Reviews that speak volumes

Discover what makes QuickBooks Online the #1 accounting software for small businesses.2

★★★★★

Different kinds of reporting [are] available at one click only, like P&L, balance sheets, and cash flows.

QuickBooks offers a good combination of ease of use and breadth or features. The reporting is also great. You can drill into almost any detail.

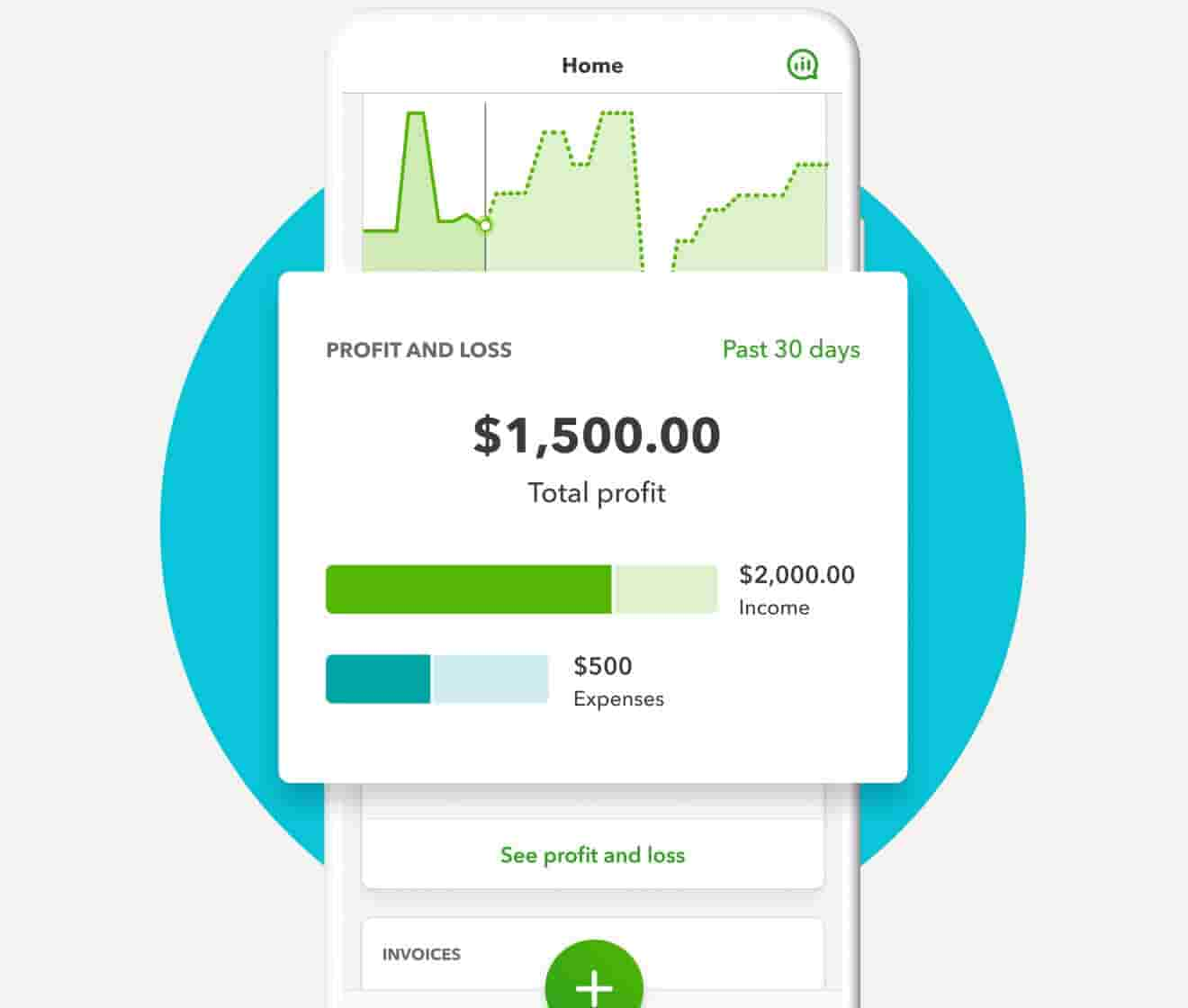

The big picture, in focus

Get a holistic look at how your business is doing, from income statements to balance sheets, all on your QuickBooks dashboard. Or track what’s coming in and what’s going out with a cash flow statement.

By creating a customized spending road map you can ensure you’re working toward your business goals. And give investors the financial statements they need to approve you for a loan.

Track business performance at a glance and make informed business decisions with customizable, presentation-ready reports. Tailor your reports to the info that matters most, and keep your accountant in the loop with email updates.

Available only in QuickBooks Online Advanced

Know more, so you can do more

Know who owes you

Keep tabs on your open invoices, customer balances, and past due amounts with accounting reports like the Customer Balance Summary or Accounts Receivable Aging Summary.

Work with a bookkeeper

With QuickBooks Live Expert Full-Service Bookkeeping, you get to work with a dedicated virtual expert who handles your books. They prepare and deliver custom reports according to your unique business needs.**

Automatically sync your spreadsheets

Seamlessly send data back and forth between QuickBooks Online Advanced and Excel for more accurate business data and custom insights.**

Available only in QuickBooks Online Advanced

Deeper insights into your business

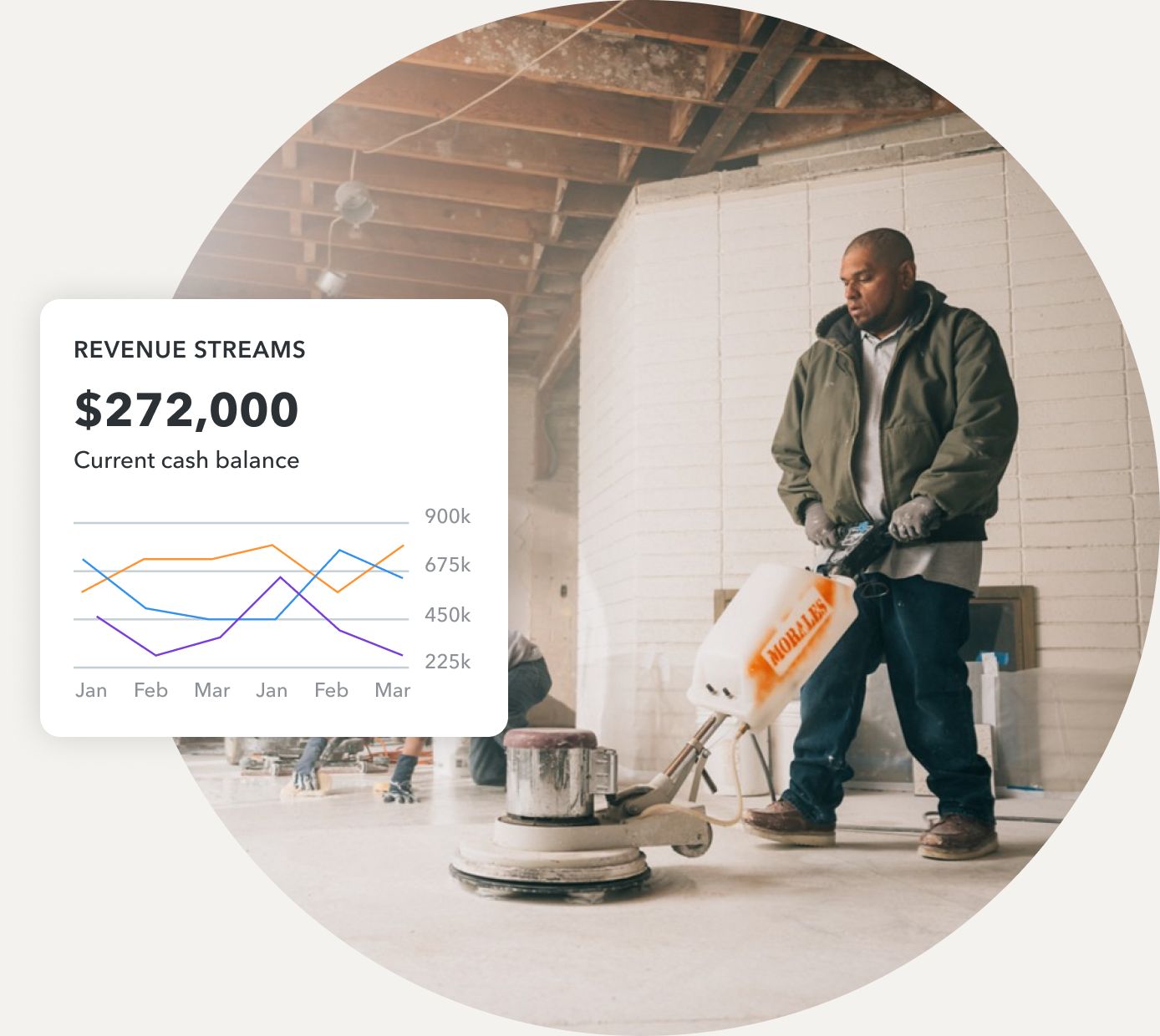

Track money your way

Tags are customizable labels that allow you to track money-in and money-out transactions. Create custom tags based on what’s important to your business.

Get insights and reports

See where you’re making and spending money with a Profit & Loss report based on custom tags. Tag reports help you see how your business is doing and uncover ways to be more profitable.

Easily track transactions

Easily track and search for transactions based on the tags you created. Save time and quickly find what you’re looking for when you search by tag.

Plans for every kind of business

Buy now and get Live Expert Assisted FREE for 30 days*

Simple Start

Essentials

Plus

Advanced

NEW

NEW

Get help from our bookkeepers when you need it. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence.

- Get set up by connecting accounts

- Automate tasks to save you time

- Discover features that work for your business

- Categorize and reconcile transactions correctly

- Build and review reports to make smart decisions

Call 1-800-816-4611 to get 50% off Live Expert Assisted for 3 months.*

Your business story is personal

Your business story is personal