Always know how much cash is on hand

Manage your cash flow

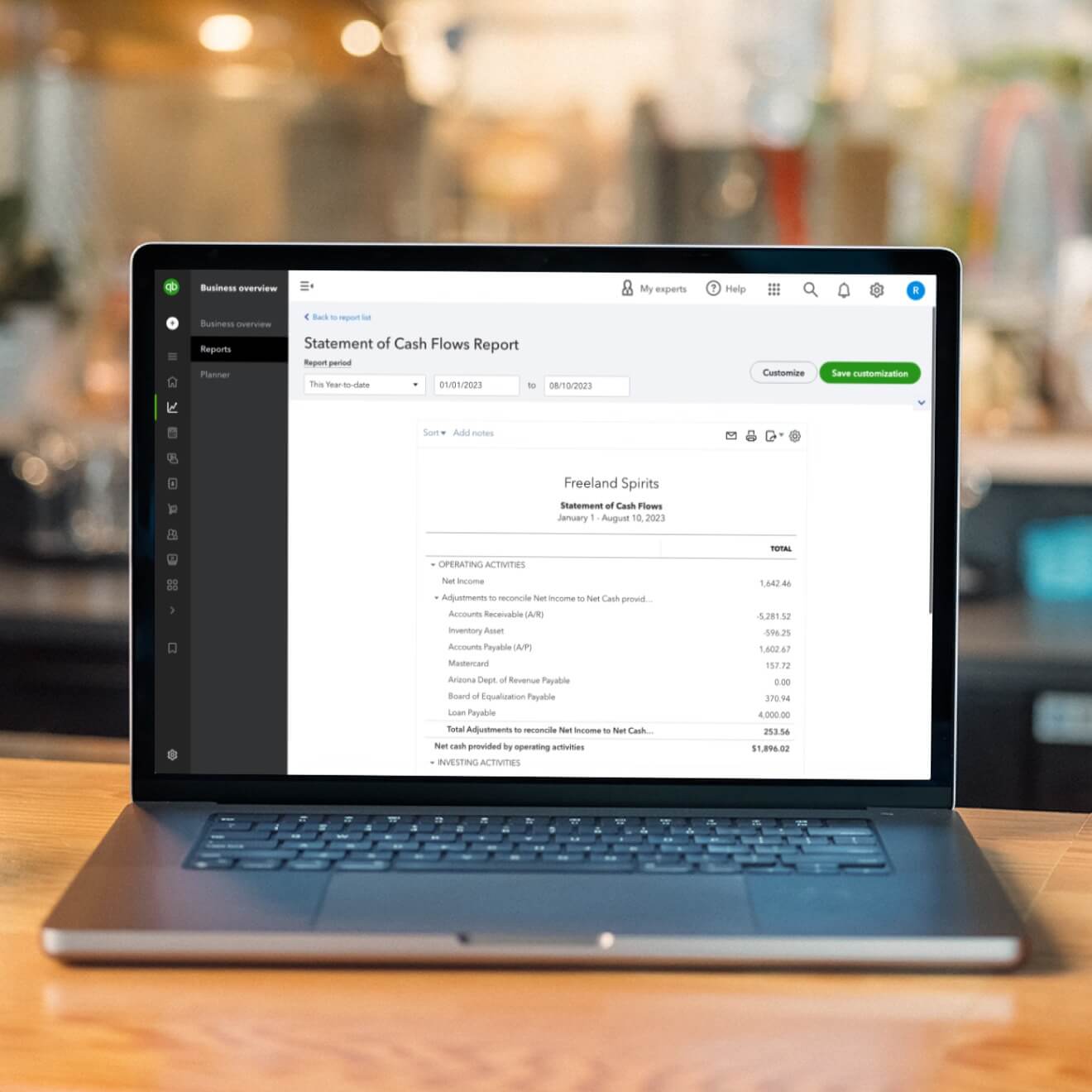

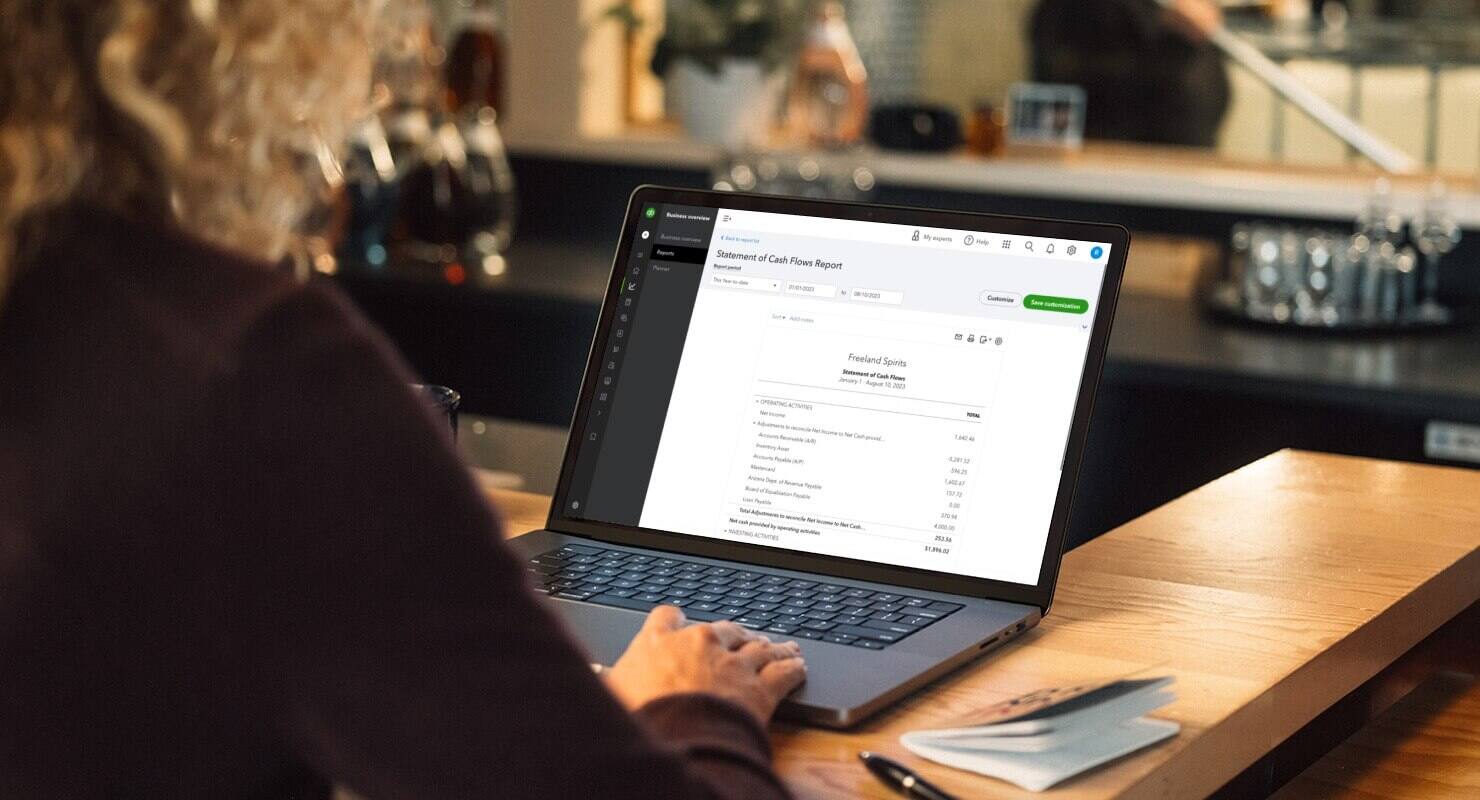

Many small businesses strive to get a better handle on money coming in and going out. This is where cash flow comes into play. QuickBooks tracks and organizes all your accounting data, and can generate your cash flow statement—so you always know how much money you have coming in to cover your bills.

Make better business decisions

Cash is essential to keeping your business financially stable and successful. Quickly generate your cash flow statement with QuickBooks, and you’ll get a clear view of your cash flow for any time period.

Set yourself up for success

The cash flow statement—along with the balance sheet and income statement—is one of the 3 key financial statements used to assess your company’s financial position. QuickBooks can generate all the reports you need to keep your business running smoothly. Even look back in time and predict your future cash flow.

What’s a cash flow statement?

In most small businesses, revenue doesn’t always match up with spending, so understanding your cash flow is critical. The cash flow statement—also known as a statement of cash flows—helps you evaluate whether there is enough money coming in, and enough cash on hand, to pay your bills. In financial accounting, a cash flow statement provides a snapshot of your cash balance.

The cash flow statement helps you look back over a specific period (typically a quarter) to predict the net cash, or amount of cash, you will need over a specific accounting period to fund your operating activities.

Cash flow should not be confused with profit. Profit refers to the difference between revenue and cost over a period of time, whereas cash flow measures your cash on hand. A small business may be profitable but still not have the cash needed to pay employees, vendors, or creditors. Businesses need to manage cash flow to ensure that there is enough money coming in to pay the bills today.

The cash flow statement is one of the three key financial statements used to assess a company’s financial status. The other two are the balance sheet and the income statement. All three financial reports work together to provide insight into the financial position of the business. For example, the ending cash balance in the statement of cash flows should equal the ending cash balance in the balance sheet.

A cash flow statement is used to attract new investments, inform your fundraising efforts, and get more access to financing options. For banks and creditors, your cash flow statement provides some reassurance that your small business is able to pay back its loans or fund its own operating expenses.

Free cash flow statement template

Developing a cash flow statement is essential to understanding how well you can cover your current liabilities using your current assets, also known as your business’ liquidity. Think of a cash flow statement as a snapshot of your company’s cash on hand.

Since cash flow statements are widely used among small businesses, it’s a good idea to keep the format consistent. We’ve created an Excel cash flow statement template that you can start using today. It includes an example cash flow statement that you can use to make sure you fill it out correctly.

Get your free Excel cash flow statement template

While Excel templates can be useful for a company just starting off, they eventually become unmanageable when you’re dealing with a high volume of transactions. As your business grows, consider switching to QuickBooks accounting software to help you save time and organize your finances in one place.

To get a complete view of your small business finances, download our Excel balance sheet template and income statement templates.