Free invoice templates

Download free customizable and printable invoice templates from QuickBooks.

A well-designed and custom invoice says a lot about your business. Customers want to know you’re a reputable and trustworthy operation. No matter your industry, build your brand and get money faster with the help of our free invoice templates. Meant to save you time, our invoice templates are easy to download and edit offline in the format you prefer—including PDF, Word, and Excel.

Our blank invoice templates are designed for small business owners looking for a quick way to bill clients and customers for goods and services they provide. Simply add details to the invoice template to create a unique and professional invoice for your customers in the format of your choice.

If you need more than a basic template, check out our industry-specific invoice templates. Whether you run a construction company, are a photographer, or work in property management, find the suitable invoice template for your business and industry and download it in the file format of your choice.

If you’re a business that ships products internationally, a commercial invoice is a document that you’ll need to send along with a package before it goes to its destination. Customs uses these invoices to properly assess the product being shipped and the taxes and fees associated with the item.

Commercial invoices should include:

If you’re a construction company looking to request payment from clients after you’ve completed your work, this template is for you.

Construction invoices should include:

Similar to invoices for construction companies, contractor invoices are important to send to customers so they know when to provide payment for the work that was completed.

Contractor invoices should include:

Invoices don’t just help freelancers get paid for the work they completed on time, they can also help you keep track of the services you provide throughout the year—which will be a huge help during tax season. Make sure to label each invoice you provide to different clients with an invoice number to help you stay on top of pending payments.

Freelance invoices should include:

Photography services can be a large investment for your clients, so it’s important to provide a clear description and cost breakdown of all of your services.

Photography invoices should include:

Proforma invoices allow small business owners to send a preliminary bill of sale to customers. The purpose of proforma statements is to give customers a description and breakdown of total costs that both parties can agree upon before moving forward with services.

Proforma invoices should include:

Use sales invoices to provide customers with a summary of the goods or services they purchased, how much they owe, and when the payment is due. They’re also an important part of your small business bookkeeping.

Sales invoices should include:

A service invoice should include an itemized list of all of the services you provided to a customer. These are especially important for any customers you have that are on a recurring payment schedule.

Service invoices should include:

Legal invoices are crucial to ensure your clients pay you on time for any legal services you provide. Upon offering legal services to a client, you must decide on a service arrangement, as this will determine when you issue the invoice. Service arrangements include a flat fee, hourly rate, contingency fee, or retainer payment.

Legal invoices should include:

Restaurants use invoices to bill customers for the food they ordered and any service provided, such as catering. Invoices are important in the daily operations of restaurants because they help restaurant owners keep track of and monitor their inventory.

Restaurant invoices should include:

Payment structures can differ for consultants depending on their and their client’s preferences. For example, some may prefer to be charged on an hourly basis or per project basis. This is why sending an invoice with a price breakdown of the services you provide is important to ensure your client pays you correctly.

Consulting invoices should include:

A property management invoice includes an itemized list of services you provided to clients to help them manage rental properties—such as tenant screenings, maintenance repairs, and rent collection. Invoices are helpful to keep businesses organized when managing multiple properties and to keep clients and tenants up to date on the cost of managing these properties.

Property management invoices should include:

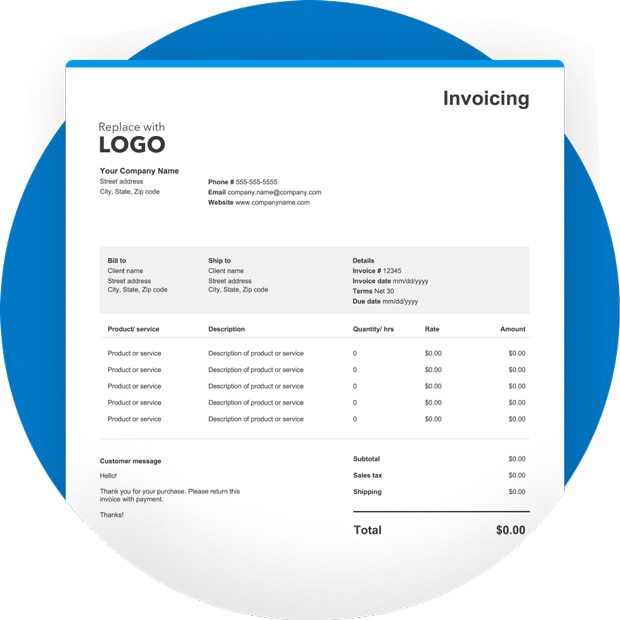

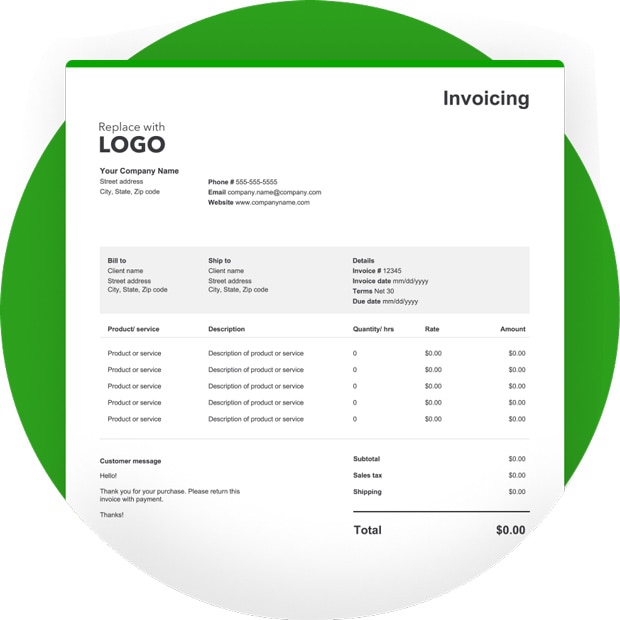

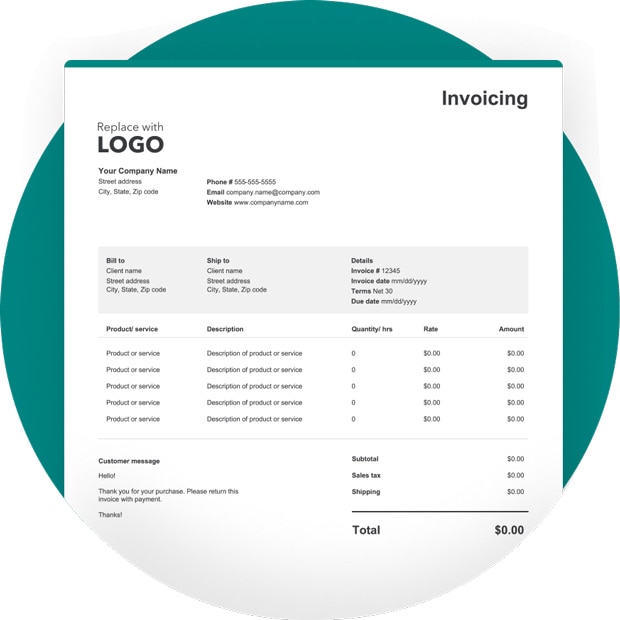

An invoice is a document used to collect payments from customers after you deliver goods or services. It includes a list of the products and/or services you provided, their costs, the total amount due, and how these costs should be paid.

When creating and filling out an invoice, make sure to include the following information on each invoice you create:

Beyond these important requirements, you can adjust your invoices to meet the needs of your business.

Numbering your invoices makes it easy to track payments, keep your accounting records straight, and helps ensure that your business income is properly documented when it comes time to pay taxes. Assign each invoice you issue with a unique invoice number, and document that number directly on the invoice and in your records.

Once you fill out an invoice template, it’s time to send it to your customer. There are a few ways you can do this. You can:

Be sure to track your sent invoices, making note of when you issued the invoice and when payment is due.

Keeping track of sent invoices is crucial so you don’t miss a payment date. Here are some best practices for tracking invoices:

Use an invoice tracking spreadsheet to stay up to date on sent invoices and payments received

Use accounting software that automatically records the status of your invoices

Label each invoice with an invoice number so you can easily keep track of new and recurring payments

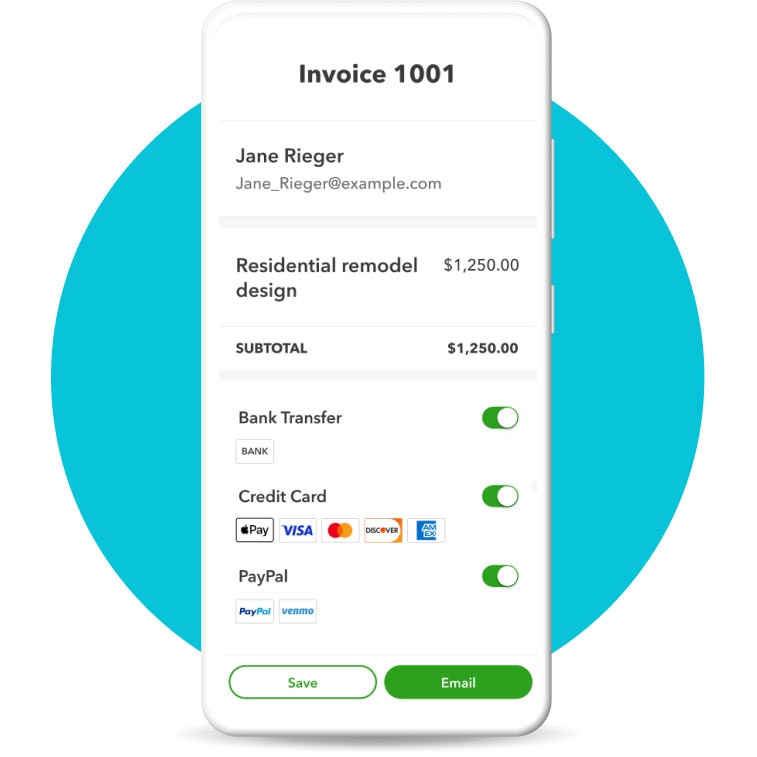

Create an online invoice that’s ready to send within minutes. Intuit Assist can help personalize with colors and images from your website, and quickly add the necessary info. Download it, and it’s ready to send.

When billing your clients, are you waiting for them to make their payments? Our guide covers 20 tips for getting your clients to pay their invoices faster (and on time).

Learn the key differences between invoices and receipts, their uses, and how you can use them in your business.