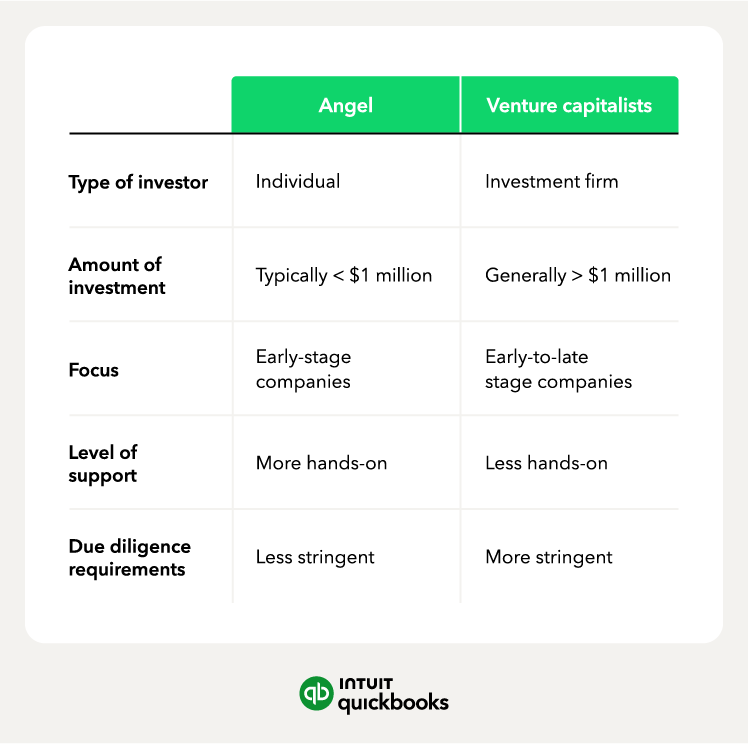

4. Venture capitalists

Type of funding: Equity funding

Venture capitalists also invest in companies in exchange for an equity stake. However, they tend to be firms and invest more than angel investors. They often invest in industries with high growth potential, such as technology.

Venture investors are another type of funding for startups, where, unlike traditional funding sources, venture capitalists are willing to take risks on innovative and unproven business ventures.

When considering potential investments, venture capitalists evaluate a variety of criteria. They look for companies with a strong management team, a scalable business model, and a large addressable market. They also typically seek companies that have achieved some level of success, such as generating revenue.