Keep tabs on your business’s financial performance

Know where you’re at

The income statement gives you a snapshot view of your business’s financial performance and profitability so you can make better financial decisions. It’s one of the main financial statements that businesses use to understand cash flow and profitability.

Make better decisions

The income statement details revenue, expenses, and profits (or losses) over a specific time period. Insights from the income statement can help you evaluate where you can reduce expenses, grow revenue, and increase profit.

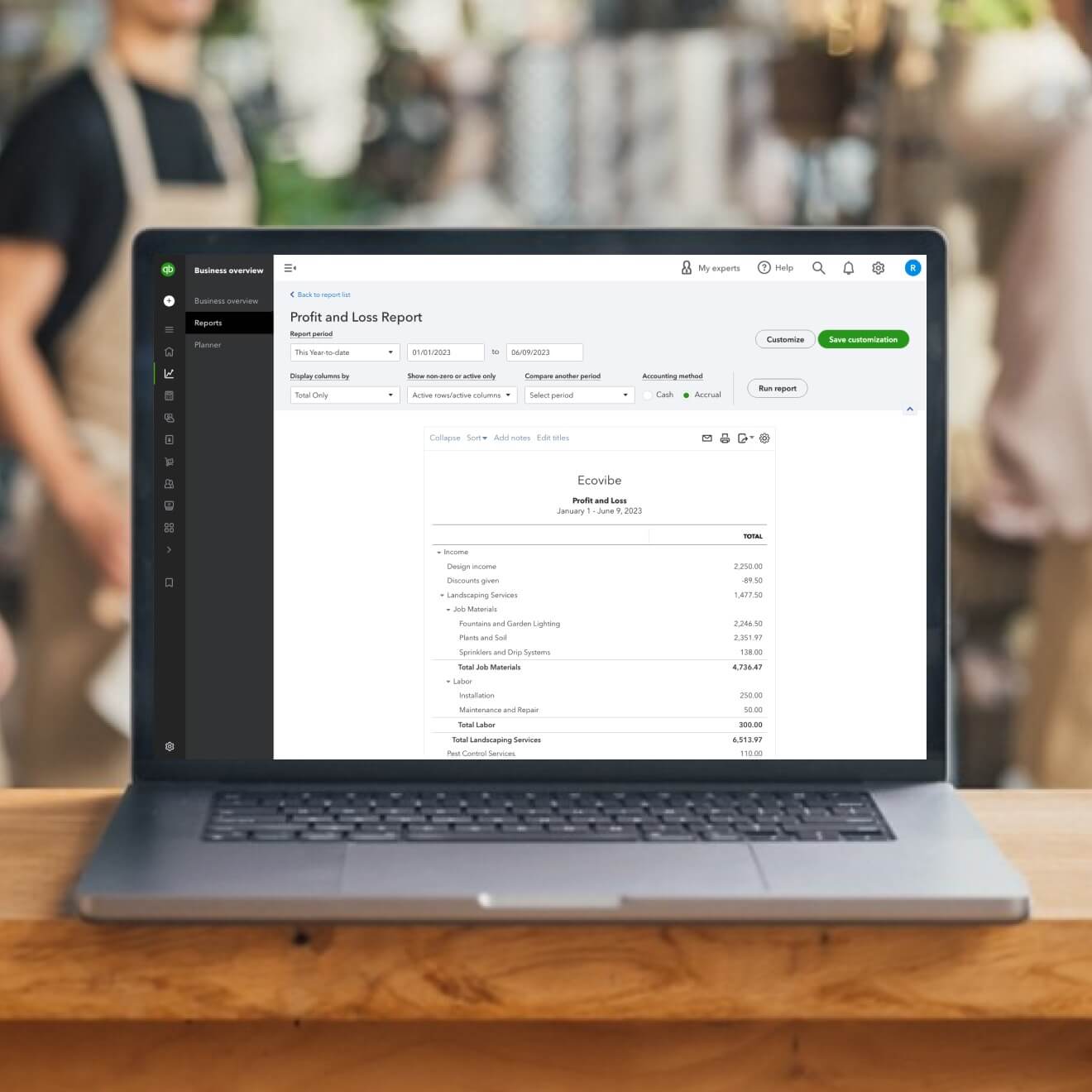

We’ll handle the numbers

Spend less time manually entering data. QuickBooks tracks and organizes all of your business’s accounting data, making it easy to access and review your income statement.

Everything you need to know about income statements

By Kathryn Pomroy

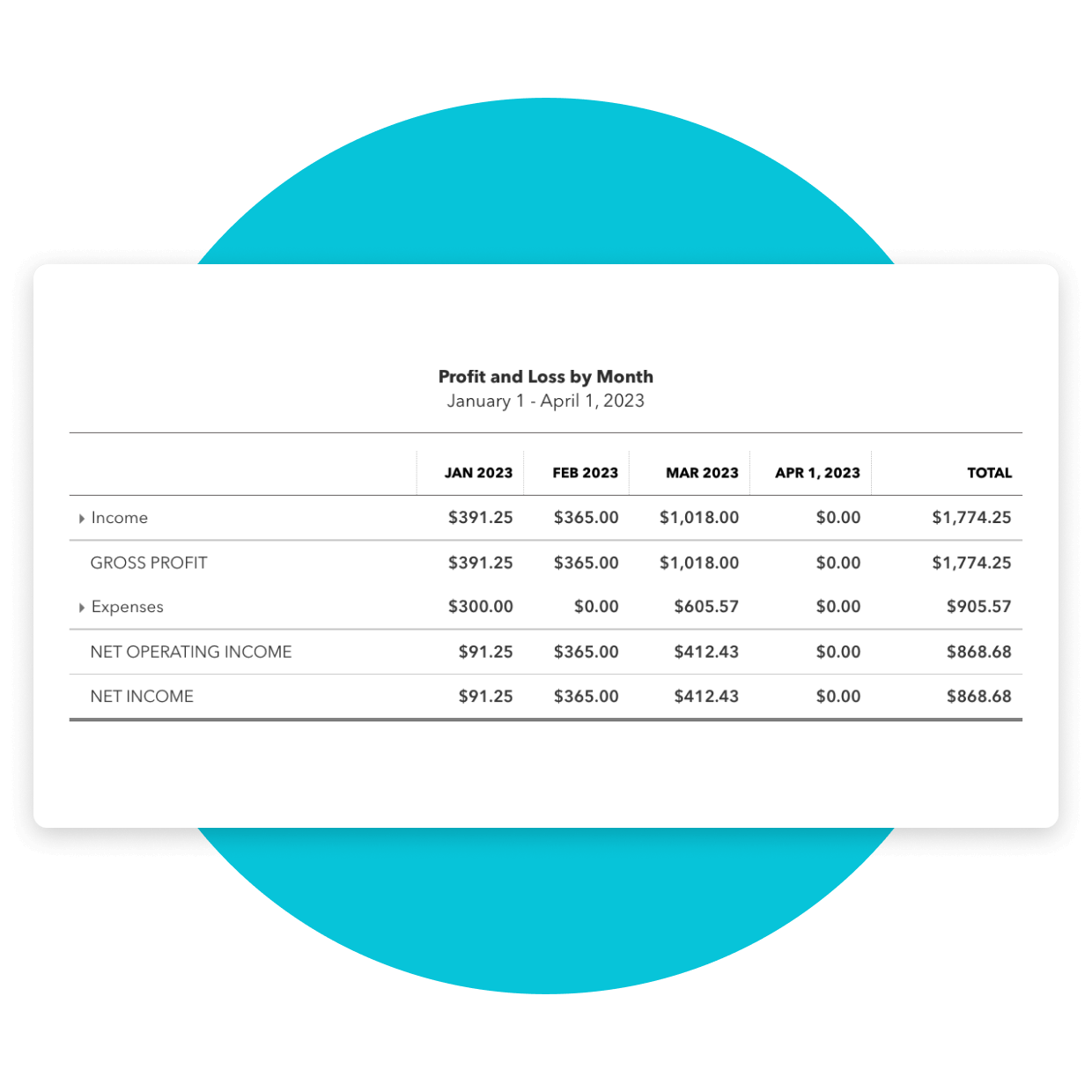

The income statement, also called the profit and loss statement, is used to calculate profits by comparing revenue to expenses. It compares your income to your expenses and shows you the amount of profit or loss over a specified amount of time. This is the best report for understanding whether your business is profitable or losing money. The five components of the income statement are sales (or revenue), cost of goods sold, gross profit, operating expenses, and net income or loss. Many small businesses choose to create income statements on a monthly basis to find patterns in profits and expenditures.

The income statement is one of the three key financial statements used to assess a company’s financial position. The other two are the balance sheet and the cash flow statement. These financial statements should be reviewed at least every quarter to evaluate a company’s financial performance, value, and growth. They are used for financial projections, to estimate the potential for new projects, to set goals for the future, and to secure funding.

Download the free income statement template

Understand how your business is performing with an income statement. The income statement, also known as the profit and loss statement, gives you a better understanding of your total revenue, net income, and net profit over a specific time period. We’ve also included a sample income statement to make it easy for business owners to see what a completed income statement might look like.

Download our income statement template and start using it today to get a clear picture of how your business is doing.

Get a complete view of your small business finances by downloading our free balance sheet and cash flow statement Excel templates.

If you’re a new small business owner, Excel templates can be a useful solution. The more your business grows, the harder it gets to track everything in Excel. Save time and manage your finances in one place—let QuickBooks accounting software do the hard work for you.