QUICKBOOKS DESKTOP PAYMENTS

Getting paid shouldn’t be hard work

Use the payments solution built right into QuickBooks Desktop.

Use the payments solution built right into QuickBooks Desktop.

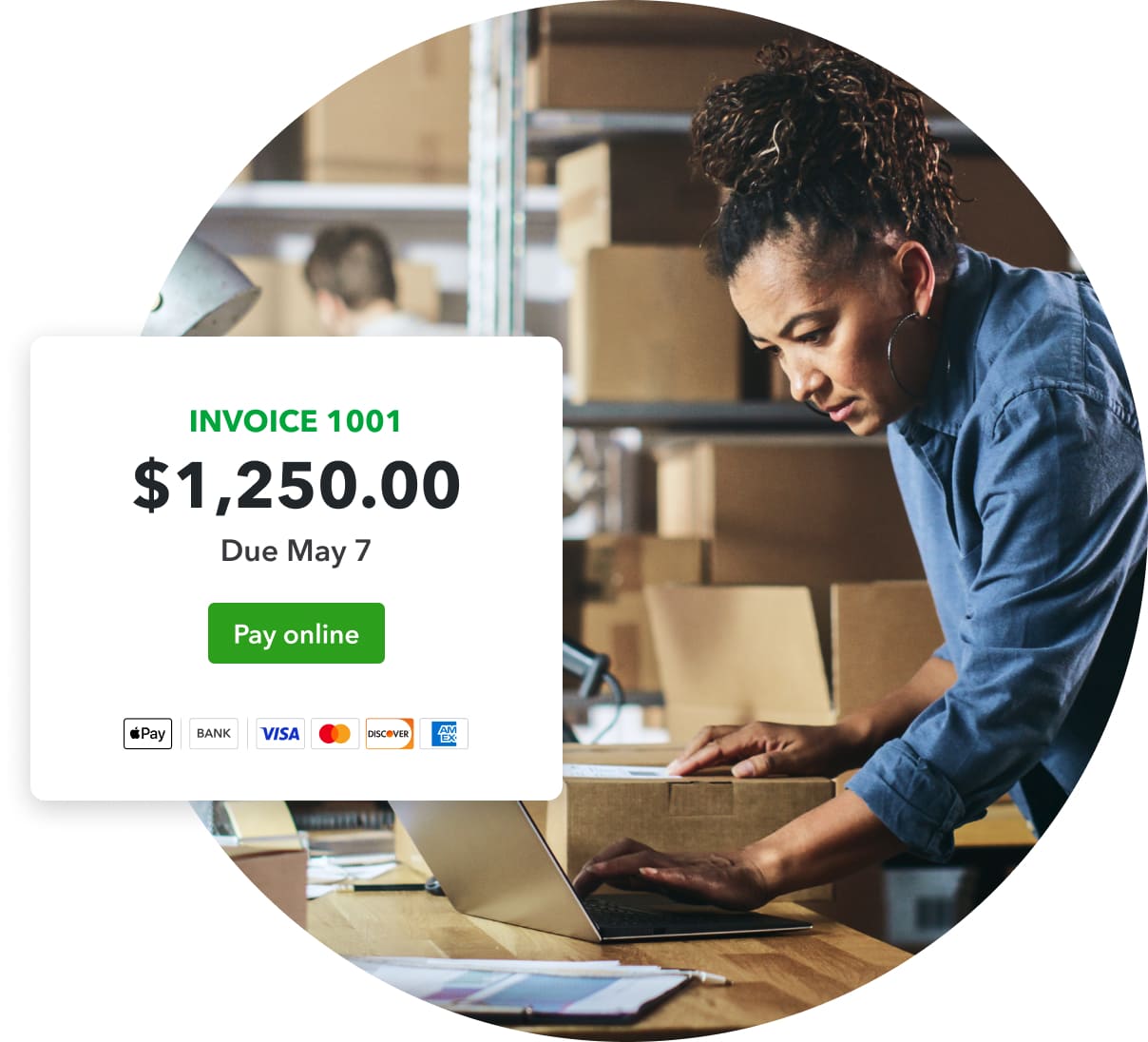

Add a button to your invoices to let customers pay online.

Don’t lose another minute waiting on checks in the mail. Accept cards, eChecks and ACH payments.

Get eligible payments deposited next day,² or instantly for 1.75% more.³

With every payment, your books automatically stay up to date.⁴

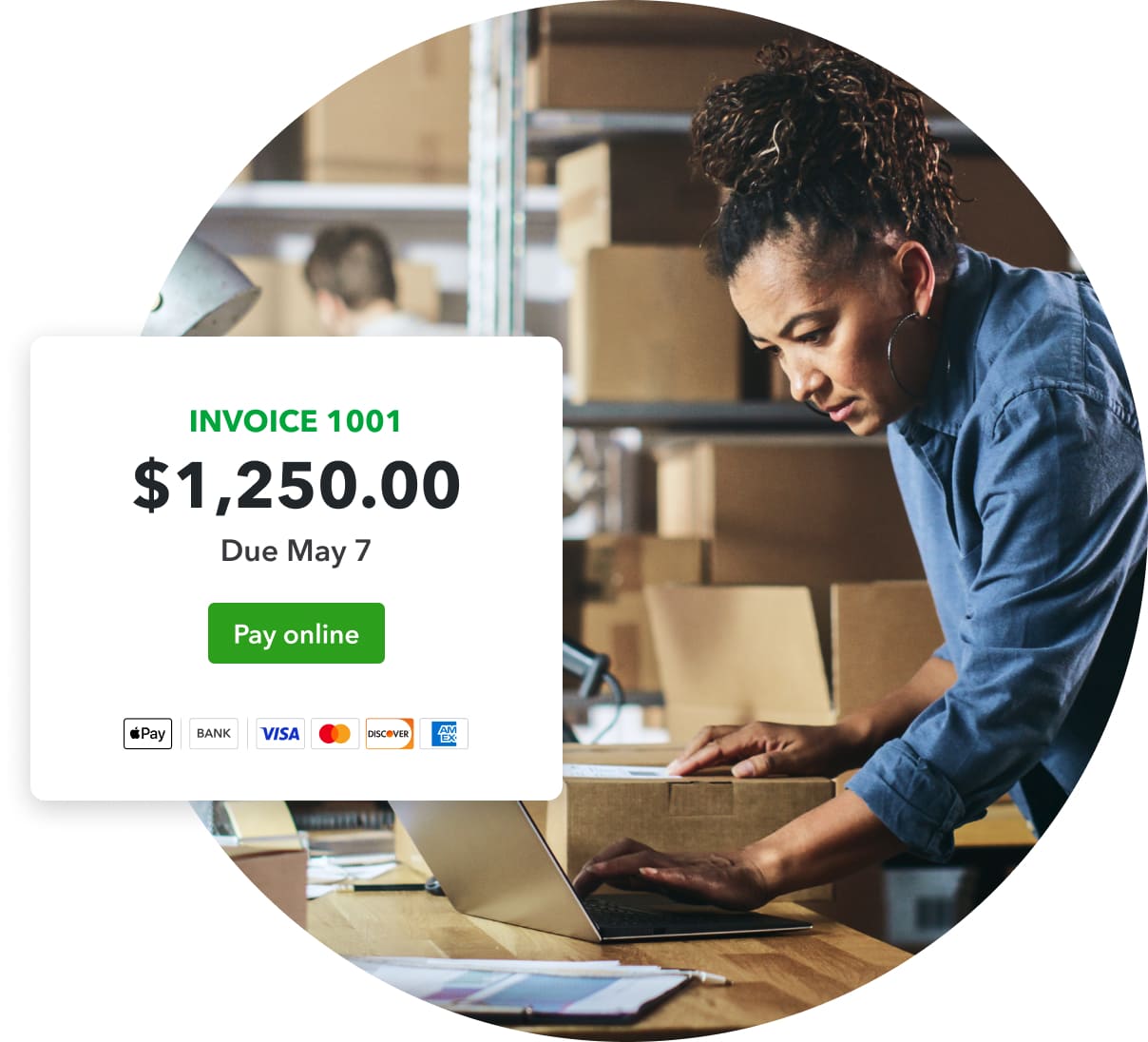

Make invoices instantly payable1

Add a button to your invoices to let customers pay online.

Get your money fast, paper free

Don’t lose another minute waiting on checks in the mail. Accept cards, digital wallets, eChecks and ACH payments.

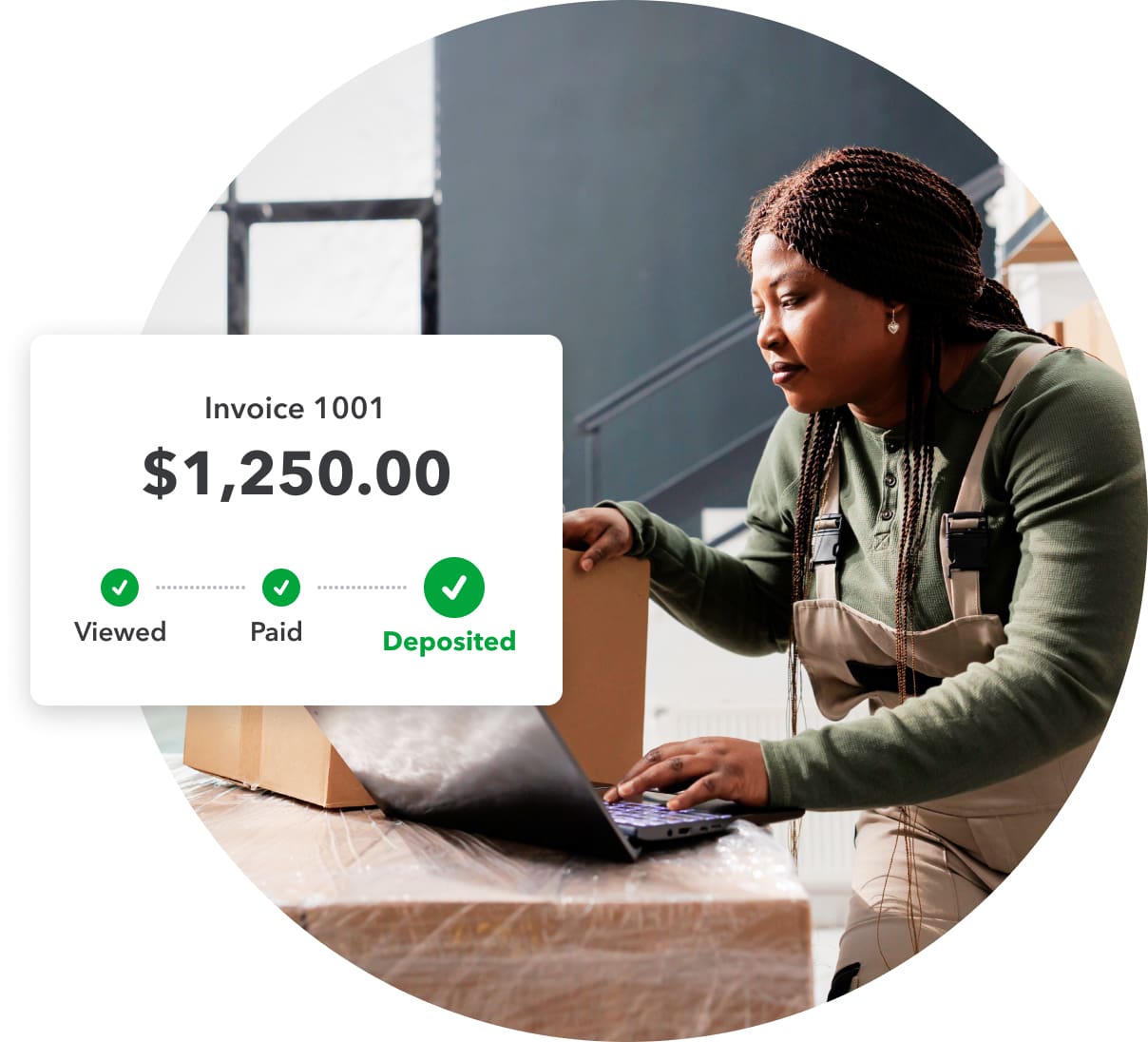

Fast deposits, stronger cash flow

Most payments are deposited next-day.² Or, get an instant deposit when you pay an additional 1.75% – even late nights, weekends, and holidays.³

Set and forget recurring invoices

Schedule invoices in advance and let your customers set up automatic online payments.

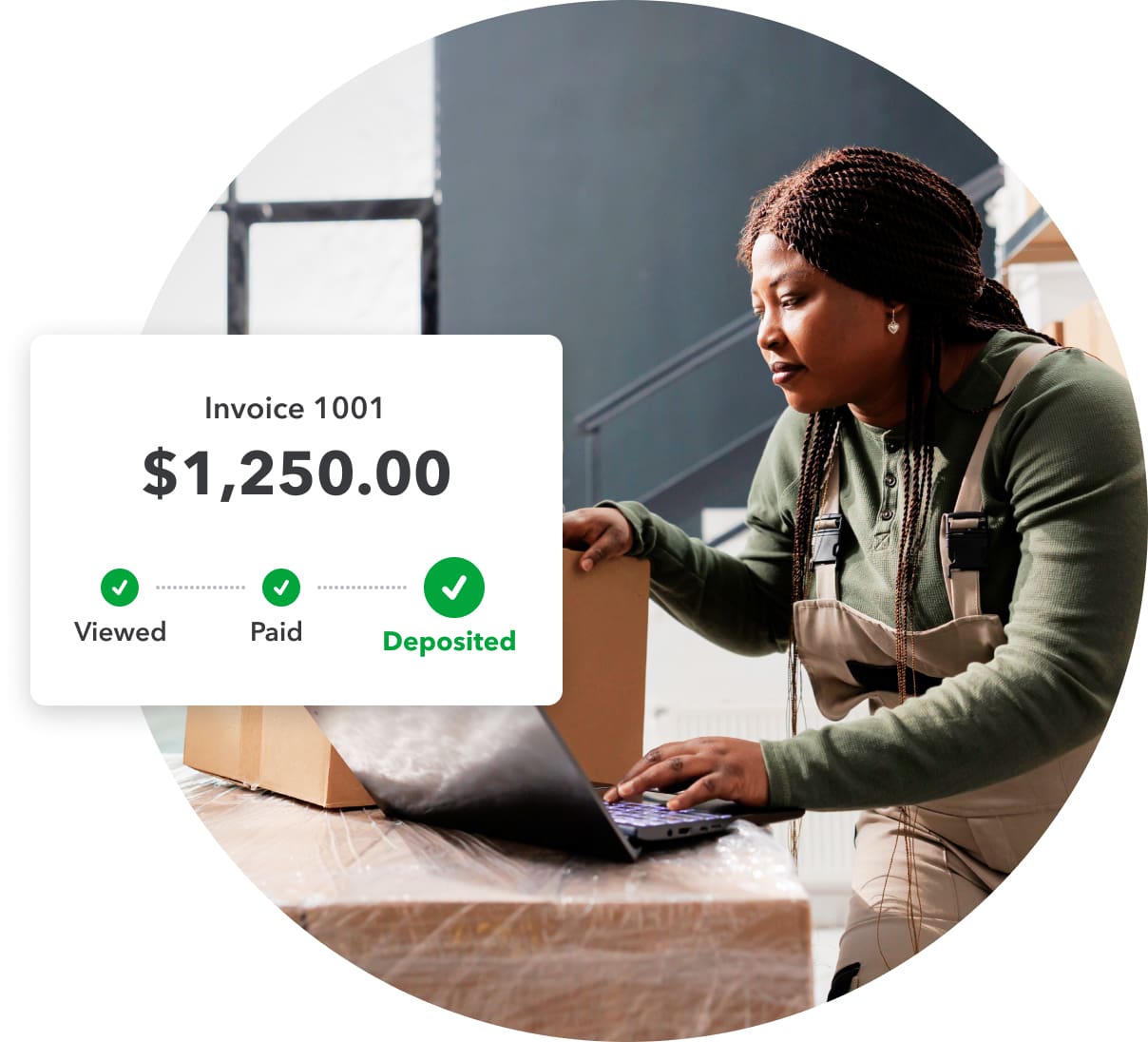

Track invoice status in real-time

Keep tabs on your cash flow. At a glance, see when an invoice was sent, viewed, and paid.

Invoicing that grows with your business

No matter what your invoicing needs might be—a few payments now or a few thousand down the road, QuickBooks Payments can handle it.

Professional, customizable invoices

Create a professional-looking invoice that impresses your customers. Tailor it the way you want by choosing a color and font, and by adding your company logo.

Send reminders, automatically

No need to track invoice due dates or manually follow up on late payments. Set up a reminder schedule and let QuickBooks follow up for you.

Let customers pay with a link⁵

Text or email your customers a link to request payment so they can pay online. Collect fees for initial consultations, advance deposits, and more.

Accept payments wherever you do business

Take contactless payments like Apple Pay and Google Pay, plus chip and swipe cards, with our GoPayment app and card reader.⁶

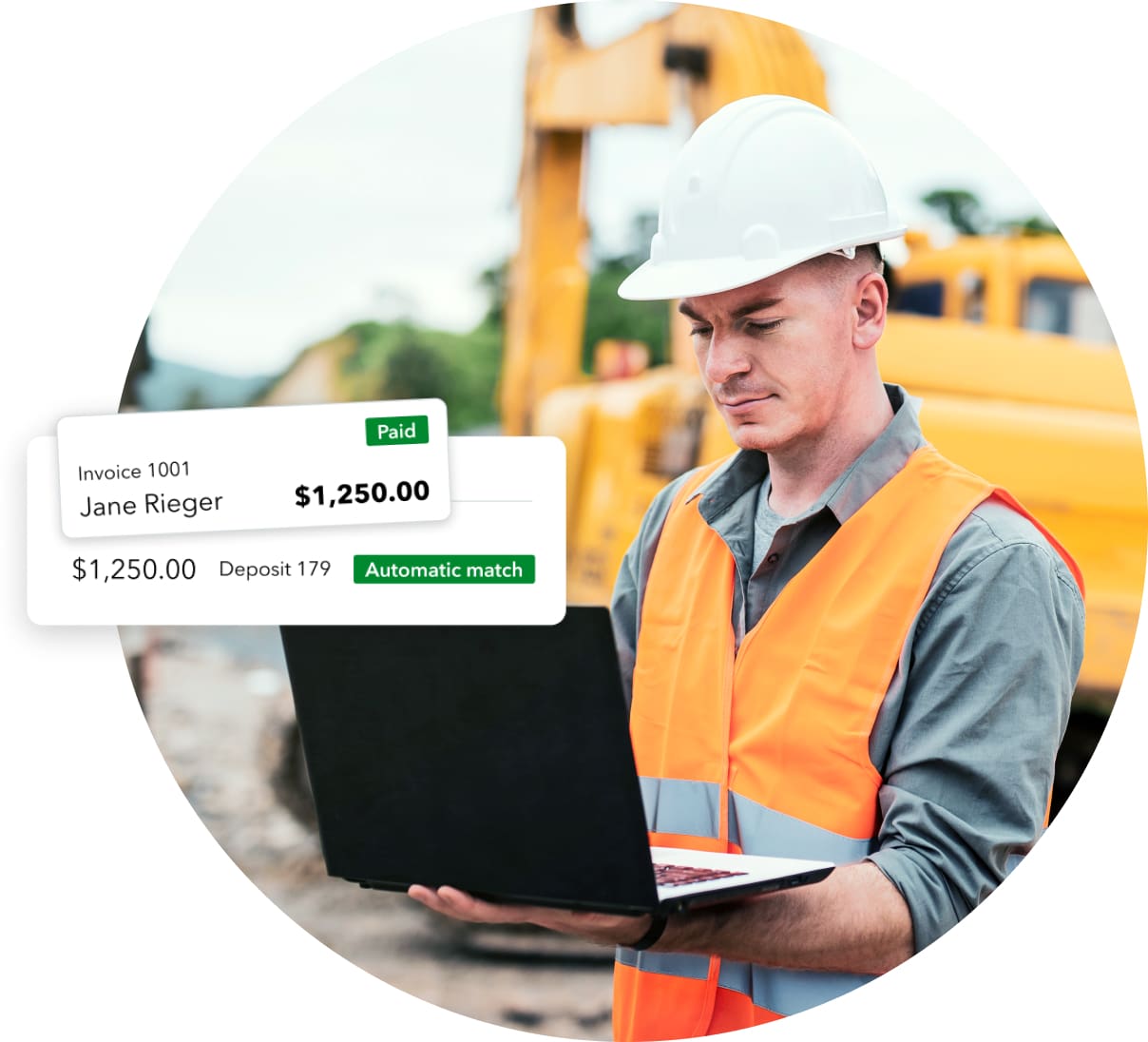

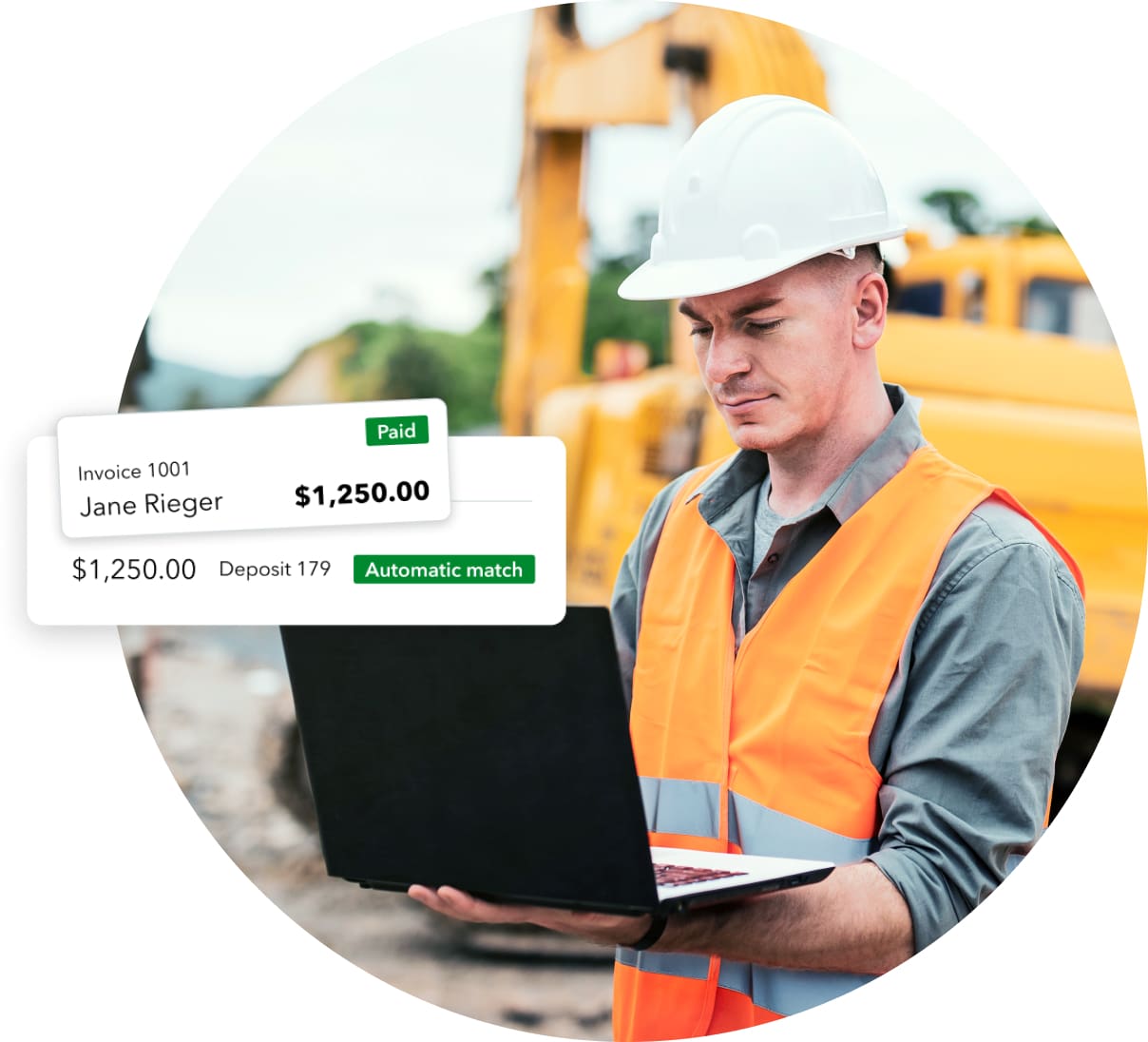

Bookkeeping done for you³

When a customer pays, QuickBooks Desktop Payments automatically records and matches the transaction. Your books stay organized all year, with no extra effort.

Get started with ease—right in QuickBooks

Apply right in QuickBooks and start taking payments today.

Clear pricing, no commitment

Avoid surprises with our transparent pricing options. No contracts, monthly minimums, or setup fees.

Here when you need us

Customer support is available anytime, from getting started with Payments to any needs along the way.

Make invoices instantly payable1

Add a button to your invoices to let customers pay online.

Get your money fast, paper free

Don’t lose another minute waiting on checks in the mail. Accept cards, digital wallets, eChecks and ACH payments.

Fast deposits, stronger cash flow

Most payments are deposited next-day.² Or, get an instant deposit when you pay an additional 1.75% – even late nights, weekends, and holidays.³

Set and forget recurring invoices

Schedule invoices in advance and let your customers set up automatic online payments.

Track invoice status in real-time

Keep tabs on your cash flow. At a glance, see when an invoice was sent, viewed, and paid.

Invoicing that grows with your business

No matter what your invoicing needs might be—a few payments now or a few thousand down the road, QuickBooks Payments can handle it.

Professional, customizable invoices

Create a professional-looking invoice that impresses your customers. Tailor it the way you want by choosing a color and font, and by adding your company logo.

Send reminders, automatically

No need to track invoice due dates or manually follow up on late payments. Set up a reminder schedule and let QuickBooks follow up for you.

Let customers pay with a link⁵

Text or email your customers a link to request payment so they can pay online. Collect fees for initial consultations, advance deposits, and more.

Accept payments wherever you do business

Take contactless payments like Apple Pay and Google Pay, plus chip and swipe cards, with our GoPayment app and card reader.⁶

Bookkeeping done for you³

When a customer pays, QuickBooks Desktop Payments automatically records and matches the transaction. Your books stay organized all year, with no extra effort.

Get started with ease—right in QuickBooks

Apply right in QuickBooks and start taking payments today.

Clear pricing, no commitment

Avoid surprises with our transparent pricing options. No contracts, monthly minimums, or setup fees.

Here when you need us

Customer support is available anytime, from getting started with Payments to any needs along the way.

You’ll need QuickBooks Desktop 2022 or later to get started.

Don’t have an account? Explore QuickBooks Desktop

You’ll need QuickBooks Desktop 2022 or later to get started.

Don’t have an account? Explore QuickBooks Desktop

No termination fees, setup fees, or monthly minimum.

Adding the 'pay now' button to invoices is my favorite thing about using QuickBooks Desktop Payments. It makes it so easy for customers to pay right away.

With QuickBooks Desktop Payments, I’m getting paid so much faster now that I’m not having to wait for checks in the mail.