10. Misuse of accounting software

Financial tools like accounting software make bookkeeping simpler, but they still need attention to keep errors out of the system. Errors in your accounting software can be introduced by things like setting up your books incorrectly, not syncing with third-party applications, or failing to check work that's been automated.

Potential impact

Misused or missing information can throw your books out of balance, creating an inaccurate financial record for your business. With AI-powered automations and data synced from third parties, such as banks or payment platforms, errors can be introduced if you don't stay on top of your books. The impact of any error can compound if it's not identified quickly.

Error signs

If syncing with apps has stopped, accounts don't balance, or entries are miscategorized, it's possible there’s been a misuse of accounting software.

Solutions

Double-check your bookkeeping regularly to avoid accounting software errors. Check settings in your accounting software and any connected third-party apps to get syncing up to date, then verify that the imported data is correct. You can also take some of the pressure off with services like QuickBooks Live Expert Assisted to get expert help automating tasks and guidance on best practices.* Tap an expert to help you set up your books correctly for your business.

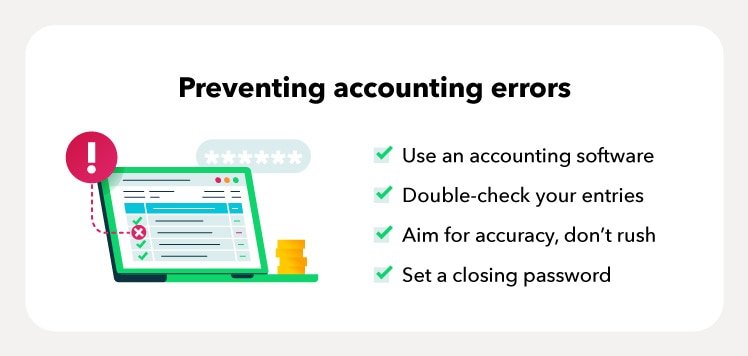

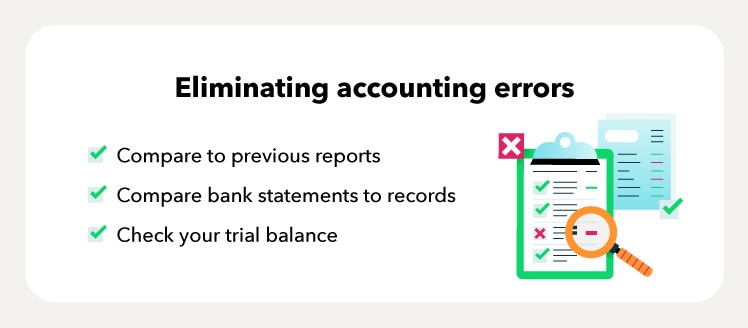

Solutions to accounting errors

There are many ways to prevent and spot accounting errors before they can slow you down. To avoid accounting errors, use bookkeeping best practices and always double-check your work.