Income statement reports show financial performance based on revenues, expenses, and net income. By regularly analyzing your income statements, you can gather key financial insights about your company, such as areas for improvement or projections for future performance.

Income statement: Definition, preparation, and examples

Learn how your business can create and use income statements, along with other financial statements.

What is an income statement?

The income statement, also known as a profit and loss statement, shows a business’s financial performance during a specific accounting period. It reports net income by detailing a business’s revenues, gains, expenses, and losses. Put simply, an income statement follows this equation:

Total revenue – total expenses = net income

What are income statements used for?

The income statement serves as a tool to understand the profitability of your business. The income statement can also help you make decisions about your spending and overall management of business operations. Income statements should be generated quarterly and annually to provide visibility throughout the year.

The information gleaned from the income statement can help you:

- Improve your business’s financial performance in the upcoming quarter or year.

- Identify business activities to allocate greater investment.

- Determine whether, and which, expenses need to be cut.

- Use business resources more efficiently.

- Forecast business growth.

- Measure profitability with earnings per share.

The income statement should be used in tandem with the balance sheet and cash flow statement. With insights from all three of these financial reports, you can make informed decisions about how best to grow your business.

Why are income statements important for small businesses?

Forecast profitability and make decisions

By generating income statements and other financial reports on a regular basis, you can analyze the statements over time to see whether your business is turning a profit. You can use this information to make financial projections and more informed decisions about your business.

Identify cash flow issues

Understanding cash flow is critical for small businesses. When used in conjunction with the other financial statements, an income statement can give you a clear view of your cash flow.

Apply for credit or loans

Many small businesses need financial statements to apply for credit or to provide financial information to a potential lender. Using an income statement to demonstrate a consistent history of income and profitability can make this process easier.

Remain compliant

Accurate records of expenses, revenues, and credits are required for tax purposes and can help keep you in compliance with tax regulations.

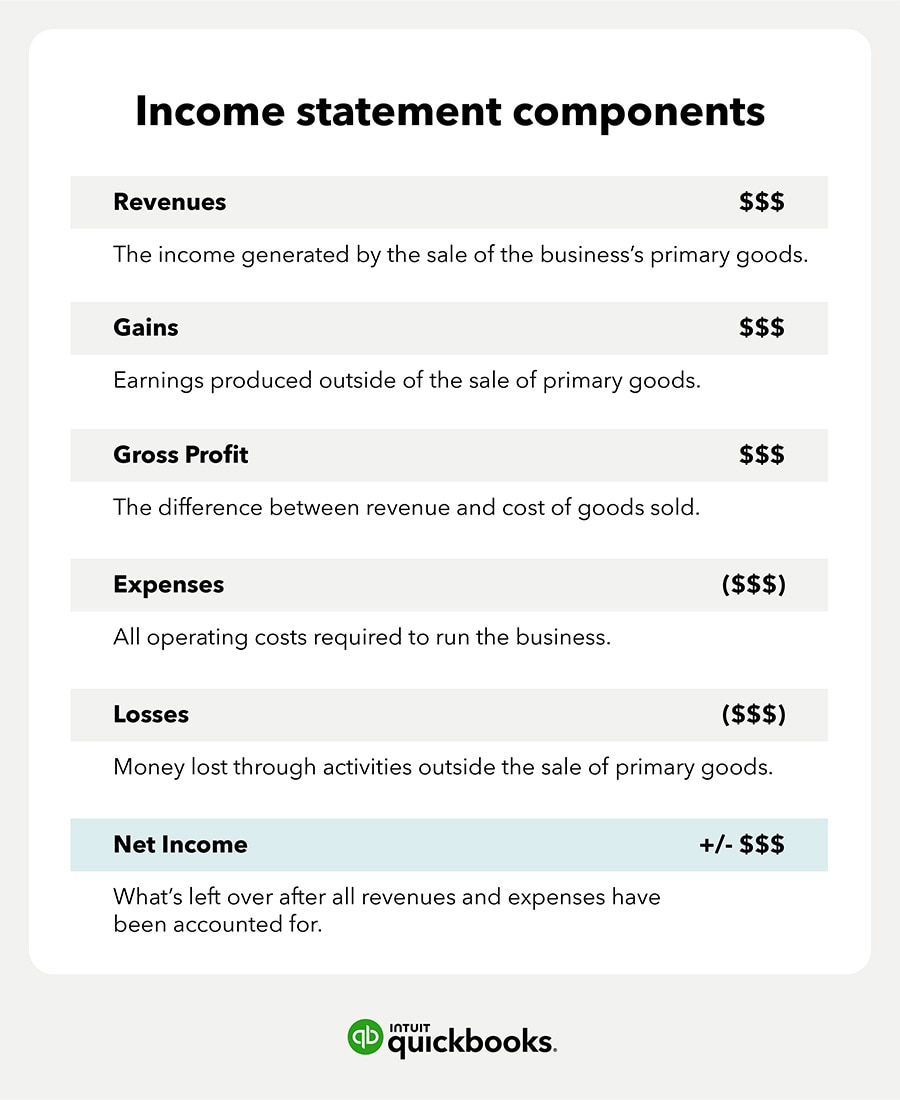

Components of an income statement

The elements of an income statement include revenues, gains, gross profit, expenses, losses, and net income or loss.

Revenues

Revenue is all income generated by the sale of the business’ primary goods or services. Revenue may also be referred to as the “top line,” because it is the first line on the income statement.

- Operating revenue is defined as revenue from primary business activities.

- Non-operating revenue is the revenue gained from secondary activities such as interest, rental income, and partnerships.

Gains

Gains are the earnings produced outside of the sale of your main goods or services. For example, selling off an asset can be categorized under gains.

Gross profit

Gross profit is what's left of your revenue after deducting the cost of goods sold (COGS)—the direct costs related to producing goods or providing services.

Revenue – COGS = gross profit

Expenses

Expenses include all operating expenses required to run your business. Operating expenses—also known as selling, general, and administrative expenses—include costs such as advertising, insurance, and rent. The costs associated with producing your goods or providing services are not included in the expenses section of the income statement.

Losses

Losses include money lost through activities outside of transactions for your primary goods or services. For example, paying out a lawsuit settlement is considered a loss.

Net income or net loss

Net income—or loss—is what is left over after all revenues and expenses have been accounted for. If there is a positive sum (revenue was greater than expenses), it’s referred to as net income. If there’s a negative sum (expenses were greater than revenue during that period), then it’s referred to as net loss.

Net income = (total revenue + gains) – (total expenses + losses)

How to prepare an income statement for your small business

Preparing financial statements can seem intimidating, but it doesn’t have to be an overwhelming process. We’ve broken down the steps for preparing an income statement, as well as some helpful tips.

1. Select the reporting period for the income statement

Income statements can be prepared monthly, quarterly, or annually, depending on your reporting needs. Larger businesses typically run quarterly reporting, while small businesses may benefit from monthly reporting to better track business trends.

2. Create a trial balance report

A balance report details your end balance for each account that will be listed on the income statement and provides all of the end balances required to create your income statement. This can be done with accounting software, like QuickBooks Online. You can begin your free QuickBooks Online trial today. You can also look at QuickBooks Online subscription levels and see a comparison of QuickBooks vs. Xero accounting software.

3. Determine income statement type: Single-step or a multi-step

Single-step income statements can be used to get a simple view of your business’s net income. These take minimal time to prepare and don't differentiate operating versus non-operating costs.

A multi-step income statement calculates net income and separates operational income from non-operational income—giving you a more complete picture of where your business stands.

Jump to find more details and examples of these two types of income statements:

4. Finalize your income statement

Give your statement a final QA either manually or using an automated platform. Using software allows you to automatically track and organize your business’s accounting data so you can access and review income statements.

You can use QuickBooks Live to get help generating income statements and other key financial reports.* You can also download our free income statement template to streamline the process or partner with a live bookkeeper to help you understand your company’s finances.*

How to select the income statement type that’s best for you

When deciding how you’d like to report your net income, it’s important to consider the pros and cons of both single-step and multi-step income statements.

Single-step income statements are the simplest and most commonly used by small businesses. But multi-step income statements are great for small businesses with several income streams.

For small businesses with few income streams, you might generate single-step income statements on a regular basis and a multi-step income statement annually. If you have more than a few income streams or a complicated financial landscape, you might use multi-step income statements to get a better view of your profits and losses.

Benefits of a single-step income statement for small businesses

- Time savings: A single-step income statement is performed by calculating just one formula, making it a much quicker process and requiring less preparation than the multi-step option.

- Clarity: Single-step income statements break down a business’s financial standing into just four categories: revenue, expenses, gains, and losses. This paints a concise picture.

- Easier to read: Because all expenses are grouped together in the single-step statement, it’s easier to read and understand. This is ideal for small businesses that don’t yet have the resources to hire a bookkeeper or accountant.

Benefits of a multi-step income statement for small businesses

Typically, multi-step income statements are used by larger businesses with more complex finances. This is because they provide greater detail. However, multi-step income statements can benefit small businesses that have a variety of revenue streams. There are several ways multi-step income statements can benefit your small business.

- More detail: A multi-step income statement breaks down revenue streams into operating and non-operating subcategories—giving you a more detailed view of what’s coming in.

- Efficiencies: A multi-step income statement can give you a look into how well your business is using internal and external resources to generate revenue.

- Relationships: The more detailed breakdown of expenses can provide a better understanding of how business activities are affecting your bottom line.

How to read and prepare a single-step income statement

A single-step income statement is a simplified approach to viewing your net profit or loss. Single-step income statements include revenue, gains, expenses, and losses, and they strictly show operating costs.

For single-step income statements, you need only one calculation: net income. To determine net income, you simply subtract all your expenses from total revenue.

Net income = (revenues + gains) – (expenses + losses)

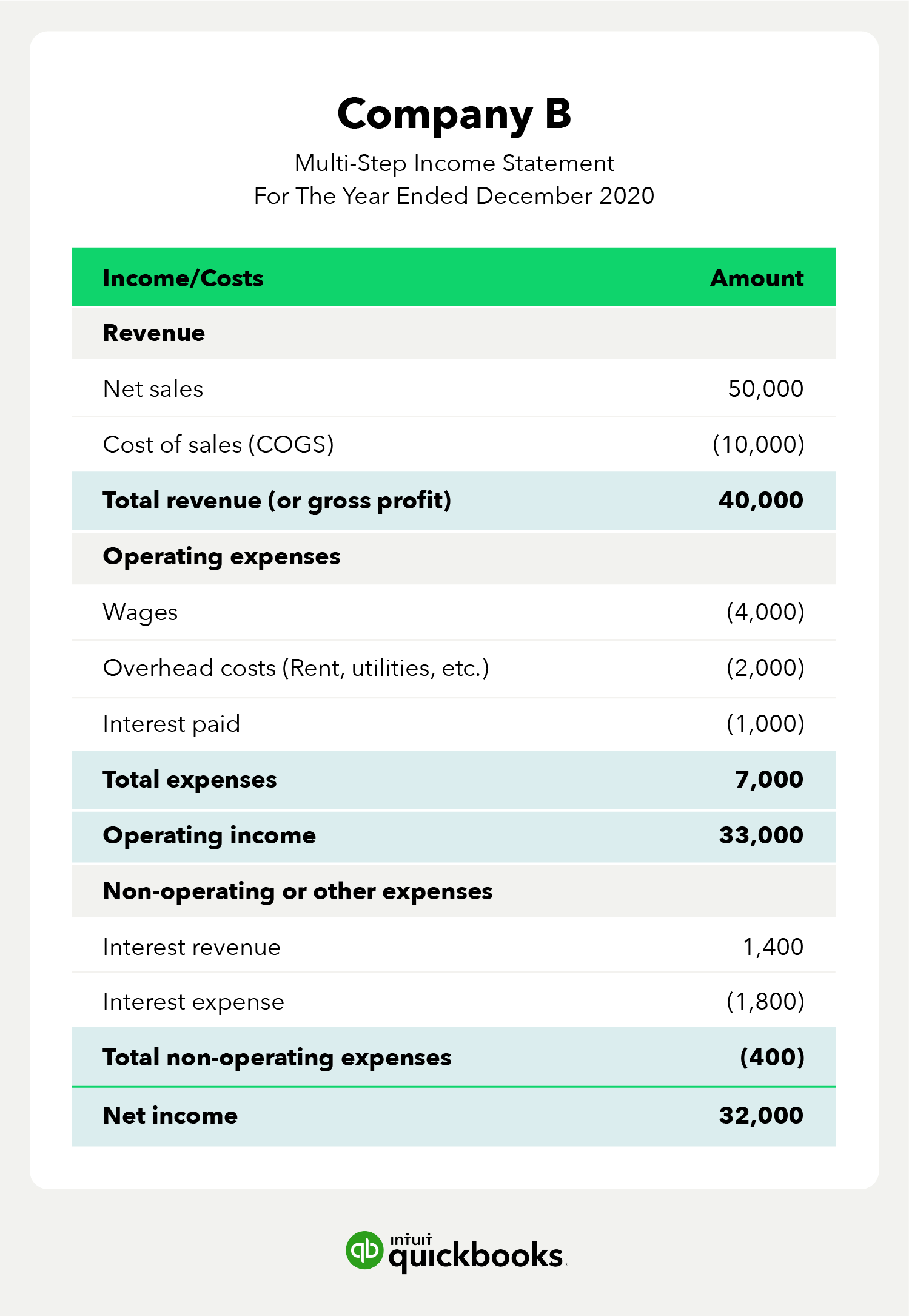

How to read and prepare a multi-step income statement

A multi-step income statement uses a more complex method of calculating net profit or loss. Multi-step income statements add in four measures of profitability: gross, operating, post-tax, and pre-tax, and they use separate operating and non-operating expenses. This gives a more detailed financial picture.

For the multi-step income statement method, you need to complete three additional steps:

1. Find gross profit

Gross profit = net sales – COGS

2. Find operating income

Operating income = gross profit – operating expense

3. Calculate net income

Net income = operating income + non-operating income

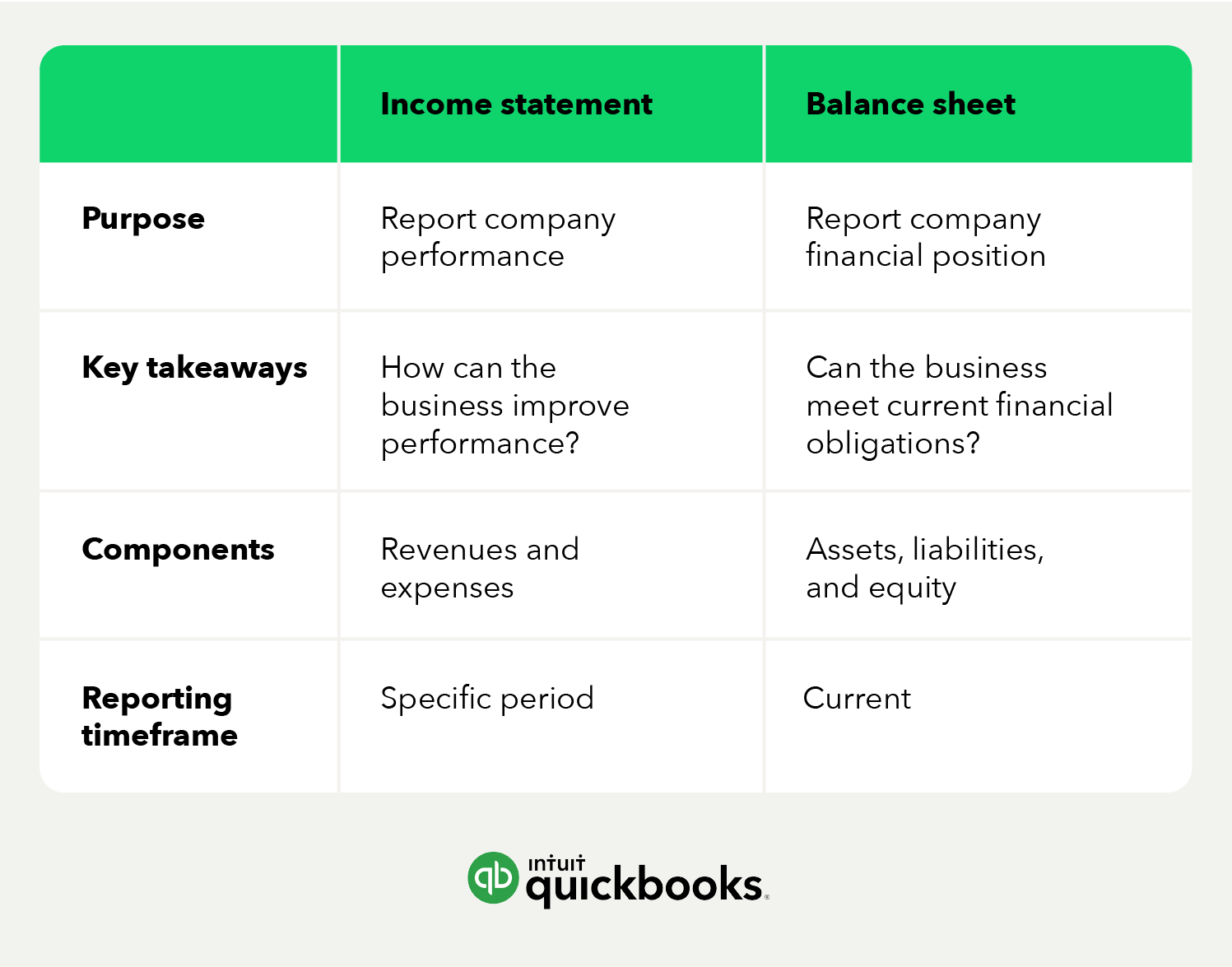

Differences between an income statement vs. balance sheet

The income statement and balance sheet are two of the main financial statements businesses use, in addition to the cash flow statement. But they have key differences, which include:

- Purpose: The income statement showcases the company’s financial performance, whereas the balance sheet showcases the company’s financial position.

- Takeaways: Business owners can determine financial shortcomings and how to improve performance using the income statement. The balance sheet helps business owners determine whether they can meet their current financial obligations.

- Components: The income statement includes the company’s revenues and expenses, while the balance sheet shows assets, liabilities, and equity.

- Reporting timeframe: The income statement is used to report expenses and revenue during a specific period of time. The balance sheet is used to reflect current financial circumstances.

Start generating income statements

An income statement is a valuable tool for guiding your business’s financial decisions. While you can prepare income statements on your own, accounting software can help provide simplicity and accuracy. With QuickBooks Live,* you can work with accounting experts to keep tabs on your financial standing, while spending less time crunching numbers and more time building your business.

*QuickBooks Live Bookkeeping requires QuickBooks Online subscription. Additional terms, conditions, limitations, and fees apply.