Take all kinds of payments

Right through the invoice

Send your customers invoices they can pay online right away.

On site or in store

Take payments in person with the GoPayment appGoPayment app and card reader not included with QuickBooks Money and card reader.

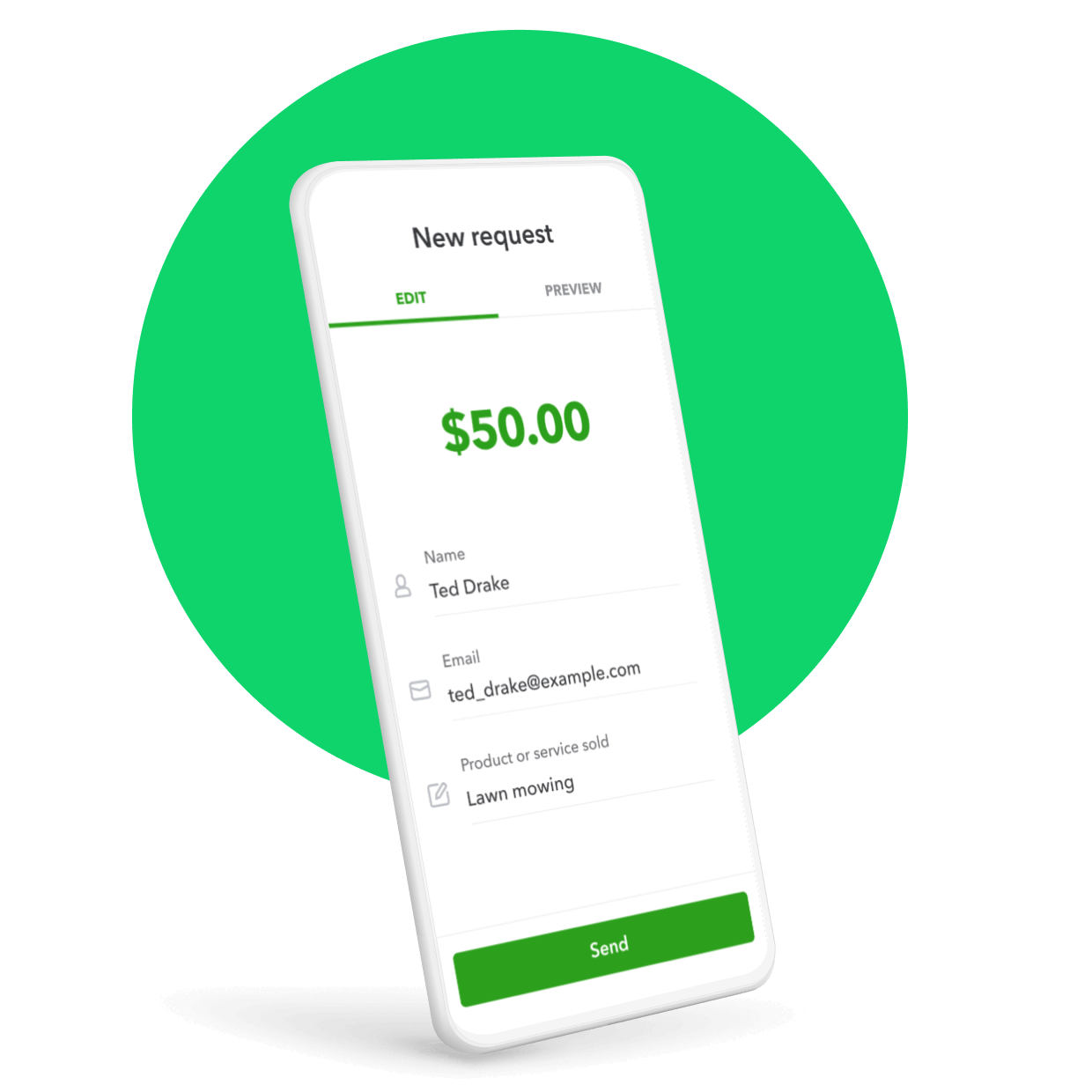

Send simple payment requests

Take the awkwardness out of billing your customers by giving them convenient ways to pay.

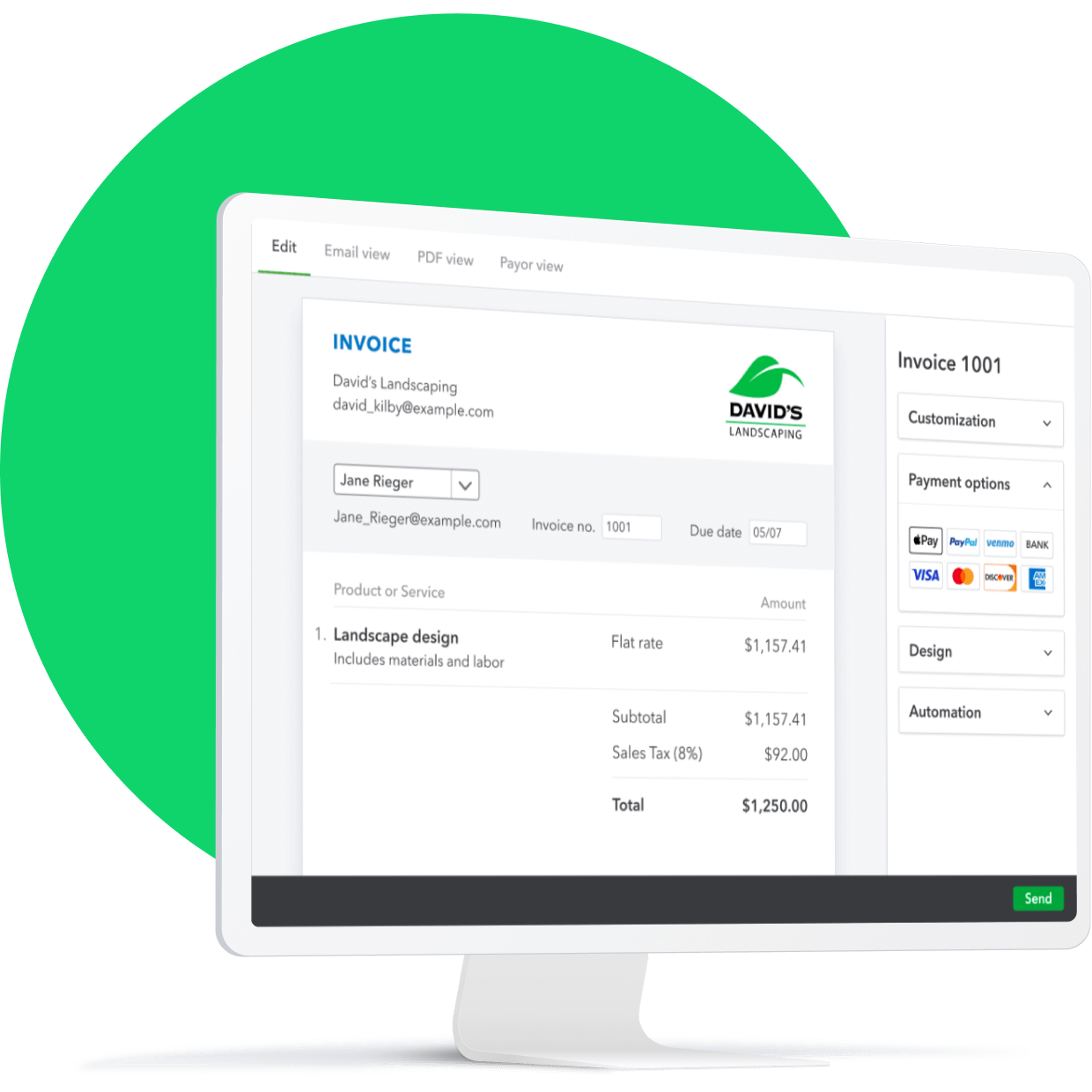

Create instantly payable invoices

Send custom invoices with everything your customers need to pay online, including sales tax, due dates, products, and services.

Sit back and send a payment link

Send your customers a simple link they can use to pay on the spot, wherever they are.

Pay bills on time, every time

Schedule and pay bills with QuickBooks Online so you’re always on time. Get notified when bills are due, and quickly pay vendors and contractors with a bank deposit, check, or bank transfer.

Manage it all in QuickBooks

Payments go to the bank

With a QuickBooks Checking account, eligible payments are deposited soonerNot included with QuickBooks Money, fee-free.**

Automatic bookkeeping

Payments through QuickBooks are automatically matchedAutomatic bookkeeping not included with QuickBooks Money.**

Business banking

Get access to instant depositNot included with QuickBooks Money—no monthly fees or minimums.**

Chargeback protectionNot included with QuickBooks Money

We’ll cover up to $25,000 per year—$10,000 per dispute.**

Business connections

Send invoices to connections through our business network.**

Payments go to the bank

With a QuickBooks Checking account, eligible payments are deposited soonerNot included with QuickBooks Money, fee-free.**

Automatic bookkeeping

Payments through QuickBooks are automatically matchedAutomatic bookkeeping not included with QuickBooks Money.**

Business banking

Get access to instant depositNot included with QuickBooks Money—no monthly fees or minimums.**

Chargeback protectionNot included with QuickBooks Money

We’ll cover up to $25,000 per year—$10,000 per dispute.**

Business connections

Send invoices to connections through our business network.**

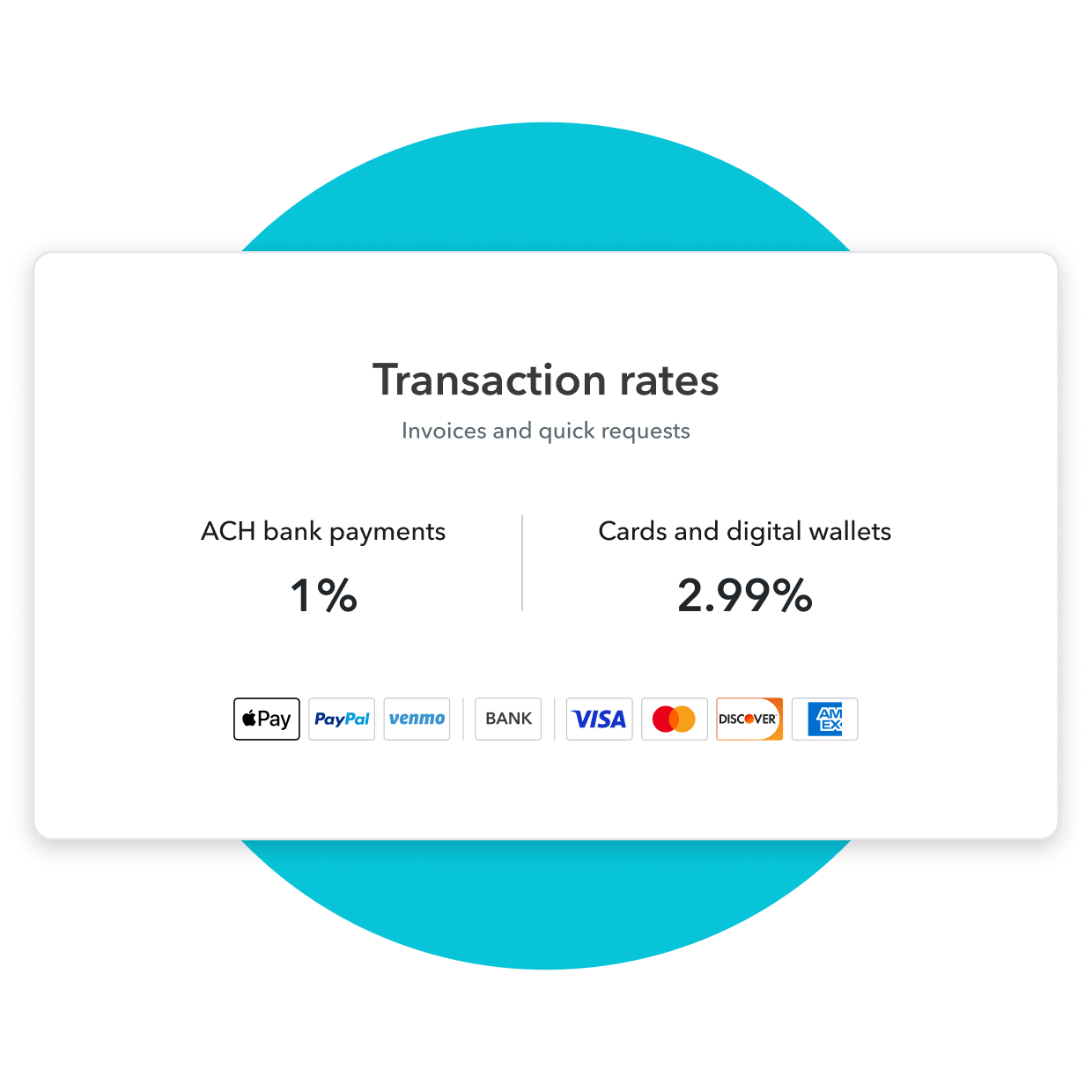

Keep more of what you make

QuickBooks makes getting paid easier. Get competitive payment rates without monthly fees or minimums—just pay as you go.

If you process over $2,500 per month, call to see how you could save up to 25%.2

Call 1-800-264-1859

Pick the best plan for your business

Start with our simple money management tool or pick a plan that comes with accounting.

Already a QuickBooks customer? Sign in