When you think of bookkeeping, you may think it’s all just numbers and spreadsheets. That’s not exactly the case. Bookkeeping is the meticulous art of recording all financial transactions a business makes. By doing so, you can set your business up for success and have an accurate view of how it’s performing.

So, what is bookkeeping? And what are the benefits? Let us walk you through everything you need to know about the basics of bookkeeping.

Overview: What is bookkeeping?

- Bookkeeping vs. accounting: What’s the difference?

- Access to detailed records of all transactions

- Ability to make informed decisions

- Better tax preparation

2 types of bookkeeping for small businesses

- Single-entry bookkeeping

- Double-entry bookkeeping

- Consider a phased approach

- Keep your general ledger current

- Plan for taxes throughout the year

- Keep your personal and business finances separate

Should I do my own bookkeeping? 2 questions to ask yourself first

Overview: What is bookkeeping?

Bookkeeping is the process of tracking and recording a business’s financial transactions. These business activities are recorded based on the company’s accounting principles and supporting documentation.

Examples of these documents include:

- Bills

- Receipts

- Invoices

- Purchase orders

Business transactions can be recorded by hand in a journal or an Excel spreadsheet. To make things easier, many companies opt to use bookkeeping software to keep track of their financial history.

Bookkeeping is just one facet of doing business and keeping accurate financial records. With well-managed bookkeeping, your business can closely monitor its financial capabilities and journey toward heightened profits, breakthrough growth, and deserved success.

Bookkeeping vs. accounting: What’s the difference?

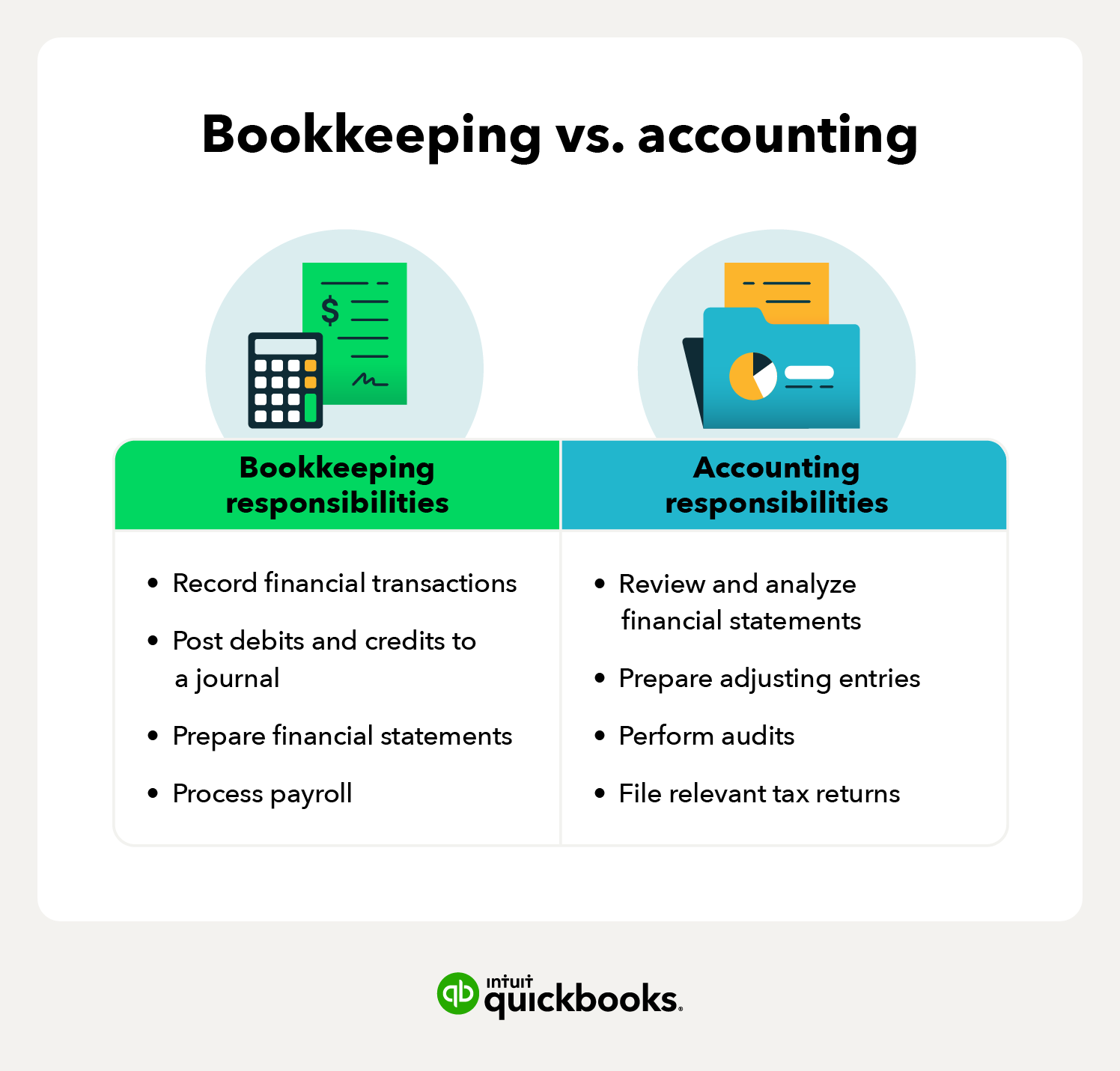

At first glance, bookkeeping and accounting may seem interchangeable. While it may be easy to confuse the two, they are not the same thing. Accounting is the umbrella term for all processes related to recording a business’s financial transactions, whereas bookkeeping is an integral part of the accounting process.

Common examples of bookkeeping include:

- Recording financial transactions

- Posting debits and credits to a journal

- Preparing financial statements

- Processing payroll

Unlike accounting, bookkeeping zeroes in on the administrative side of a business’s financial past and present. Accounting, on the other hand, utilizes data from bookkeepers and is much more subjective.

Common examples of accounting include:

- Reviewing and analyzing financial statements

- Preparing adjusting entries

- Performing audits

- Filing relevant tax returns

Without bookkeeping, accountants would be unable to successfully provide business owners with the insight they need to make informed financial decisions.

3 key benefits of bookkeeping

If you’re new to business, you may be wondering about the importance of bookkeeping. Whether you outsource the work to a professional bookkeeper or do it yourself, you’ll be able to reap a variety of benefits.

1. Access to detailed records of all transactions

By logging and keeping track of all financial transactions, you will have easy access to any financial information you might need. To make it even easier, bookkeepers often group transactions into categories.

Common transaction categories include:

- Goods

- Services

- Wages

- Taxes

When it’s finally time to audit all of your transactions, bookkeepers can produce accurate reports that give an inside look into how your company delegated its capital. The two key reports that bookkeepers provide are the balance sheet and the income statement. The goal of both reports is to be easy to comprehend so that all readers can grasp how well the business is doing.

2. Ability to make informed decisions

Because bookkeeping involves the creation of financial reports, you will have access to information that provides accurate indicators of measurable success. By having access to this data, businesses of all sizes and ages can make strategic plans and develop realistic objectives.

Examples of financial statements that can help with decision-making include:

- Balance sheets

- Income statements

- Cash flow statements

Not only can this help you set goals, but it can also help you identify problems in your business. With an accurate record of all transactions, you can easily discover any discrepancies between financial statements and what’s been recorded. This will allow you to quickly catch any errors that could become an issue down the road.

3. Better tax preparation

When it’s time to file your taxes, you’ll need to comply with the Internal Revenue Service’s (IRS) legal regulations and systems that govern their finances. Some of the most common documentation businesses must provide to the federal government include:

- Financial transactions

- Financial statements

- Tax compliance

- Cash flow reports

By staying up to date with your bookkeeping throughout the year, you can help alleviate some of the stress that comes with filing your taxes.

2 types of bookkeeping for small businesses

When it comes to bookkeeping, there are two main types: single-entry bookkeeping and double-entry bookkeeping. Follow along to learn more about which method might be best for you and your business.

1. Single-entry bookkeeping

The single-entry bookkeeping method is often preferred for sole proprietors, small startups, and companies with unfussy or minimal transaction activity. The single-entry system tracks cash sales and expenditures over a period of time.

With this bookkeeping process, you must maintain three pieces of documentation:

- Cash sales journal: This is where the business records all revenue.

- Cash disbursements journal: This is where the business records all expenses.

- Bank statements: All journal entries should align with the business’s bank statements.

In these documents, transactions are recorded as a single entry rather than two separate entries.

2. Double-entry bookkeeping

Double-entry bookkeeping is the practice of recording transactions in at least two accounts, as a debit or credit. When following this method of bookkeeping, the amounts of debits recorded must match the amounts of credits recorded. This more advanced process is ideal for enterprises with accrued expenses.

The following documents are required for double-entry bookkeeping:

- Journal entries

- General ledgers

- Inventory

- Cashbooks

- Accounts payable

- Accounts receivable

- Loans

- Payroll

The double-entry system of bookkeeping is common in accounting software programs like QuickBooks. With this method, bookkeepers record transactions under expense or income. Then they create a second entry to classify the transaction on the appropriate account.

Bookkeeping best practices

Now that you’ve got a firm grasp on the basics of bookkeeping, let’s take a deeper dive into how to practice good bookkeeping. There’s no one-size-fits-all answer to efficient bookkeeping, but there are universal standards. The following four bookkeeping practices can help you stay on top of your business finances.

1. Consider a phased approach

Trying to juggle too many things at once only works to put your organization in danger. If you’re looking to convert from manual bookkeeping to digital, consider a staggered approach. Overhauling all at once can be overwhelming and discouraging, so it’s best to take it slow and make meaningful and intentional shifts.

Those baby steps can help you manage your organization on a new and improved system. Small steps also give everyone time to familiarize themselves with the new bookkeeping software.

2. Keep your general ledger current

A general ledger is a collection of accounts that classify and store all records associated with a company’s financial transactions. The general ledger includes balance sheet accounts (liabilities, equity, assets) and income statement accounts (revenue, expenditure, gains, losses).

Under the double-entry accounting structure, every business transaction will affect two or more general ledger accounts. General ledger accounts include:

- Asset accounts such as cash, accounts receivable, investments, land, equipment, and inventory

- Liability accounts such as accounts payable, accrued expenses payable, customer deposits, and notes payable

- Stockholders’ equity accounts such as common stock, treasury stock, and retained earnings

Your general ledger should be up to date so that your bookkeeping software is able to provide functionality that you can navigate easily. QuickBooks is an excellent option for novice and seasoned digital bookkeepers alike.

3. Plan for taxes throughout the year

Whether it’s updating your books or keeping in contact with your tax adviser, maintain your business’s financial records and expenses throughout the year. That way, you can be well prepared when it’s time to file taxes with the IRS. Without any hiccups or last-minute scrambles, you’ll be able to enter tax season confidently.

4. Keep your personal and business finances separate

As you dive deeper into the bookkeeping process, it may be tempting to blur the lines between your personal and business finances, but it’s not the best idea. By avoiding this, you’ll reduce the risk of triggering an IRS audit and will allow an accurate picture of your business finances.

Some common ways to help keep your personal and business finances separate include:

- Utilizing a business credit card for all business expenses

- Setting up separate checking accounts

- Keeping all personal and business receipts organized and separate

By following these tips and diligently working to keep your personal and business finances separate, you’ll get a clear view of the performance of your business, while minimizing the risk of accidentally misrepresenting your business’s finances.

Should I do my own bookkeeping? 2 questions to ask yourself first

Now that you have a better understanding of bookkeeping, you may be wondering if it’s something you want to take on yourself or with the help of a professional. When making this decision, there are two things you should keep in mind.

1. Do I have the expertise?

How does your accounting and bookkeeping experience size up? You may be hoping for the best and have a few college courses in your back pocket. Even with these tools, you may not have the expertise you need to handle the responsibilities of a bookkeeper.

If you’re unfamiliar with local and federal tax codes, doing your own bookkeeping may prove challenging. On the other hand, if you have in-depth tax and finance knowledge beyond the bookkeeping basics, you may be able to get the job done.

2. Do I have the time?

Bookkeeping can be time-consuming and tedious. If you’re a new business owner, you’re likely already spread thin. Adding bookkeeping to the mix may overwhelm you. But if you have the time to dedicate to updating your books regularly, doing your own bookkeeping may be feasible.

If you’re like most modern business owners, odds are you didn’t become one so that you could practice professional-level bookkeeping. Outsourcing the work to a seasoned bookkeeper can allow you to focus on your business plan and growth.

Ready to get started?

Take routine bookkeeping off your never-ending to-do list with the help of a certified professional. A QuickBooks Live bookkeeper can help ensure that your business’s books close every month, and you’re primed for tax season. Our expert CPAs and QuickBooks ProAdvisors average 15 years of experience working with small businesses across various industries.

Whether you’re trying to determine the best accounting system for your business, learn how to read a cash flow statement, or create a chart of accounts, QuickBooks can guide you down the right path.

Whether you've started a small business or are self-employed, bring your work to life with our helpful advice, tips and strategies.