Business banking account FAQ

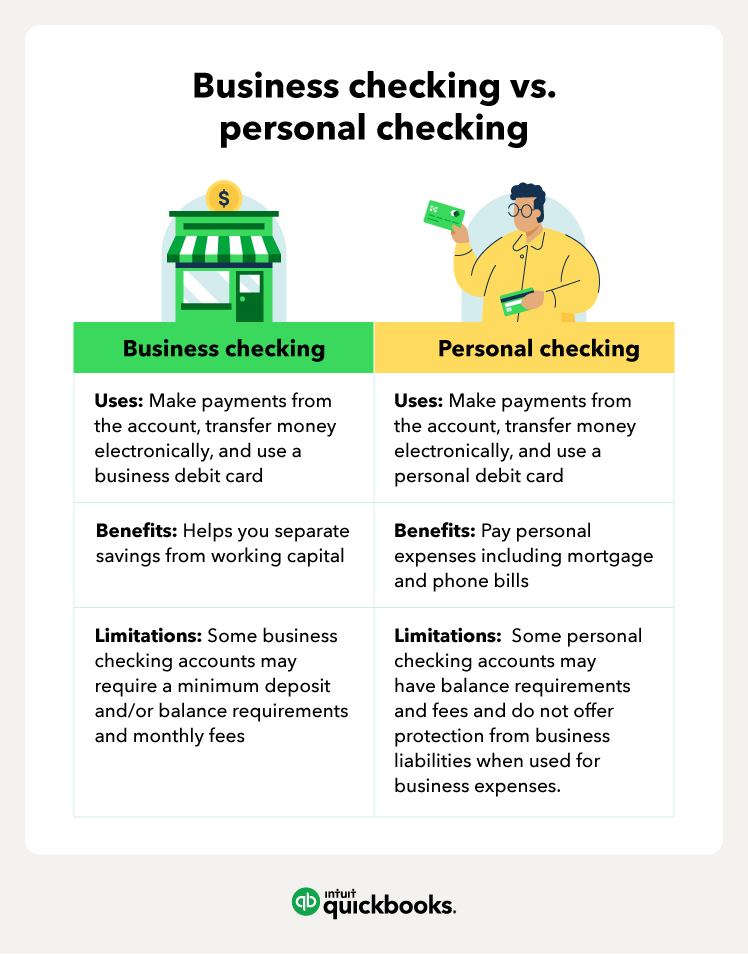

Still not sure about the ins and outs of business checking vs personal checking accounts? Check out some frequently asked questions to ramp up your understanding of these bank accounts.

Can I use my personal account for business expenses or my business account for personal expenses?

No, it’s not recommended that you use your personal bank account for business purposes. Nor should you use your business account for personal expenses. Separating your business and personal financials may help you avoid legal issues or problems with recordkeeping.

Can I use my personal checking account if I own a corporation or LLC?

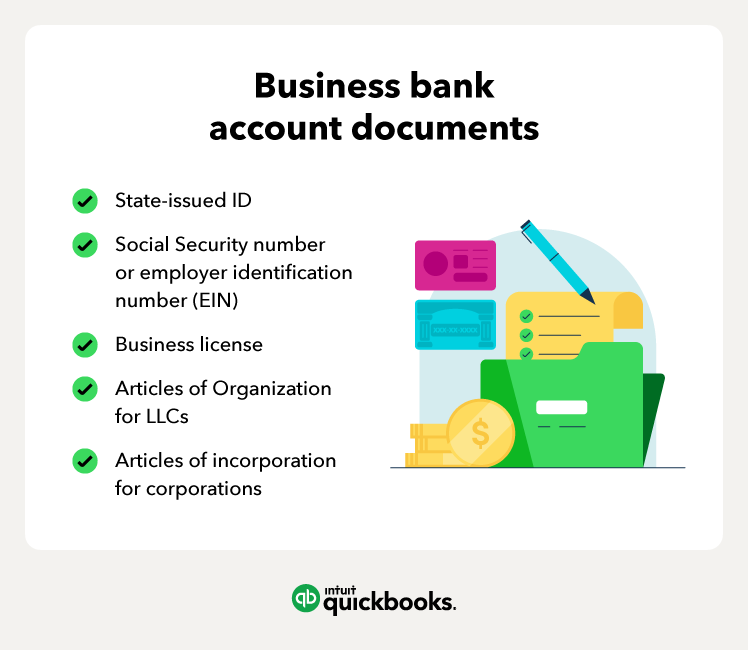

No, if you’re registered as an LLC or corporation, a separate bank account for business finances may help protect you legally. It’s a good idea to open a bank account under your business name as soon as you start handling business transactions.

Can I use my personal bank account as a sole proprietor?

You’re not required to have a separate business bank account as a sole proprietorship, but separate accounts are still a good idea. A dedicated business account can help you separate business and personal finances and manage your business finances more easily.

Do you need business revenue to open a business checking account?

No, you do not need to earn money or show proof of a profit before you open a business checking account. Opening a separate bank account for your business should be one of the first steps you take as soon as you start your company.

However, keep in mind that some business checking vs. personal checking accounts require a minimum deposit amount when you sign up. Make sure you read the terms and conditions before opening your business account.

Are business checking accounts FDIC insured?

Folks that aren’t sure whether to choose a business checking vs. personal checking account should know the Federal Deposit Insurance Corporation (FDIC) protects personal deposit accounts up to $250,000 per account. Business checking accounts can receive the same amount of protection.

The FDIC protects the following items:

- Checking accounts

- Savings accounts

- Negotiable Order of Withdrawal accounts

- Money market deposits

- Certificates of deposit (CDs)

- Money orders

- Cashier checks

- Other official bank-issued items

Keep in mind that the FDIC protections do not apply to investments, safe deposit boxes, annuities, or life insurance policies. However, you do have the reassurance that your funds are covered up to the applicable amount.

Final thoughts

While personal checking accounts are great for storing your funds, opening a separate account for business expenses could serve a larger purpose. Business banking accounts allow you to legitimize your company, streamline bookkeeping, and protect your assets. Making the switch could greatly enhance your overall business.

Now that you have more information regarding business checking vs. personal checking accounts, you are ready to enhance how you run your company. If you are looking for other ways to manage your business expenses, check out out QuickBooks Checking — an online business bank account with no monthly subscriptions or minimum account fees — for seamless insights into your business finances.