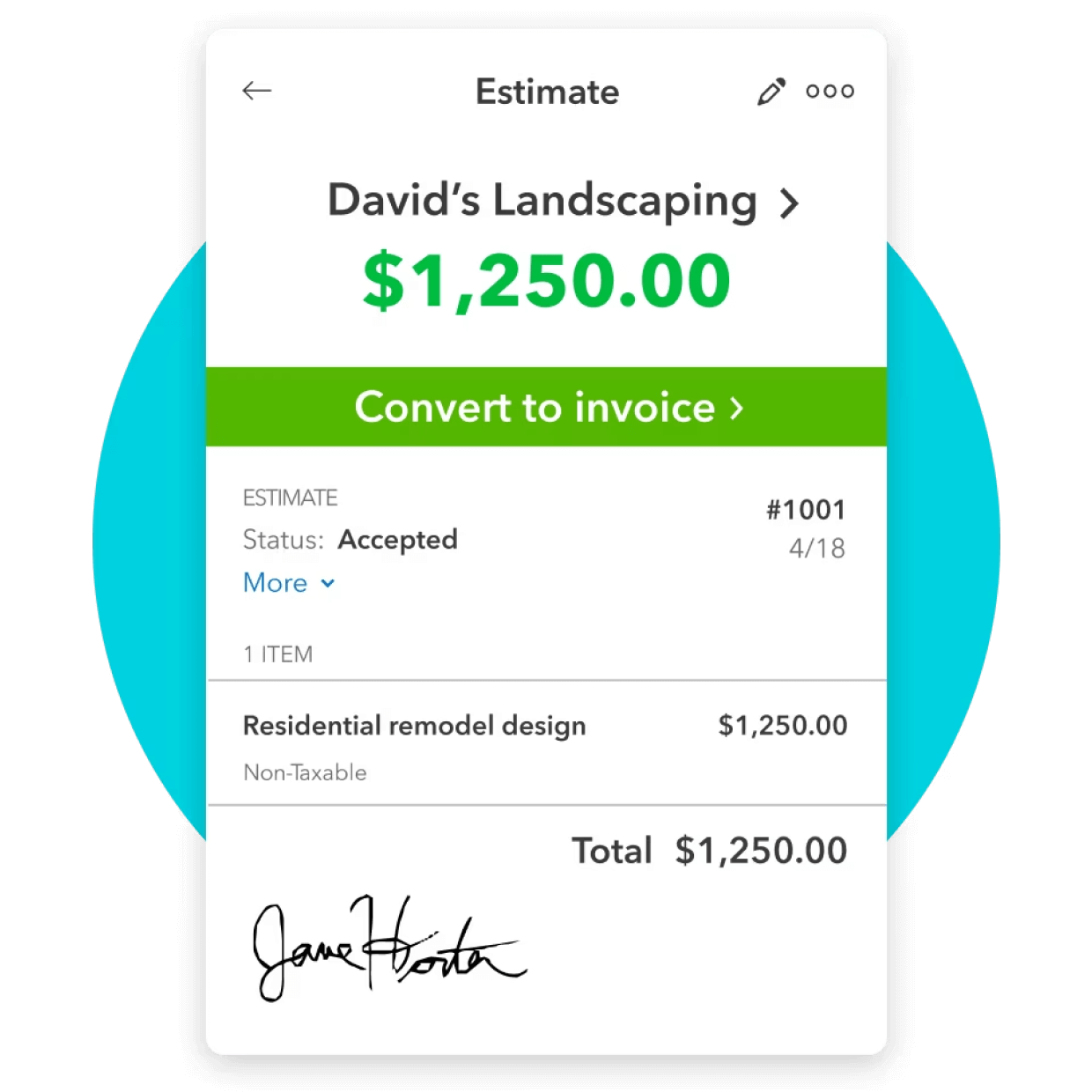

Convert estimates to invoices

Automatically turn accepted new estimates into invoices with QuickBooks. You choose when to invoice your customers and we’ll keep track of everything so you don’t have to.

Payment made easy

Enable online payments to add a button on invoices that lets your customers pay instantly online. We’ll process payments, track transactions, and transfer funds to your bank account.

Plans for every kind of business

Buy now and get Live Expert Assisted FREE for 30 days*

Simple Start

Essentials

Plus

Advanced

NEW

NEW

Get help from our bookkeepers when you need it. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence.

- Get set up by connecting accounts

- Automate tasks to save you time

- Discover features that work for your business

- Categorize and reconcile transactions correctly

- Build and review reports to make smart decisions

Call 1-800-816-4611 to get 50% off Live Expert Assisted for 3 months.*

Stand out with a stellar business proposal

By John Shieldsmith

You’re a business owner with a great idea. You told some of your friends and family members and they’re excited, too. After doing some research via Google, you’re confident that customers will also be interested. There’s just one problem—you have no idea what to do next. You need to write a business proposal.

What is a business proposal?

A business proposal is an official document that details a service or product you plan on selling to someone. Think of a business proposal as your offer. It should explain why you’re the best person for the job.

When do you need a business proposal?

There’s a right and wrong time for a business proposal. If you run a retail store, customers don’t need to see a business proposal. However, if you want to sell your store’s products to a manufacturer, get ready to start writing.

What about customers that frequent your store? In this case, you may need to create an unsolicited proposal, which is defined as any kind of marketing material. Think about flyers you get at fairs or see when walking through a store. Unsolicited proposals are a great way to keep your customers in tune with your product(s) or service(s).

Each proposal type targets a different audience. When in doubt, remember:

- Solicited business proposals often target large clients (like manufacturers) or prospective buyers and investors.

- Unsolicited business proposals target customers in a store (informational flyers with your company’s name, contact information, and a light sales pitch).

Business proposals vs. business plans

It’s easy to confuse a business plan with a business proposal because people use them interchangeably all the time. But depending on the context, there are some key differences.

- Business plans: Business plans outline the entire foundation for a business—potential client problems that the product or service solves, cited evidence of the business that is in demand, and financial projections and costs. Nearly everything about a business plan is based on research because it’s still in the concept phase. These plans are presented to potential investors in hopes of bringing a business to life.

- Business proposals: A business proposal is a document for new or potential customers. Unlike a business plan, which documents a business’ overall worth, a business proposal explains why a product or service will solve a specific customer’s problem. Always remember, business proposals are used when a company is already established.

What is an RFP?

During the business proposal phase you may come across a request for proposal (RFP). The RFP process involves looking at your company’s history and financial health before beginning the business proposal process.

- Think of the RFP as a pre-approval process, where the sender of the RFP verifies you’re a potential good fit. For example, you (the service provider or potential supplier) receive an RFP during the bidding process. You’re then required to provide an RFP response, complete with a company background check. You’ll need to provide key information, such as financial history, track records with specific projects, and proof that your legally operating in the U.S. This ensures the company issuing the RFP doesn’t waste their time with proposals from companies that aren’t a good fit. It also saves your company the trouble of creating a proposal that was doomed from the start. RFPs might sound scary, but they’re really just a formality that almost everyone has to deal with.

Tips for how to write a successful business proposal

It’s going to take a little more than a good price and a solid handshake to win over customers. Use these 5 tips to develop competitive business proposals:

1. Share a unique selling point

If you offer a unique solution to a problem, discuss it in detail. Draw distinctions between your offering and your competitors in every part of your proposal. Point out your strengths and your competition’s weaknesses. Think of ways to help investors understand the benefits your company brings to the project. Also make sure you show your team’s ability to finish on deadline.

2. Stand out in the crowd

Explain why your company is the best fit. Don’t brag about your reputation or use a standard marketing pitch. Avoid sales talk and generalizations. Instead, highlight your company’s strong performance, background information, and awesome service.

Also consider the customer or their business. Who are the decision makers and what are they interested in? Because one proposal won’t work for all potential customers, try conducting a target market analysis to determine who you’re aiming for.

Lastly, write an executive summary to drive home your message. Think of the executive summary as the CliffsNotes to your proposal. Most business proposals are incredibly boring, so use positive, engaging words. Include a summary of your proposal, which outlines the problems your service or product solves, the profit margins, and so on.

Check out some proposal tips and templates for inspiration.

3. Follow instructions

Make sure your proposal matches the requested format. This way, you already stand out from the competition. If a potential client/customer fails to specify these details, echo the format and structure you see in the call for bids. A call for bids differs from a RFP because it lists other reasons (technology used, quality) that might cause a potential client/customer to pick option No. 2.

For example, answer questions in the order they’re asked, and use the same font size, column width, and paragraph structure. Copy each request for information into your proposal and add your response. Wherever appropriate, echo the original document’s questions. For example, if the potential client/customer lists 3 criteria, provide information that addresses all 3 criteria in your proposal.

4. Meet all the requirements

Show you understand the project’s relevant requirements (all the way down to its most technical specifications) in each and every response. This not only demonstrates that you possess the necessary technical expertise to handle the project, but it also shows you’ve got the skills, planning, and reliability to do the job.

5. Don’t promise success before you start

Be realistic when writing a small or large business proposal. Promising more than you can deliver may get a client’s business, but you’ll lose them if you don’t deliver the goods. Ask trusted team members to review the proposal to ensure it’s doable. It’s always better to under-promise and over-deliver.

6. Design a personalized proposal

Create professional and personalized proposals that make you stand out. It’s likely that a potential client/customer looks through tons of proposals. Hire a professional proposal designer and make your proposal shine.

7. Follow up with prospects

It’s rare that a proposal is accepted on the spot. Always give your potential clients a courtesy email or call to thank them for their time. Remind them that you’re available to answer any questions. Sometimes small gestures give you an edge over your competition.

8. Create a detailed outline

Before you start writing, create a proposal outline that details your main points and message. Look for potential pitfalls and use the tips above so you don’t have to rewrite copy.

Write an awesome proposal

In today’s competitive environment, your ability to write a powerful business proposal can make or break you. Focus on your customer’s needs, address their pain points, and always be honest and thorough.

Download the free estimate template

An estimate helps you set expectations and build trust with existing and potential clients. It also gets you one step closer to closing a deal. Customize an estimate that summarizes discounts, product stock keeping units, payment terms, and more.

The free estimate template helps you make the right impression and attract new customers.

- Create personalized estimates

- Convert estimates to invoices

- Add a Pay Now button on invoices and get paid faster

Learn more about how QuickBooks can help you turn prospects into customers.