We’ll simplify how you track your business finances, so you can focus on the bigger picture.

Features that help you get things done

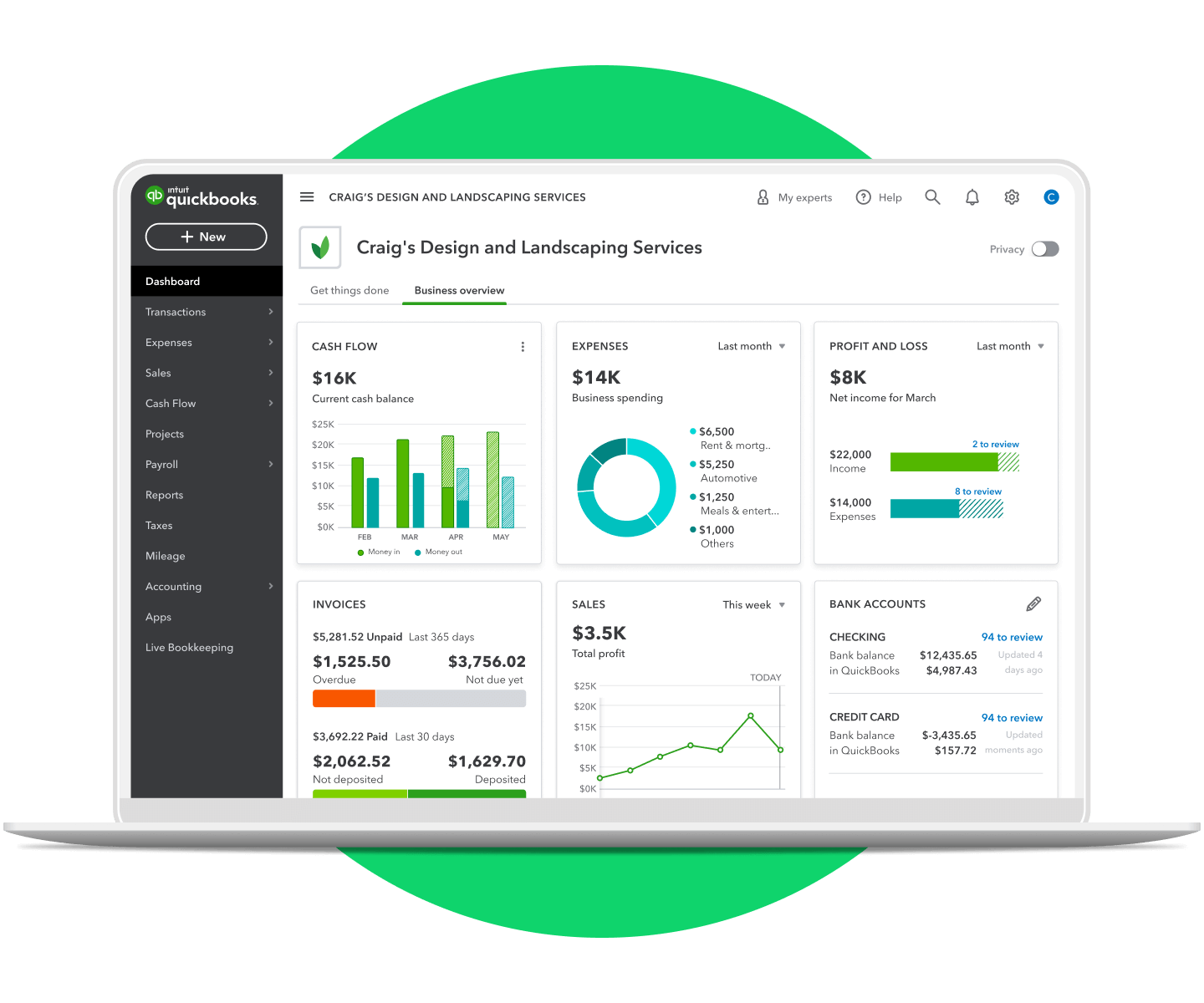

Test drive QuickBooks

Get a feel for what QuickBooks can do and try out top features using our sample company.

Get to know QuickBooks Online

Community

Get answers, tips, and a solid community. You’re not alone when you’re with QuickBooks.

Webinars

Whether you’re a new user or a pro, get your questions answered with one of our free, live webinars.

The right fit for all kinds of businesses

However you work, no matter what your business does, QuickBooks has a plan for you.

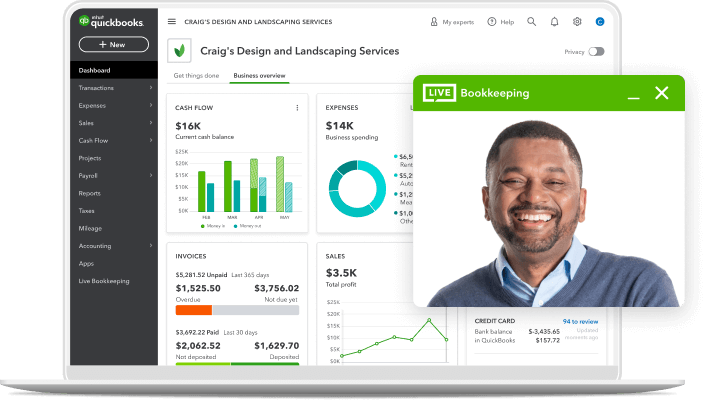

QuickBooks Live

Certified bookkeepers deliver essential reports and keep your books up to date all year.**

Find better features for building your business

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

Guarantee

Accuracy Guaranteed available with QuickBooks Online Payroll Core, Premium, & Elite: We assume responsibility for federal and state payroll filings and payments directly from your account(s) based on the data you supply. As long as the information you provide us is correct and on time, and you have sufficient funds in your account, we’ll file your tax forms and payments accurately and on time or we’ll pay the resulting payroll tax penalties. Guarantee terms and conditions are subject to change at any time without notice.

Tax penalty protection: Only QuickBooks Online Payroll Elite users are eligible to receive the tax penalty protection. If you receive a tax notice and send it to us within 15 days of the tax notice, we will cover the payroll tax penalty, up to $25,000. Intuit cannot help resolve notices for customers in Collections with the IRS because IRS Collections will only work with businesses directly. Additional conditions and restrictions apply. Learn more about tax penalty protection.

*Offer terms

QuickBooks Online Discount Offer Terms: Discount applied to the monthly price for QuickBooks Online (“QBO”) is for the first 3 months of service, starting from the date of enrollment, followed by the then-current monthly list price. Your account will automatically be charged on a monthly basis until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. To be eligible for this offer you must be a new QBO customer and sign up for the monthly plan using the “Buy Now” option. This offer can't be combined with any other QuickBooks offers. Offer available for a limited time only. To cancel your subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

**Features

QuickBooks Checking Account opening is subject to identity verification and approval by Green Dot Bank.

QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank.

Payments’ Merchant Agreement applies. QuickBooks Payments account subject to credit and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

Deposit Sweep Program: Cash balances above $250,000 will be automatically swept from Green Dot Bank and equally spread across our participating financial institutions, providing you with up to $5 million in FDIC insurance coverage. Customers are responsible for monitoring their total assets at each institution. Learn more and see a list of participating institutions here

Instant Deposit at no extra cost: Includes use of Instant Deposit without the additional cost. Instant Deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria. Standard rates apply for ACH, swiped, invoiced, and keyed card transactions. Deposits are sent to the bank account linked to your QuickBooks Debit Card in up to 30 minutes. Deposit times may vary for third party delays.

Annual percentage yield: The annual percentage yield ("APY") is accurate as of November 17, 2022 and may change at our discretion at any time. The APY is applied to deposit balances within your individual Envelopes. We use the average daily balance method to calculate interest on all balances held in Envelopes. Balances held in your primary QuickBooks Checking account that are not in an Envelope will not earn interest. See Deposit Account Agreement for terms and conditions.

Envelopes: You can create up to 9 Envelopes. Money in Envelopes must be moved to the available balance in your primary deposit account before it can be used. Envelopes earn interest as well. Each Envelope will automatically earn interest once created, which will be separately tracked from the primary account and any other Envelope. The interest will be applied to deposit balances in each individual Envelope at the end of your Billing Cycle. See Deposit Account Agreement for terms and conditions.

QuickBooks online services: Online services vary by participating financial institutions or other parties and may be subject to application approval, additional terms, conditions, and fees.

Receipt capture: Requires QuickBooks Online mobile application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Mileage tracking: Mileage tracking is only available to the master administrator of the QuickBooks Online account. Requires QuickBooks Online mobile application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Third party apps: Third party applications available on apps.com. Subject to additional terms, conditions, and fees.

Money movement services, such as direct deposit, are provided by Intuit Payments Inc., a subsidiary of Intuit Inc. For more information about Intuit Payments Inc.’s money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

Next-day direct deposit: Payroll processed before 5 PM PT the day before shall arrive the next business day (excluding weekends and holidays). Requires setup of direct deposit and bank verification. May be subject to eligibility criteria. Deposit delays may occur because of third party delays, risk reviews, or issues beyond Intuit’s control. Available for contractors for an additional fee.

Same-day direct deposit: Available to QuickBooks Online Payroll Premium and Elite users. Payroll processed before 7 AM PT shall arrive the same business day (excluding weekends and holidays). Requires setup of direct deposit and bank verification. Same-day direct deposit may be subject to eligibility criteria. Deposit delays may vary because of third party delays, risk reviews, or issues beyond Intuit’s control. Same-day direct deposit available only for employees.

Automated tax payments and filings: Automated tax payments and filing available for state and federal taxes. Enrollment in e-services is required for tax payments and filings only. Automated tax payments and filings for local taxes available in QuickBooks Online Payroll Premium and Elite only.

QuickBooks Workforce: Available to employees. Requires an Intuit Account and acceptance of the Intuit Terms of Service and Privacy Statement.

Auto Payroll: Available if setup for the company is complete. At least one employee has completed setup and has consistent payroll that qualifies for automation (i.e. salaried or hourly with default). Company must complete bank verification if Employee has direct deposit as the payment method, and the first payroll must run successfully. The account must not have a hold.

Automated 1099 e-file & delivery: Prepare your 1099s in QuickBooks at no extra charge. If you choose the 1099 E-File Service, Intuit will e-file your Federal 1099 information with the IRS, and then print and mail a copy directly to your contractors; fees apply. As part of the paid 1099 E-File Service, we also give your contractors online access to their 1099s. State filing not included. You should check with your state agency on any state filing requirements.

Contractor payments: Subscription to QuickBooks Online Payroll is required. Money movement services are provided by Intuit Payments Inc. subject to eligibility criteria, credit and application approval. Payments processed before 5PM PST the day before, arrive the next business day (excluding weekends and holidays). Individual deposit times may vary because of third party delays, risk reviews, or issues beyond Intuit Payment Inc.'s control.

Workers’ comp administration: Benefits are powered by AP Intego and require acceptance of AP Intego’s Privacy Policy and Terms of Use. Additional fees will apply. There is a monthly fee (currently, $5 per month) for QuickBooks Online Payroll Core users for the QuickBooks Workers' Comp Payment Service. This non-refundable fee will be automatically added to each monthly Intuit invoice at the then-current price until you cancel. The fee is separate from any workers’ comp insurance policy premium by AP Intego Insurance Group. Workers’ Compensation Service requires an active and paid QuickBooks payroll subscription. Eligibility criteria applies to transfer active insurance policy broker of record, including insurance carrier, policy renewal date, and payment method. Workers compensation insurance is not available in OH, ND, WA and WY.

Guideline 401(k): 401(k) offerings are provided and administered by Guideline, an independent third party and not provided by Intuit. Intuit is not a 401(k) plan administrator, fiduciary or other provider. Requires acceptance of Guideline's Client Relationship Summary and Privacy Policy. Additional 401(k) plan fees will apply. Employees may manage their contributions directly with Guideline. Admin and payroll access required to sign up for a 401(k) plan with Guideline.

Guideline experts: Guideline expert services are provided by and administered by Guideline, an independent third party and not provided by Intuit. Guideline live US-based support is available M-F, 6 AM-4 PM PT.

Health benefits: Powered by SimplyInsured and requires acceptance of SimplyInsured’s Privacy Policy and Terms of Use. Additional fees will apply. SimplyInsured does not offer insurance in HI, VT, and DC. Insurance coverage eligibility is not guaranteed, and depends solely on the rules of the insurance carrier. The insurance carrier has sole and final discretion as to the eligibility for health insurance products.

HR services: HR support is provided by experts at Mineral, Inc. Requires acceptance of Mineral’s Privacy Policy and Terms of Service. HR support center is available only to QuickBooks Online Premium and Elite subscriptions. HR advisor support is only available in QuickBooks Online Payroll Elite. HR support is not available to accountants who are calling on behalf of their clients.

**Product information

QuickBooks Online and QuickBooks Self-Employed system requirements: QuickBooks Online requires a persistent internet connection (a high-speed connection is recommended) and computer with a supported Internet browser or a mobile phone with a supported operating system (see System Requirements) and an Internet connection. Network fees may apply.

QuickBooks Online and QuickBooks Self-Employed mobile apps: The QuickBooks Online mobile and QuickBooks Self-Employed mobile companion apps work with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

QuickBooks Live monthly bookkeeping services: During the first month, a Live Bookkeeper provides cleanup services that start from the date of your last business tax return through the end of the calendar month of first sign-up to Live Bookkeeping. The services provided during the first month are as follows, as applicable: update bookkeeping based on information you provide; connect bank and credit cards; categorize and update transactions up until the last tax-filing date; reconcile bank and credit card accounts with past statements, as provided by you; reconcile remaining balance sheet accounts; and run a summary report of work completed, balance sheet, and profit loss statement of YTD for cleanup period(s).

A Live Bookkeeper cannot begin cleaning up your past books until they receive the required supporting documentation, which your bookkeeper will request from you after your first meeting. Once your bookkeeper receives all the necessary documentation, they’ll typically complete your cleanup within 30 days. In some cases, your cleanup may take longer depending on timeliness of documentation and the complexity of your books.

During each subsequent month, ongoing Live Bookkeeping services include: an overview of the main features of QBO; setup of customers and vendors; assistance with reports and reporting tools; setup of chart of accounts; assistance with bank connections, expense type classification, categorization, and reconciliation based on information you provide; importing of historical data; and ongoing assistance with bookkeeping practices). Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide. For more information about services provided by Live Bookkeeping, refer to the QuickBooks Terms of Service.

QuickBooks app integration: Online services vary by participating financial institutions or other parties and may be subject to application approval, additional terms, conditions, and fees. For more information see apps.com.

QuickBooks Online usage limits: QuickBooks Online Advanced includes unlimited Chart of Account entry. Simple Start, Essentials and Plus allow up to 250 accounts. QuickBooks Online Advanced includes unlimited Tracked Classes and Locations. QuickBooks Plus includes up to 40 combined tracked classes and tracked locations. Tracked Classes and Locations are not available in Simple Start and Essentials.

QuickBooks Checking Account opening is subject to identity verification and approval by Green Dot Bank.

QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank.

QuickBooks Payments and QuickBooks Checking accounts: Users must apply for both QuickBooks Payments and QuickBooks Checking accounts when bundled. QuickBooks Payments’ Merchant Agreement and QuickBooks Checking account’s Deposit Account Agreement apply.

QuickBooks Checking account: Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Green Dot Bank operates under the following registered trade names: GoBank, GO2bank and Bonneville Bank. Registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits. Green Dot is a registered trademark of Green Dot Corporation. ©2021 Green Dot Corporation. All rights reserved. QuickBooks products and services, including Instant Deposit, QuickBooks Payments, Cash flow planning / forecasting are not provided by Green Dot Bank.

Cancellation policy: You're free to switch plans or cancel any time.

Customer support: For hours of support and how to contact support, click here.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Call Sales: 1-800-285-4854

© 2024 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc.

By accessing and using this page you agree to the Website Terms of Service.

Monday - Friday, 5 AM to 6 PM PT