Welcome work-life balance

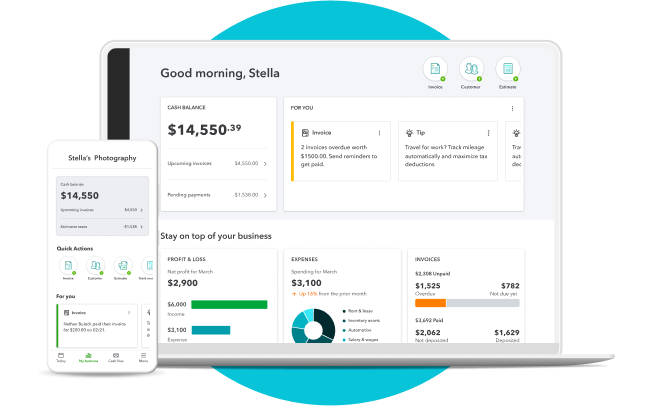

With everything under one roof, even the smallest businesses can free up time for what matters.

- Connect multiple bank accounts for more seamless money management.

- Get mobile alerts for key events like paid invoices to stay in the know.

- Make quick decisions and find opportunities based on accurate, up-to-date reports.

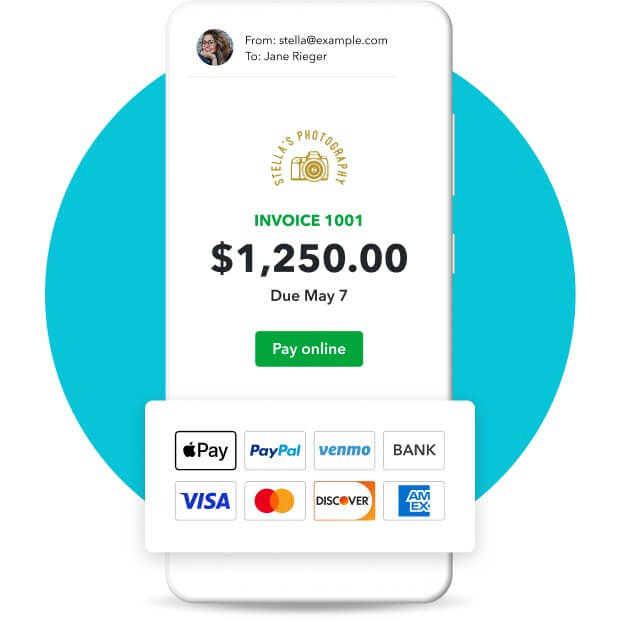

- Send invoices or payment requests. Customers can use card, ACH, Apple Pay®, PayPal, or Venmo.**

- Get same-day deposits on eligible payments at no added cost.**

- Apply for a business bank account with no monthly fees or minimum balance required.**

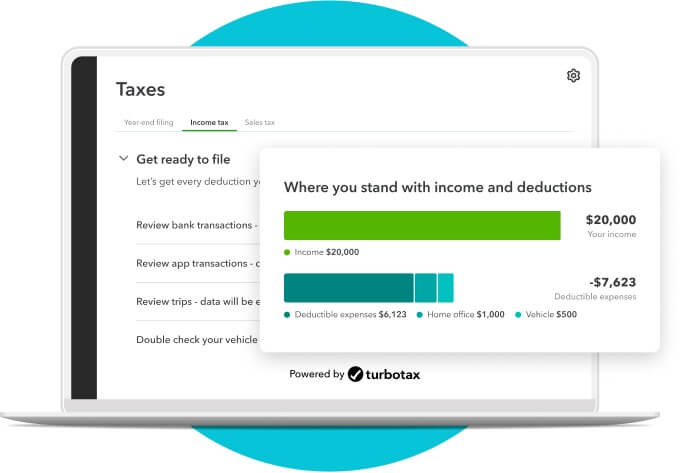

- All your expenses are automatically sorted into tax categories for your review.

- Maximize deductions, stay compliant, and know what to expect when it's time to file your taxes.**

- Prepare your tax year return with access to expert help, powered by TurboTax.**

Find a plan that’s right for you

Do more with your business money. Or choose a plan that includes money management and bookkeeping tools.

Manage money

Manage money and accounting

QuickBooks Money

Money management without the bookkeeping.

$0/mo

Just pay per transaction

Business bank account

Get a business bank account that’s free to open—with no monthly fees and no minimum balances.**

Earn 3.00% APY

Every dollar put away in savings envelopes earns you interest at over 40x the U.S. average.

NEW

Accept payments

Give customers flexible ways to pay—via PayPal,** Venmo, Apple Pay®, credit, debit, or ACH payments.

Payment transaction rates

Get competitive payment processing rates with no setup costs or hidden fees—just pay as you go.

Invoices

Send instantly payable invoices, track their status, send payment reminders, and match payments to invoices—automatically.

Same-day deposit

Eligible payments land in your bank account the same day—nights, weekends, and holidays—so you can access cash fast at no extra cost.**

Cash flow history

See your business money come in and out over time, so you can make smart business decisions and pivot as you grow.

OR

QuickBooks Solopreneur

Bookkeeping for self-employed individuals.

$20

$10/mo

Save 50% for 3 months*

Business bank account

Open a QuickBooks Checking account for free—there’s no monthly fees or minimum balance.**

Earn 3.00% APY

Every dollar put away in savings envelopes earns you interest at over 40x the U.S. average.

NEW

Accept payments

Give customers flexible ways to pay—via PayPal,** Venmo, Apple Pay®, credit, debit, or ACH payments.

Payment transaction rates

Get competitive payment processing rates with no setup costs or hidden fees—just pay as you go.

Invoices

Send instantly payable invoices, track their status, send payment reminders, and match payments to invoices—automatically.

Same-day deposit

Get instant access to eligible payments no matter what time of day you get paid.**

Cash flow history

See your business money come in and out over time, so you can make smart business decisions and pivot as you grow.

Estimates

Customize estimates, accept mobile signatures, see estimate status, and convert estimates into invoices.

Separate business and personal expenses

Auto-categorize business and personal expenses to easily track and maximize tax deductions.

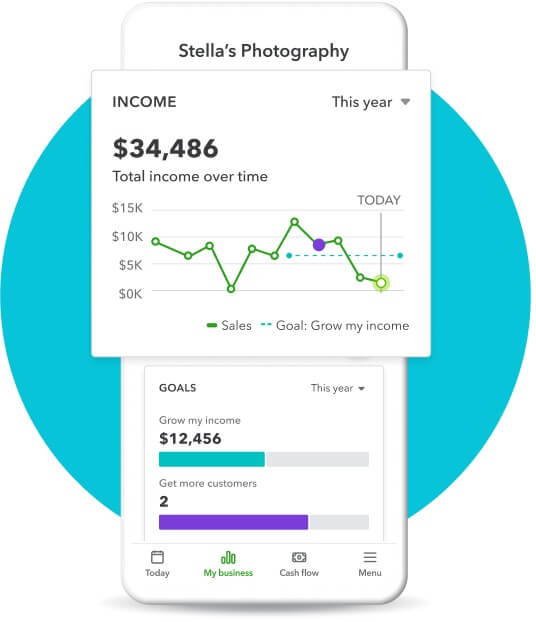

Set and track growth goals

Set up growth goals for your business with target dates and we’ll suggest actions to take to achieve them.

Access expert tax help

Save time and effort by seamlessly moving from books to taxes, then prepare your current tax year return with unlimited expert help to get every credit you deserve. Access live tax experts powered by TurboTax and pay only when you file. Costs vary by entity type. Subject to eligibility.

with QuickBooks Live Tax

Tax deductions

Share your books with your accountant or export important documents.**

Basic reports

Get an overview of your business with profit & loss and sales reports.

Mileage tracking

Automatically track miles, categorize trips, and get sharable reports.**

Track sales

We track rate changes automatically and calculate sales tax whenever it’s applied.

Basic income and expenses

Securely accept invoice payments, stay on top of expenses, and automatically keep transactions organized.

Receipt capture

Snap photos of your receipts and match them to transactions.**

QuickBooks Simple Start

Accounting for registered businesses.

$35

$1750/mo

Save 50% for 3 months*

Business bank account

Open a QuickBooks Checking account for free—there’s no monthly fees or minimum balance.**

Earn 3.00% APY

Every dollar put away in savings envelopes earns you interest at over 40x the U.S. average.

NEW

Accept payments

Give customers flexible ways to pay—via PayPal,** Venmo, Apple Pay®, credit, debit, or ACH payments.

Payment transaction rates

Get competitive payment processing rates with no setup costs or hidden fees—just pay as you go.

Invoices

Send instantly payable invoices, track their status, send payment reminders, and match payments to invoices—automatically.

Instant deposit

Get instant access to eligible payments no matter what time of day you get paid.**

Cash flow history

See your business money come in and out over time, so you can make smart business decisions and pivot as you grow.

Estimates

Customize estimates, accept mobile signatures, see estimate status, and convert estimates into invoices.

Recurring invoices

Automate recurring invoices and give your customers the option to set up automatic payments.

Separate business and personal expenses

A QuickBooks expert can help you set up your chart of accounts, connect your banks, and show you best practices.

Set and track growth goals

Securely import transactions and organize your finances automatically.

Access expert tax help

Save time and effort by seamlessly moving from books to taxes, then prepare your current tax year return with unlimited expert help to get every credit you deserve. Access live tax experts powered by TurboTax and pay only when you file. Costs vary by entity type. Subject to eligibility.

with QuickBooks Live Tax

Tax deductions

Share your books with your accountant or export important documents.**

General reports

Run and export reports including profit & loss, expenses, and balance sheets.*

Mileage tracking

Automatically track miles, categorize trips, and get sharable reports.**

Track sales

We track rate changes automatically and calculate sales tax whenever it’s applied.

Income and expenses

Securely import transactions and organize your finances automatically.

Receipt capture

Snap photos of your receipts and match them to transactions.**

Contractors

Assign vendor payments to 1099 categories, see payment history, prepare and file 1099s from QuickBooks.**

Connect 1 sales channel

Connect 1 online sales channel and automatically sync with QuickBooks.

Expert Assisted

Connect with Live experts when you need it. They can provide setup help and bookkeeping guidance in QuickBooks, so you can stay organized and run your business with confidence. Free for 30 days. No auto-renew.

Try expert help FREE for 30 days*

Stay steady as you grow

With QuickBooks Online plans, you have access to expert guidance, and can even integrate a Mailchimp account for simplified marketing.

RECOMMENDED

QuickBooks Solopreneur

Get special features designed for the self-employed.

- Untangle your finances for a better view of your spending with automatic categorization of business and personal expenses.

- See where your business stands with simple reports and dashboards.

- Set growth goals and get tips for reaching them.

Success is in their stories

Success is in their stories

“Being able to seamlessly navigate the features has made a tremendous impact on the financial health of my business.”

Dr. Brenda Sacino, PT DPT, Owner of Playful Progress—QuickBooks Solopreneur customer

Build your knowledge

Frequently asked questions

Simple solutions for your business of one

All the right tools to help your solo business succeed moving forward.