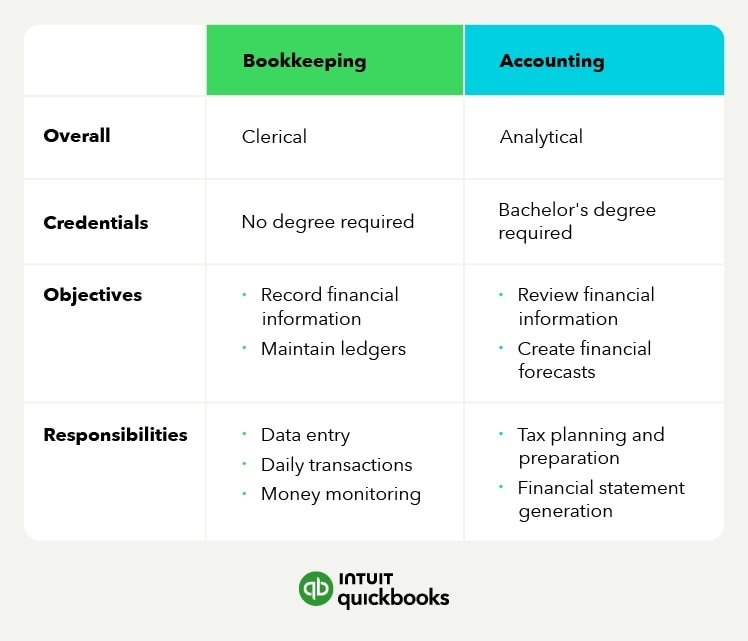

Knowing the difference between bookkeeping and accounting can be tricky, especially with the interchangeability of the terms and how the duties can overlap. Here are a few key differences between bookkeeping vs accounting.

Clerical vs. analytical

Bookkeepers handle the day-to-day recording of financial transactions, including tracking income, expenses, and payments. Their primary focus is on maintaining accurate, up-to-date ledgers and organizing financial data. This provides the foundation accountants rely on for their work.

Accountants analyze this financial data and perform higher-level tasks such as generating financial reports, offering insights on business performance, and ensuring compliance with regulations. They also provide strategic advice for financial planning and forecasting. While bookkeepers manage the records, accountants interpret the information to support decision-making and long-term financial strategy.

Credentials

The largest difference between accounting and bookkeeping roles is the required credentials, or academic qualifications, for each.

Bookkeeper credentials:

- Bookkeepers aren’t required to have any specific certification or formal education

- Bookkeepers must understand basic and key financial topics and have an eye for accuracy

- Bookkeepers must also have basic skills such as organization, communication, and attention to detail

Accountant credentials:

- Accountants must have a bachelor’s degree or higher in the field of accounting or finance.

- Accountants can attain professional certifications to grow their careers and earn a higher income, such as a CPA title.

- Accountants must also have an eye for accuracy and attention to detail as they oversee a bookkeeper's work

If you already use specific tools to manage your books, you’ll want to discuss those tools with any bookkeepers or accountants you consider working with to ensure they’re familiar with them.

Objectives

As discussed above, the main objectives of accounting and bookkeeping are similar but still different in many ways. Both disciplines work hand in hand to determine the financial health of a business. Below are the main objectives of an accountant vs a bookkeeper.

Bookkeeper objectives:

- Record transactions

- Maintain ledgers

- Detect any fraud or discrepancies

Accountant objectives:

- Review the financial records that the bookkeeper prepared

- Analyze financial records to determine if funds are being misused or misallocated

- Analyze and report the financial information to all appropriate departments, institutions, and stakeholders within the organization

Skill sets

Bookkeeping and accounting also require different skill sets for each role, and while these skills can certainly overlap, there are some notable differences:

- Mathematics: Both bookkeeping and accounting include daily basic mathematics operations like addition and subtraction; however, accounting involves more complex operations such as percentages, ratios, and exponents.

- Detail: Both roles require great attention to detail. A bookkeeper’s job is to ensure that a business documents its records correctly for the accountant to analyze. Accountants not only need to ensure that the information the bookkeeper provides is correct, but they also need to be able to identify any inconsistencies or issues within the reporting.

- Problem-solving: Bookkeeping and accounting both require expert problem-solving skills. While bookkeepers need to be able to find discrepancies within reporting, the accountant must be able to resolve any issues and come up with solutions.

Pricing

On average, a bookkeeper is usually less expensive to hire than an accountant. This is because an accountant’s responsibilities are usually more complex. However, the cost for both a bookkeeper and an accountant can differ based on things like:

- The average market price: How much a bookkeeper or accountant charges based on the area you live

- What services you need: What services you’re requesting and how much time it will take to complete these tasks

- The complexity of services: How challenging or complex your financial records are and if they’ll need more time to complete

Both bookkeepers and accountants may charge a flat rate or, more commonly, by the hour.

Roles During Tax Time

During tax time, the roles of bookkeepers and accountants differ significantly in scope and responsibility.

Bookkeepers focus on accurately recording and categorizing all financial transactions from the year—such as sales, expenses, payroll, and other daily entries. Their primary job is to organize and maintain financial records, ensuring that the data is complete and up-to-date.

Accountants take this data and perform more complex tasks, such as preparing and filing tax returns, analyzing financial records for accuracy, and maintaining compliance with tax laws. They also provide strategic advice on tax planning, identifying possible deductions or credits, and help minimize tax liabilities.

While bookkeepers provide the foundational financial data, accountants focus on interpreting that data and managing the actual tax filings and regulatory reporting.

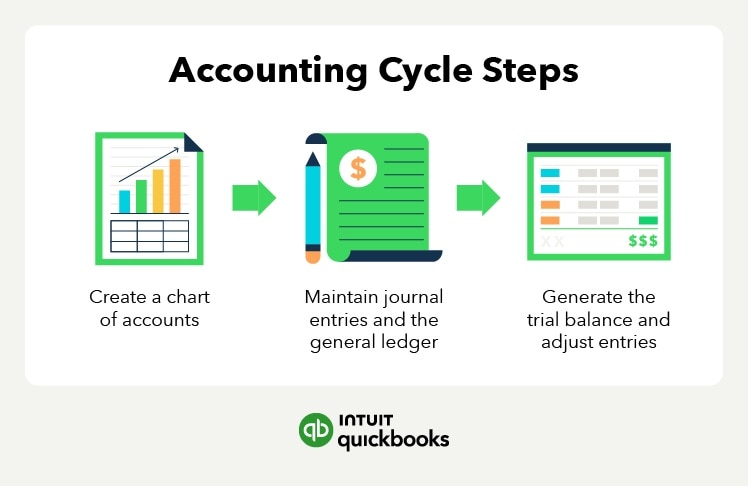

Document Preparation Differences

Bookkeepers are responsible for creating and maintaining essential financial documents that record day-to-day transactions. These include sales receipts, purchase orders, invoices, expense reports, and bank reconciliations. They record these transactions in ledgers, journals, or accounting software.

Accountants work with more comprehensive financial documents derived from the data bookkeepers provide. They prepare financial statements like balance sheets, income statements, and cash flow statements. Accountants also generate reports for budgeting, forecasting, and complying with financial regulations. These documents offer insights into the company’s overall financial health and aid in strategic planning.

Online bookkeeping services and accounting software like QuickBooks can help save you time and money by partnering with live bookkeepers and accountants who can help manage your financial records with guaranteed accuracy.