Bookkeeping is one of the many specialized tasks that business owners take on while they start and grow their businesses.

Although it might save money to do your business’ books yourself, you might have run into some of the downsides. It's common to make mistakes, get behind on your books, or realize that you've been doing something incorrectly. Hiring a bookkeeper comes with an upfront cost, but it can save you a lot of time, energy, and effort when it comes to keeping your finances in good shape. That's especially important if you have employees, lenders, or investors.

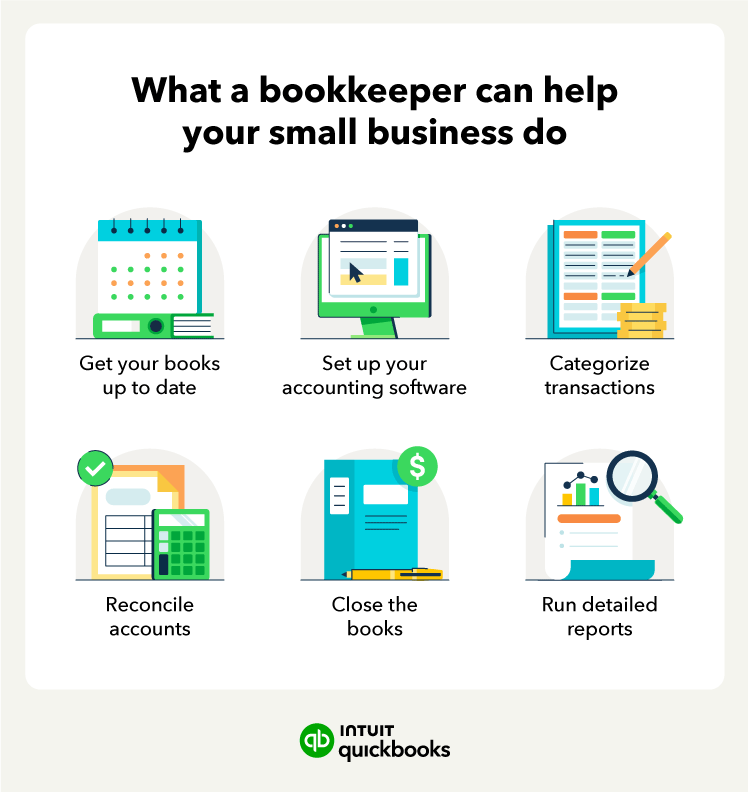

Bookkeepers help solo entrepreneurs and small business owners take care of recurring financial tasks. This allows owners to spend more time doing the things they love and get paid for. Smaller or less complex businesses might only need a few hours of bookkeeping services per month, so you aren't onboarding a full-time employee.

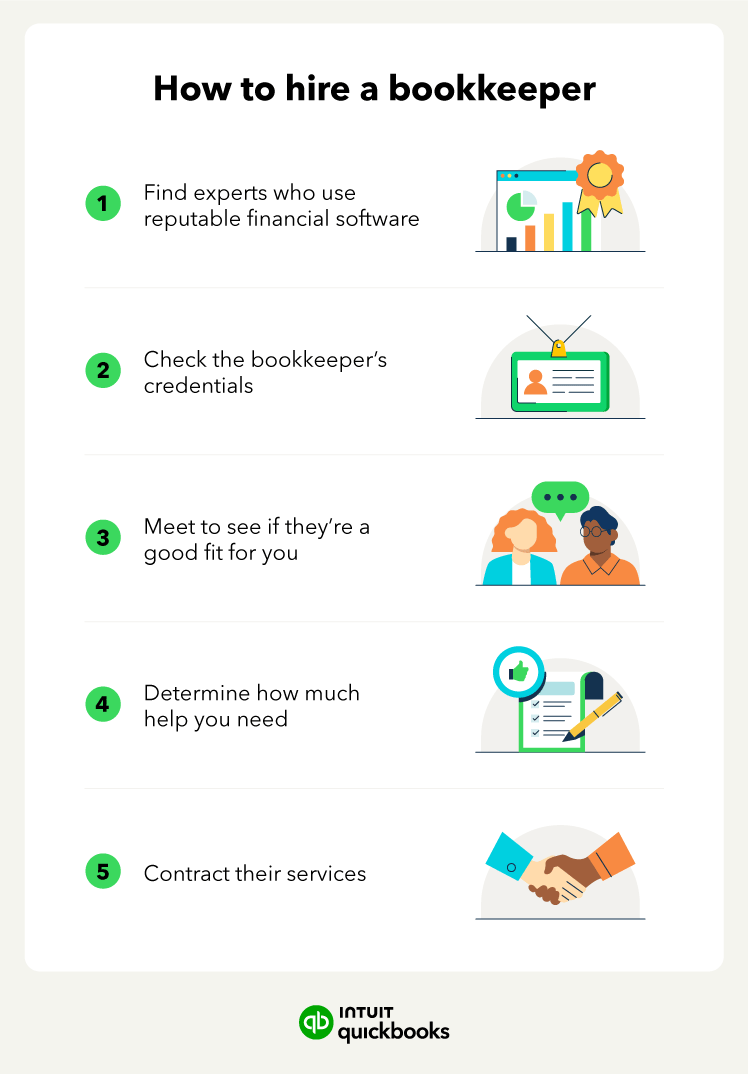

Hiring a small business bookkeeper involves a few steps to find someone you trust for the role.