With QuickBooks Online, always know what’s in stock and what’s on order. Track your inventory easily with real-time updates and reports.

Keep track of every product you buy and sell

Available in QuickBooks Online Plus and QuickBooks Online Advanced

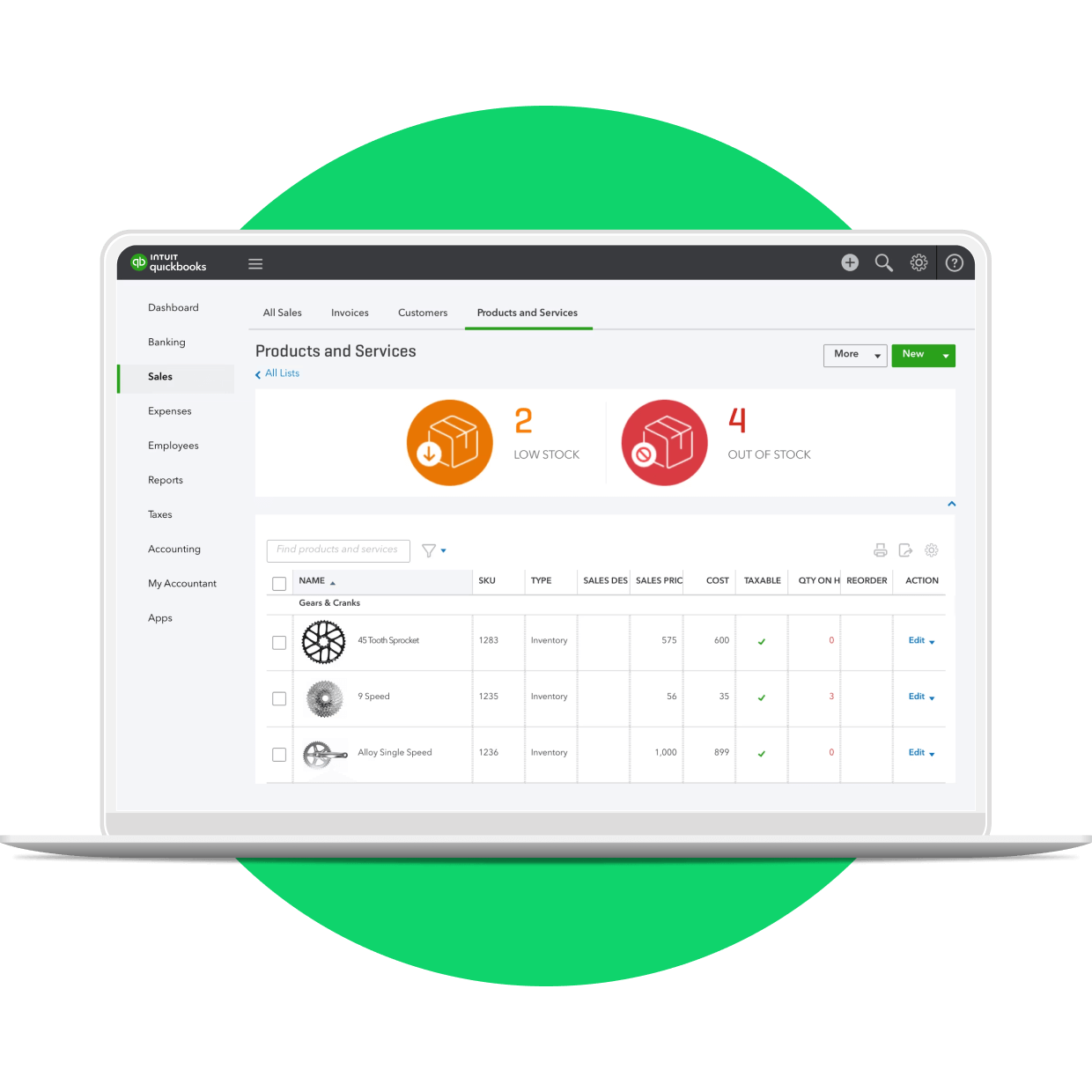

Track inventory in real time

Quantities are updated automatically as you work. Always know what’s on-hand and prevent stock shortages. Use this inventory calculator to make sure you’re not under or overstocking.

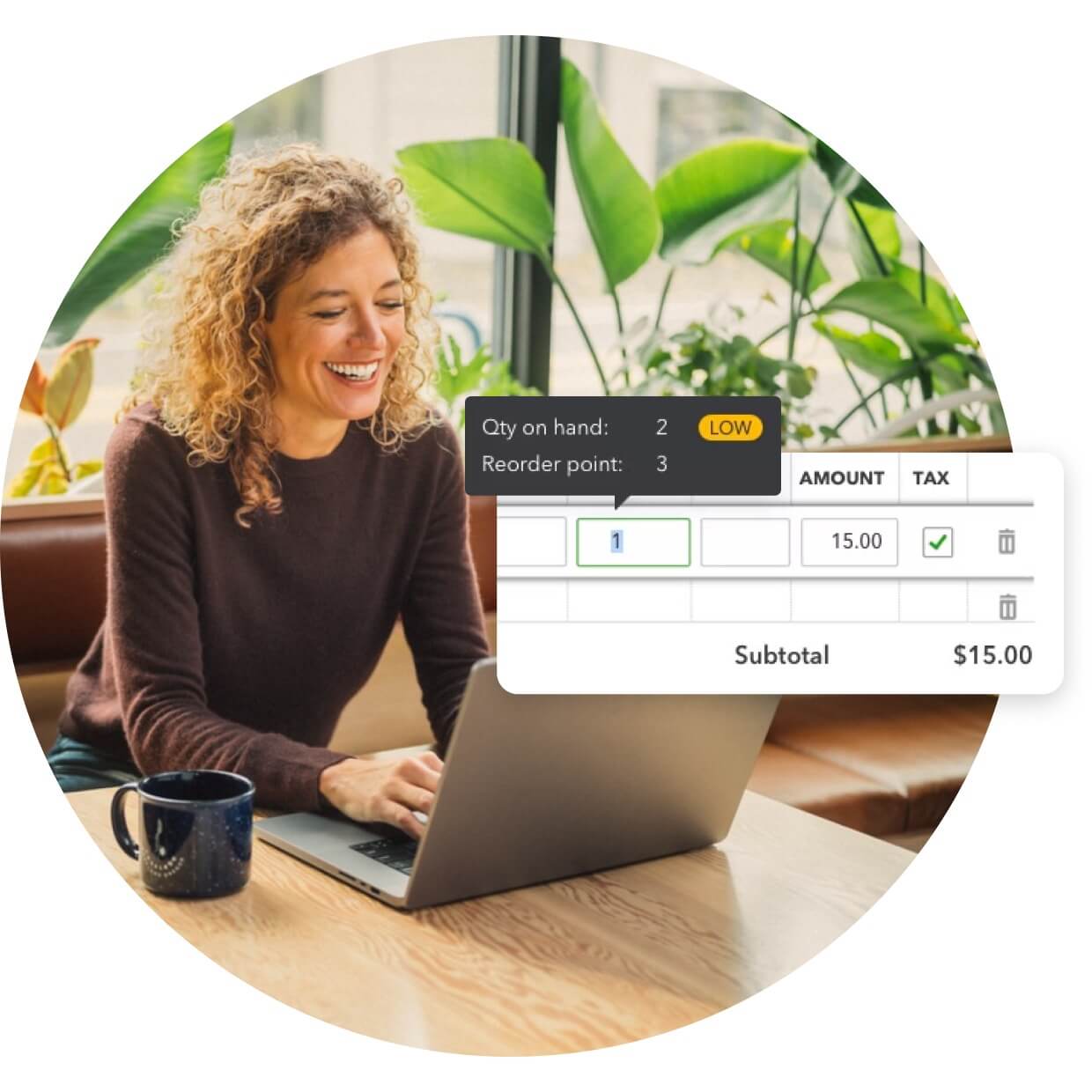

Get instant notifications

Stay ahead of back orders. We’ll alert you when it’s time to reorder inventory with low stock alerts. Once inventory arrives, QuickBooks converts the purchase order (PO) into a bill to make sure you pay your vendor on schedule.

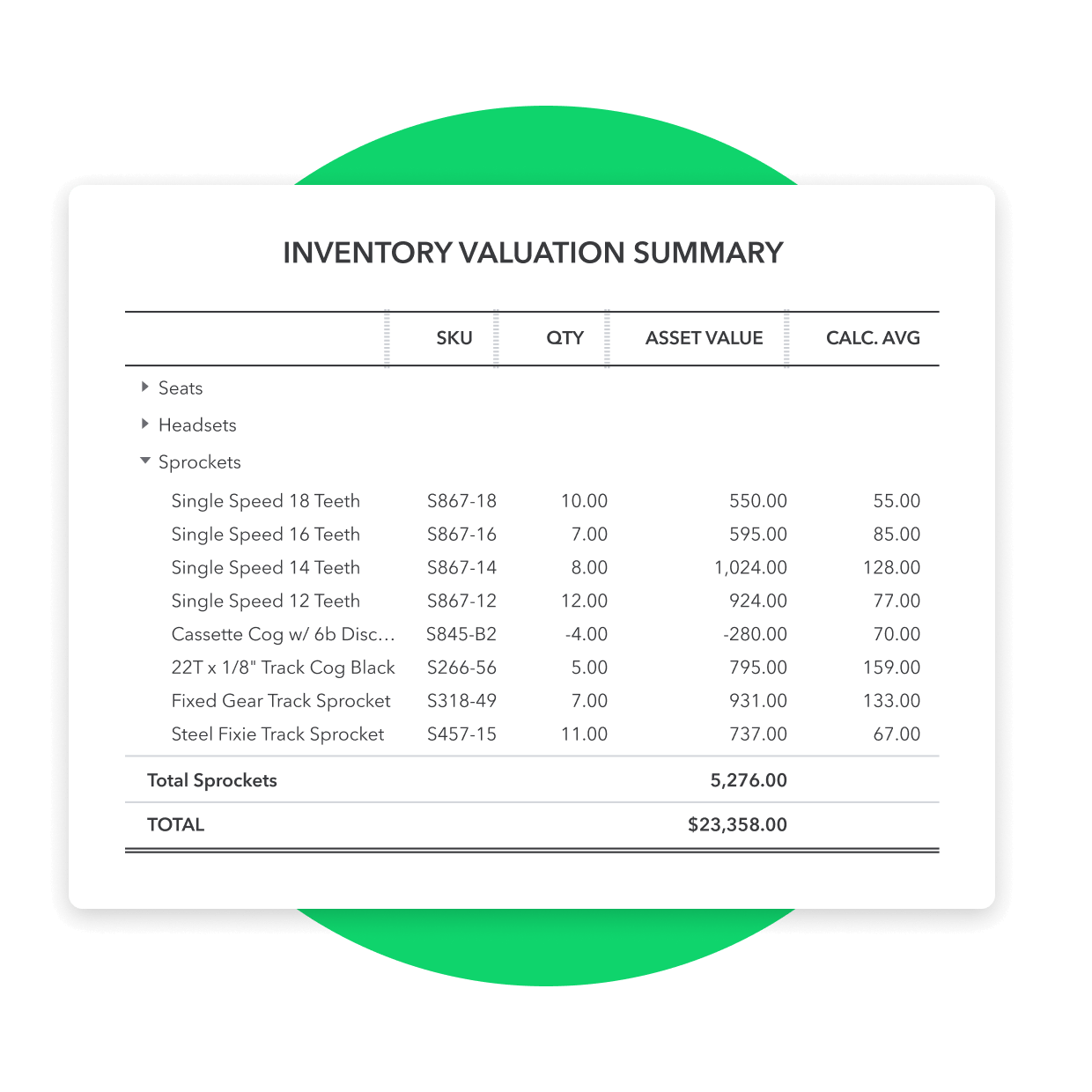

Inventory insights on demand

Access reports to instantly see your best sellers, total sales, and total taxes. Know exactly what products you have stocked with the Inventory Summary report. QuickBooks Online Plus and Advanced comes with a variety of reports to make inventory tracking easy.

Stay in sync with online sales

QuickBooks works with popular apps to boost your business.

Amazon

Create a master inventory list and sync product across channels.

Etsy

Integrate sales data to QuickBooks Self-Employed for instant insights.

Shopify

Enable automatic import of all Shopify orders and refunds in one click.

Flexible QuickBooks Online plans for your business

Plus

Advanced

NEW

NEW

Get help from our bookkeepers when you need it. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence.

QuickBooks-certified bookkeepers can help you with:

- Automating QuickBooks based on your business needs

- Categorizing transactions and reconciling accounts correctly

- Reviewing key business reports

- Ensuring you stay on track for tax time

Call 1-800-816-4611 to get 50% off Live Expert Assisted for 3 months.*

QuickBooks Commerce puts you in the driver’s seat

- Run custom reports, track sales across channels, and get alerts when it’s time to restock inventory, so you never fall behind.

- List and manage your products across multiple channels to increase brand awareness and grow your customer base.

Inventory management

By Erin Osterhaus

Tracking inventory can be tedious work, but it’s vital to running a business. Inventory management systems are designed to handle most of the administrative work, making it easy to put an important part of your business on autopilot.

So what exactly is an inventory management system?

It’s a software application that automatically updates your inventory levels as sales are made and items are shipped. It monitors your supply in real-time and helps you plan purchases from wholesalers and manufacturers. Perhaps most importantly, it’s a tool that helps you keep a finger on the pulse of your cash flow.

When you think about growing a business, you might first think about offering new products or finding new marketing channels. Improving your inventory management might not be at the top of your list, but there’s compelling evidence that it should be.

A good inventory management system can help your business in three key ways:

Save time: Instead of spending hours auditing and tracking inventory on a periodic basis, you have a dynamic look at your inventory levels. You’ll know when you’re running low on a product, so you’ll never keep customers waiting on their orders.

Cut costs: According to the 2016 National Retail Security Survey, 16.5% of inventory “shrinkage”—i.e. lost inventory—results from administrative and paperwork errors. This results in costly audits and lost time. The most efficient way to manage inventory is to automate it.

Budget and forecast: Real-time data helps you make decisions about purchasing and sales. You’ll know what products your customers love and which suppliers are slow to deliver.

The essentials of inventory management

Choosing the right inventory management system depends on your business. Real estate investors carrying property as inventory are very different than a tech company selling smartphones in 10 countries. And that is very different from a bakery selling perishable goods or a distributor selling sheet metal.

In each case, a clear look at the products coming in and going out helps the people in charge make strategic decisions. While most businesses start by managing inventory in an Excel spreadsheet (or in the CEO’s head), software usually takes its place as the supply chain grows in complexity.

What’s the difference between inventory management and supply chain management?

Inventory management is a key component of supply chain management. A company’s supply chain encompasses all of the steps needed to turn a raw material into a product available for consumers. The iPhone, for example, has an immensely complex supply chain. Apple sources parts and materials from California, Korea, Japan and China before the phone is assembled in China. Inventory management is the part of supply chain that deals with finished products. So in the iPhone’s example, Apple’s inventory management system deals with shipping the phones from factories in China to warehouses and finally to Apple stores and homes across the world.

Very few businesses have complete control of or visibility into their supply chain. In fact, most start by outsourcing manufacturing or sourcing to third parties. However, one way to improve costs is to analyze your supply chain. From choosing manufacturers to managing inventory, there are always areas for improvement.

When inventory management starts to get complex

Perishable goods – Grocery and other stores that offer perishable goods face unique challenges when it comes to inventory management. Milk and produce, for example, have short shelf lives. They become harder to sell the longer they sit on the shelf. Unlike stores that sell non-perishable items, grocery stores must be proactive about removing so-called “dead” goods once they near their expiration date.

Lots of products and categories – Some businesses hold inventory that is hard to categorize or differentiate. Auto parts distributors, for example, might carry thousands of different bearings. It’s easy to imagine a spreadsheet handling the first dozen SKUs, but getting incredibly complicated after that.

Seasonal businesses – A Planet Money podcast detailed some of the challenges that florists face before Valentine’s Day: “Sixty percent of us wait until the last minute to order our flowers, but the floral industry can’t afford to wait. About 190 million roses were pushed into production before you even cooked your Thanksgiving turkey.” Seasonality introduces a range of challenges when it comes to inventory. Manufacturing, shipping, cash flow—these parts of the business come together to make inventory a key part of serving customers when it matters most.

3 things to look for in an inventory management system

- An inventory management system should take the guesswork out of your business. The right tool is the one that frees you up to do what you do best. Here are a few things to consider as you look at replacing your current system.Re-ordering: Automatic reordering is great but not always ideal. For example, Quickbooks automatically creates POs for your vendors when you’re low on certain items. This ensures you can review them before making a purchase. You can set thresholds to queue up reorders before your inventory hits critical levels.

- Integrations: You want a tool that works with the systems you’re already using. Integrations with your accounting and POS software will make inventory management significantly easier.

- Real-time dashboards: Inventory management systems should provide you with real-time data and information. You should be able to get a pulse on your business no matter where you are as long as you have access to the internet.

Operationalizing inventory management may not be exciting, but it’s sure to save you time, money and headaches.