Reviews that speak volumes

Discover what makes QuickBooks Online the #1 accounting software for small businesses.1

★★★★★

Quickbooks has helped me get paid quicker and track all outstanding invoices with quick follow-ups.

★★★★★

We use Quickbooks as the primary bookkeeping for our small business. We send monthly invoices, reconcile our accounts, and also run profit & loss reports.

Get paid with less back-and-forth

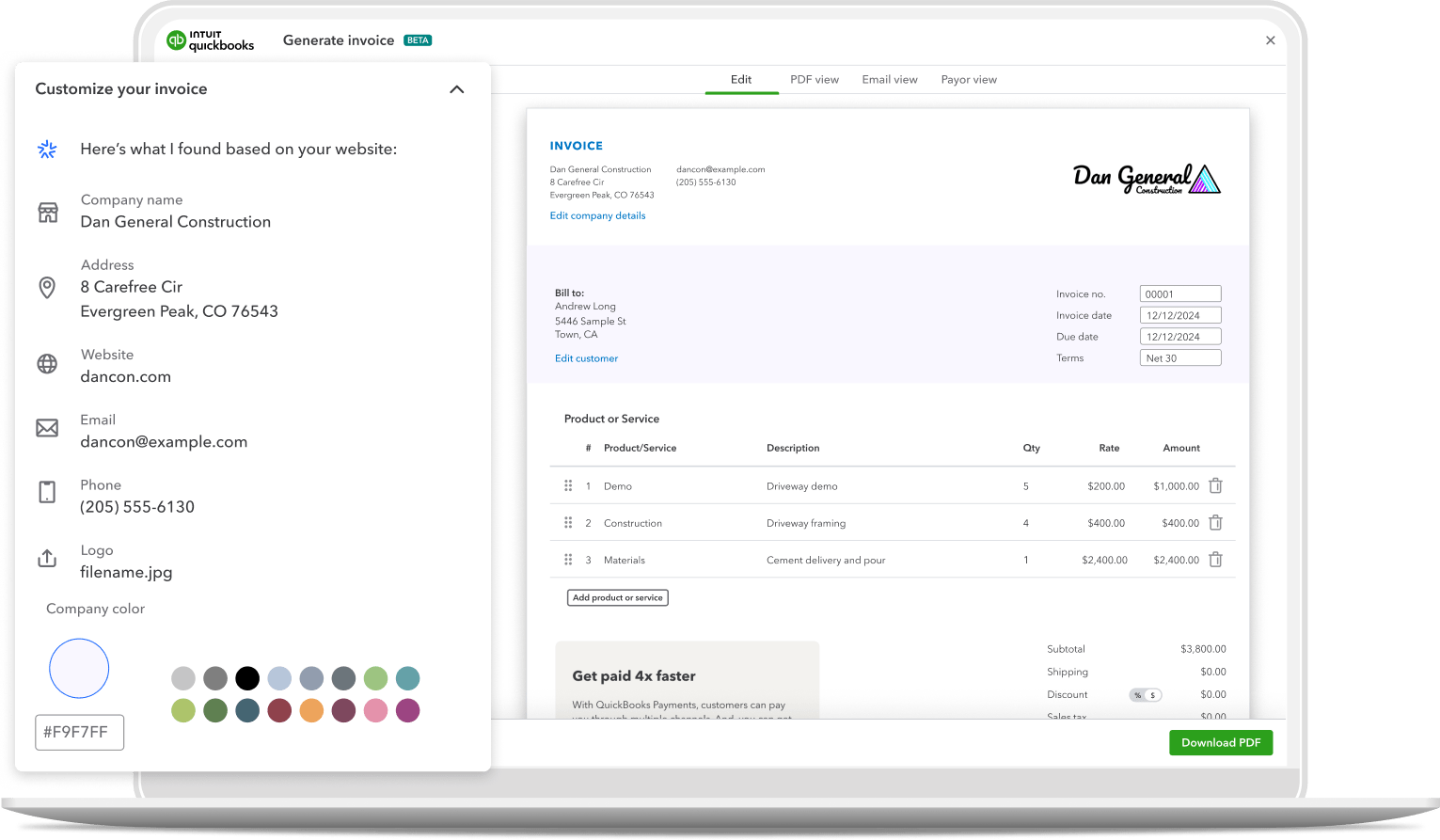

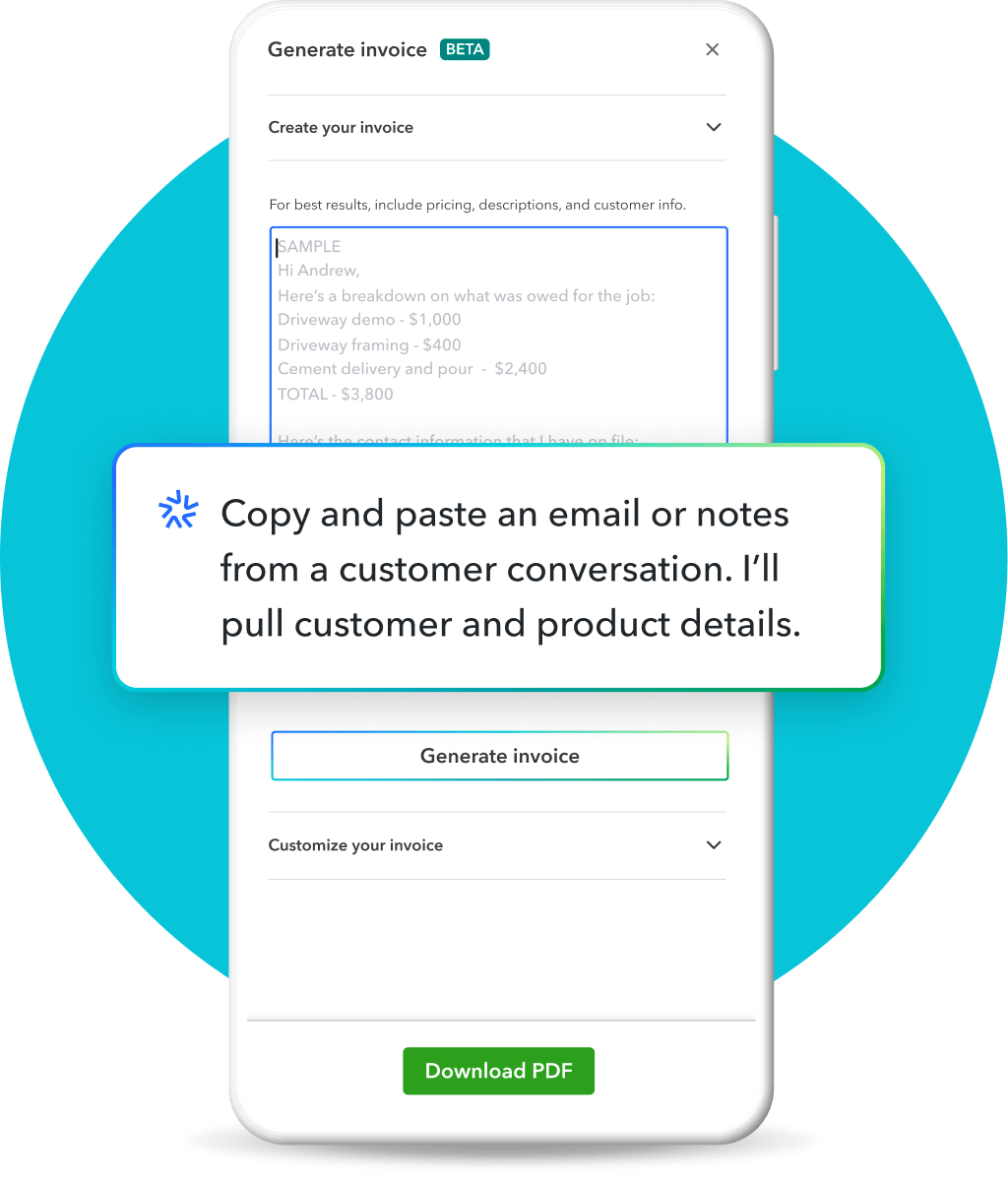

Your invoices reflect your business. Add your logo and colors and create tailored professional invoices within minutes. Or, use Intuit Assist to quickly draft a personalized invoice for you to review (try it free!)

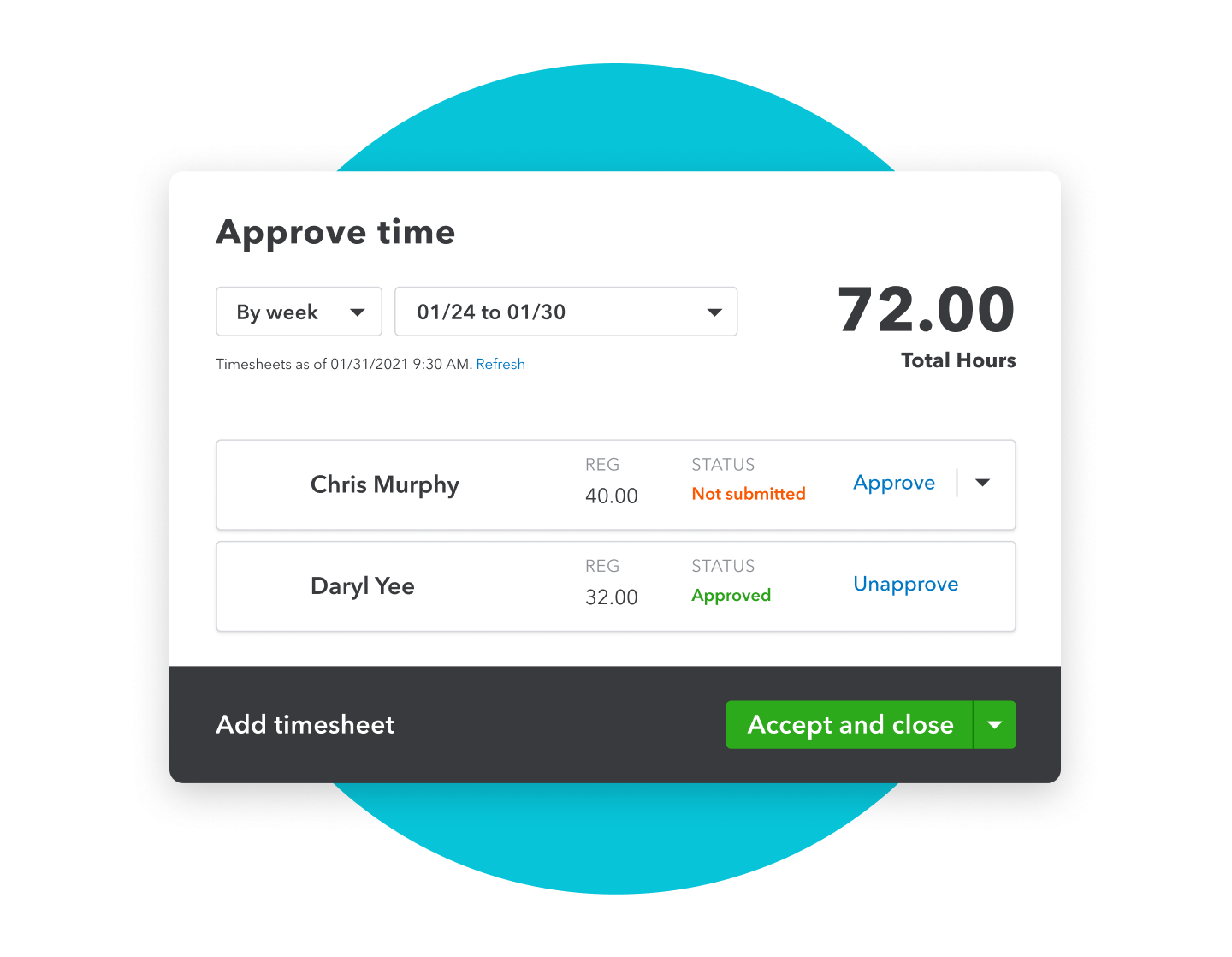

Automatically add billable hours to invoices with QuickBooks Time and Google Calendar.**

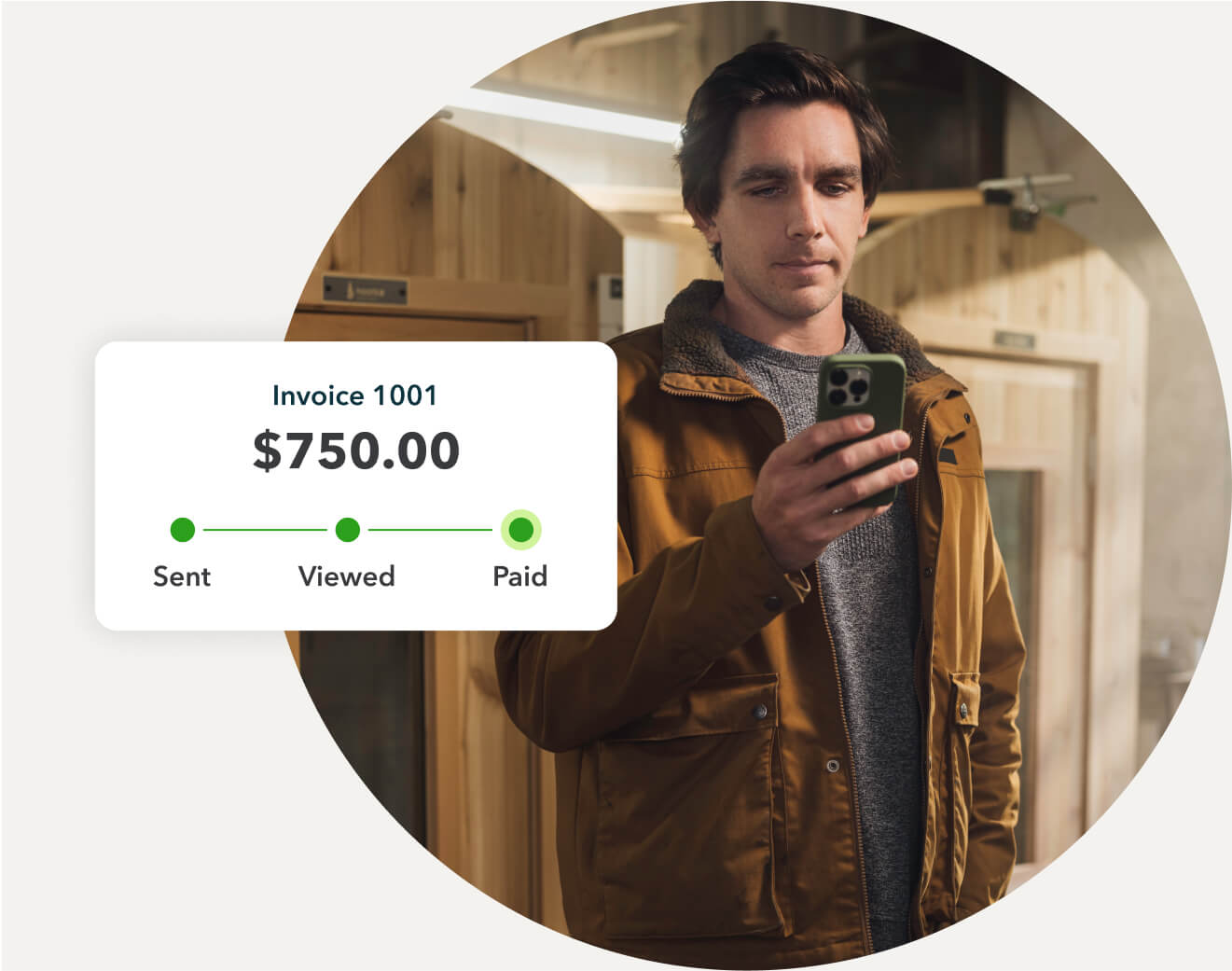

Invoice from the app. Send your invoice, know exactly when it’s viewed, and get notified when it’s paid. Avoid late payments with automated payment reminders.

Create instantly payable invoices

Send customers an invoice they can pay online right away. Get paid 4x faster than you would with paper invoicing.1

Bookkeeping without the busywork

When customers pay through QuickBooks, we’ll record and match it for you.** Your books stay organized all year.

Payment dispute protection

Protect your business from chargebacks. We'll cover up to $25,000 per year, $10,000 per dispute on card payments.*

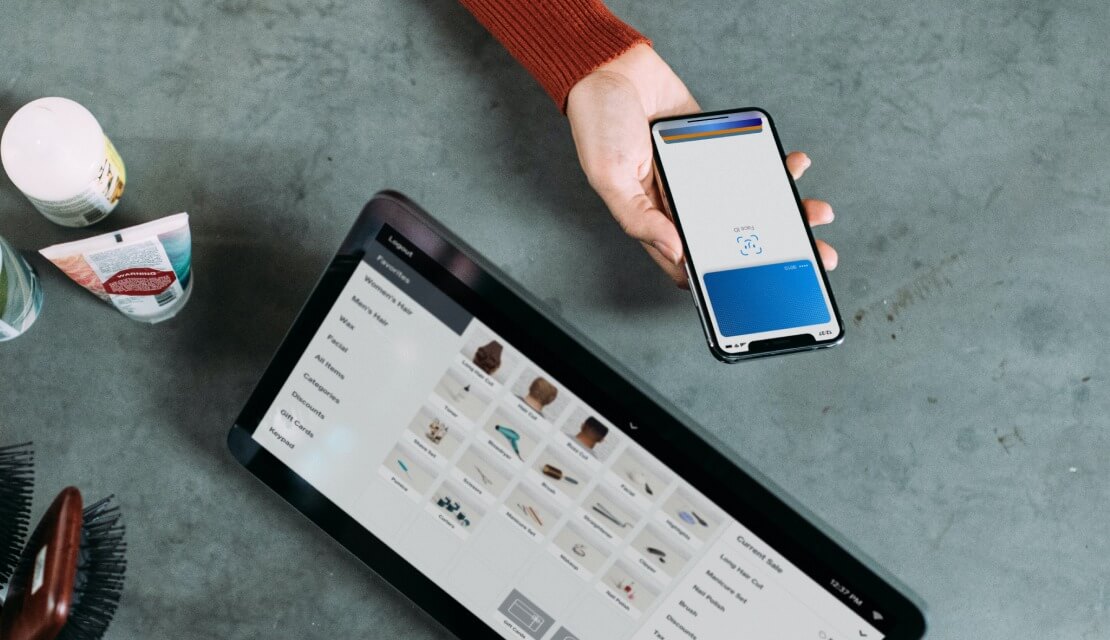

QUICKBOOKS PAYMENTS

Keep more of what you make

Get competitive payment processing rates with no setup costs or hidden fees—just pay as you go. Accept cards, ACH, Apple Pay®, PayPal, and Venmo, and manage it all right in QuickBooks.

If you process over $2,500 per month, call to see how you could save up to 25% off transaction costs.3

Call 1-800-264-1859

Steady cash, on your schedule

Set up recurring invoices to auto-send every day, week, month, or year. Keep funds rolling in no matter what you’re focused on.

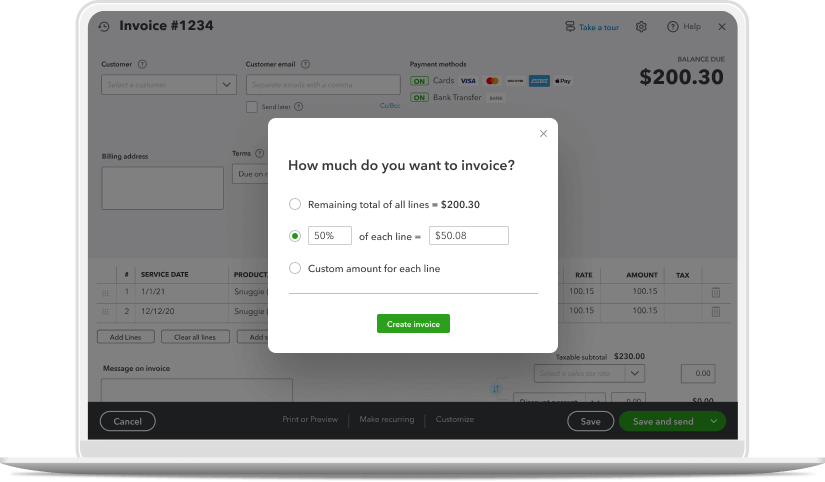

Send progress invoices

Progress invoicing makes getting paid on projects a breeze. Accept payments over time with QuickBooks’ progress invoicing feature on Plus and Advanced.

Split up payments

Don’t wait until the end of a project to get paid. Progress invoicing makes it easy to split up estimates into multiple invoices based on project milestones, stages, or the percentage of work completed.

Let us do the math

Automatically track the total amount on an estimate, how much has been paid, and how much is still owed. Stop manually adjusting your estimate or invoice and let us do the heavy lifting.

See what’s been paid

QuickBooks automatically tracks partial payments and payment progress based on your original estimate, making it easy to keep tabs on the development of a job.

Everyone in the know

Avoid surprises by keeping your customers in the loop. Show your clients the total amount invoiced, what is still owed, and what has been paid on previous invoices.

Plans for every kind of business

Buy now and get Live Expert Assisted FREE for 30 days*

Simple Start

Essentials

Plus

Advanced

NEW

NEW

Get help from our bookkeepers when you need it. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence.

QuickBooks-certified bookkeepers can help you with:

- Automating QuickBooks based on your business needs

- Categorizing transactions and reconciling accounts correctly

- Reviewing key business reports

- Ensuring you stay on track for tax time

Call 1-800-816-4611 to get 50% off Live Expert Assisted for 3 months.*

More ways to learn about invoicing

Find more of what you need with these tools, resources, and solutions.