Coursera

Coursera is an online platform that offers courses by top instructors from world-class universities and companies. You can access some courses for free, though most require a monthly subscription to access. Courses include on-demand video lectures, homework exercises, and community discussion forums. Paid courses offer graded quizzes, projects, and a course certificate upon completion.

Beginning your first subscription to Coursera starts a seven-day free trial. On the eighth day, your free trial automatically becomes a paid subscription. Coursera Plus subscriptions, which come with a host of included classes, are priced reasonably as long as you're actively taking a course.

Intuit, the company that created QuickBooks, offers bookkeeper certifications through Coursera. You can enroll for the Intuit Academy Bookkeeping Professional Certificate to get 65 hours' worth of training and a credential to show for your work.

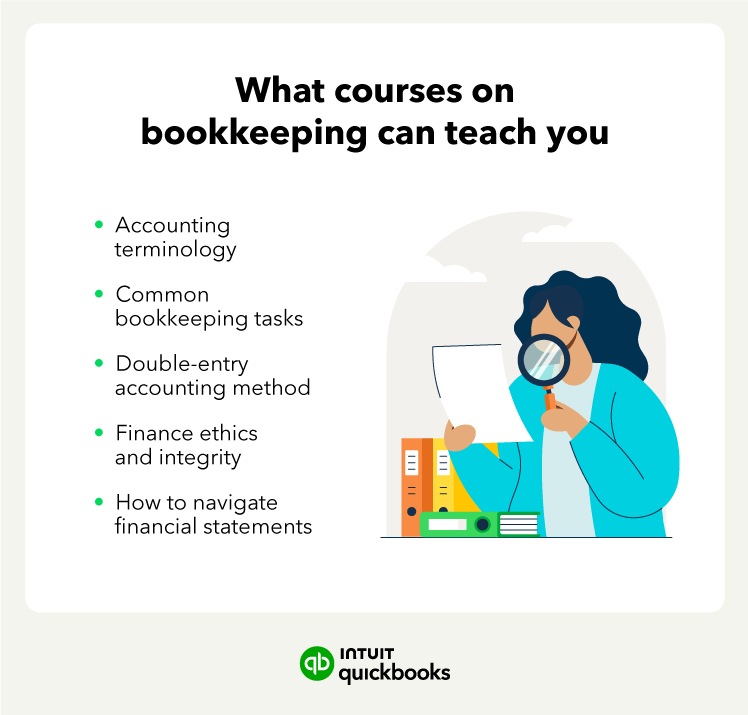

Other bookkeeping courses you can take on Coursera include:

.gif)