Whether you’re a long-time business owner or just starting your business, to-do lists pile up fast, and writing a business plan can be a time-consuming task. Using a business plan template like the one below can be an easy way to jumpstart your business planning.

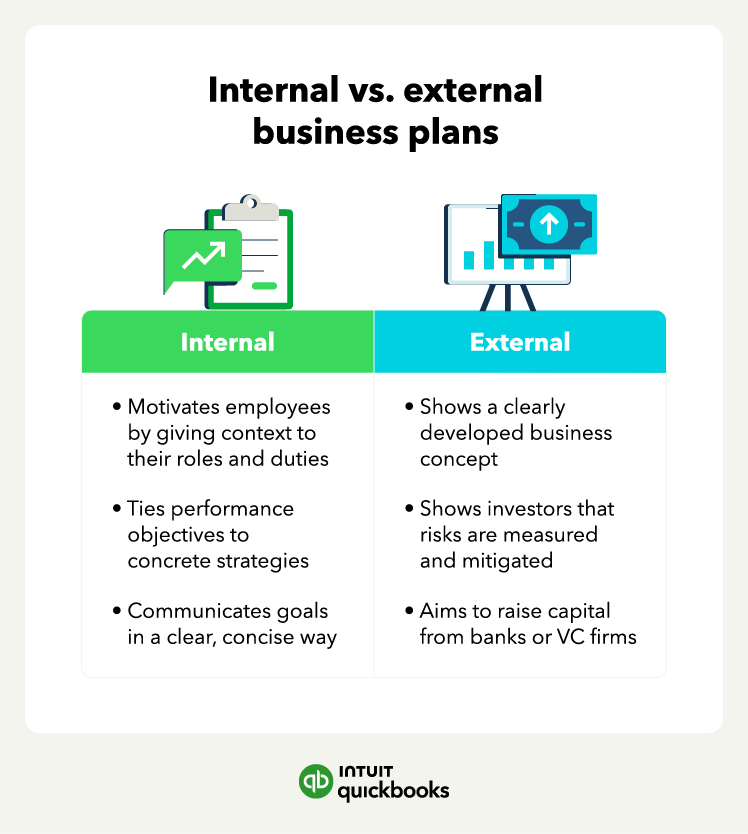

When done right, business plans can help you successfully strategize and create goals. Start with a clear picture of the audience your plan will address. Is it for investors, your bank, your employees, or yourself?

Defining your audience helps you determine the language you’ll use in presenting your ideas. Once you have your audience in mind, you can start creating the 10 key components of your business plan:

You can even map your customers’ journey to better understand their needs and preferences.

You can even map your customers’ journey to better understand their needs and preferences.